A

D

R

B&L: MFT-FSR

LABAMA

EPARTMENT OF

EVENUE

3/12

Reset

B

& L

T

D

USINESS

ICENSE

AX

IVISION

M

F

S

OTOR

UELS

ECTION

P.O. Box 327540 • Montgomery, AL 36132-7540 • (334) 242-9608 • Fax (334) 242-1199

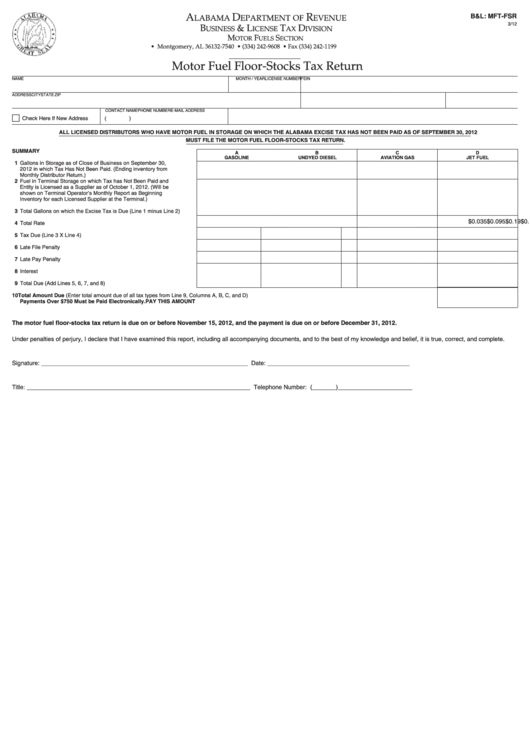

Motor Fuel Floor-Stocks Tax Return

NAME

MONTH / YEAR

LICENSE NUMBER

FEIN

ADDRESS

CITY

STATE

ZIP

CONTACT NAME

PHONE NUMBER

E-MAIL ADDRESS

Check Here If New Address

(

)

ALL LICENSED DISTRIBUTORS WHO HAVE MOTOR FUEL IN STORAGE ON WHICH THE ALABAMA EXCISE TAX HAS NOT BEEN PAID AS OF SEPTEMBER 30, 2012

MUST FILE THE MOTOR FUEL FLOOR-STOCKS TAX RETURN.

SUMMARY

A

B

C

D

GASOLINE

UNDYED DIESEL

AVIATION GAS

JET FUEL

1 Gallons in Storage as of Close of Business on September 30,

2012 in which Tax Has Not Been Paid. (Ending inventory from

Monthly Distributor Return.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2 Fuel in Terminal Storage on which Tax has Not Been Paid and

Entity is Licensed as a Supplier as of October 1, 2012. (Will be

shown on Terminal Operator’s Monthly Report as Beginning

Inventory for each Licensed Supplier at the Terminal.). . . . . . . . . . . . . . . . .

3 Total Gallons on which the Excise Tax is Due (Line 1 minus Line 2). . . . . .

$0.16

$0.19

$0.095

$0.035

4 Total Rate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5 Tax Due (Line 3 X Line 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6 Late File Penalty . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7 Late Pay Penalty . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8 Interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9 Total Due (Add Lines 5, 6, 7, and 8) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10 Total Amount Due (Enter total amount due of all tax types from Line 9, Columns A, B, C, and D)

Payments Over $750 Must be Paid Electronically. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . PAY THIS AMOUNT

The motor fuel floor-stocks tax return is due on or before November 15, 2012, and the payment is due on or before December 31, 2012.

Under penalties of perjury, I declare that I have examined this report, including all accompanying documents, and to the best of my knowledge and belief, it is true, correct, and complete.

Signature: _____________________________________________________________ Date: __________________________________________

Title: __________________________________________________________________ Telephone Number: (_______)______________________

1

1 2

2