8881

Credit for Small Employer Pension Plan

OMB No. 1545-1810

Form

Startup Costs

(Rev. December 2006)

Attachment

Department of the Treasury

130

Attach to your tax return.

Internal Revenue Service

Sequence No.

Name(s) shown on return

Identifying number

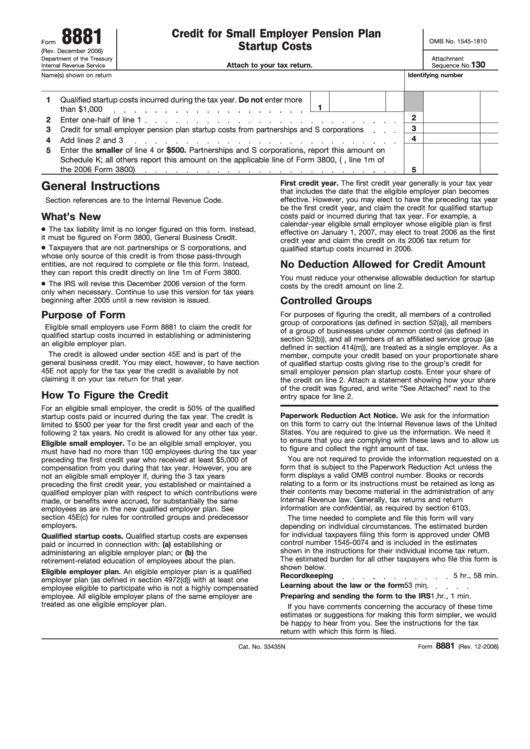

1

Qualified startup costs incurred during the tax year. Do not enter more

1

than $1,000

2

2

Enter one-half of line 1

3

3

Credit for small employer pension plan startup costs from partnerships and S corporations

4

4

Add lines 2 and 3

5

Enter the smaller of line 4 or $500. Partnerships and S corporations, report this amount on

Schedule K; all others report this amount on the applicable line of Form 3800, (e.g., line 1m of

the 2006 Form 3800)

5

First credit year. The first credit year generally is your tax year

General Instructions

that includes the date that the eligible employer plan becomes

effective. However, you may elect to have the preceding tax year

Section references are to the Internal Revenue Code.

be the first credit year, and claim the credit for qualified startup

What’s New

costs paid or incurred during that tax year. For example, a

calendar-year eligible small employer whose eligible plan is first

The tax liability limit is no longer figured on this form. Instead,

effective on January 1, 2007, may elect to treat 2006 as the first

it must be figured on Form 3800, General Business Credit.

credit year and claim the credit on its 2006 tax return for

Taxpayers that are not partnerships or S corporations, and

qualified startup costs incurred in 2006.

whose only source of this credit is from those pass-through

No Deduction Allowed for Credit Amount

entities, are not required to complete or file this form. Instead,

they can report this credit directly on line 1m of Form 3800.

You must reduce your otherwise allowable deduction for startup

The IRS will revise this December 2006 version of the form

costs by the credit amount on line 2.

only when necessary. Continue to use this version for tax years

Controlled Groups

beginning after 2005 until a new revision is issued.

Purpose of Form

For purposes of figuring the credit, all members of a controlled

group of corporations (as defined in section 52(a)), all members

Eligible small employers use Form 8881 to claim the credit for

of a group of businesses under common control (as defined in

qualified startup costs incurred in establishing or administering

section 52(b)), and all members of an affiliated service group (as

an eligible employer plan.

defined in section 414(m)), are treated as a single employer. As a

The credit is allowed under section 45E and is part of the

member, compute your credit based on your proportionate share

general business credit. You may elect, however, to have section

of qualified startup costs giving rise to the group’s credit for

45E not apply for the tax year the credit is available by not

small employer pension plan startup costs. Enter your share of

claiming it on your tax return for that year.

the credit on line 2. Attach a statement showing how your share

of the credit was figured, and write “See Attached” next to the

How To Figure the Credit

entry space for line 2.

For an eligible small employer, the credit is 50% of the qualified

Paperwork Reduction Act Notice. We ask for the information

startup costs paid or incurred during the tax year. The credit is

on this form to carry out the Internal Revenue laws of the United

limited to $500 per year for the first credit year and each of the

States. You are required to give us the information. We need it

following 2 tax years. No credit is allowed for any other tax year.

to ensure that you are complying with these laws and to allow us

Eligible small employer. To be an eligible small employer, you

to figure and collect the right amount of tax.

must have had no more than 100 employees during the tax year

You are not required to provide the information requested on a

preceding the first credit year who received at least $5,000 of

form that is subject to the Paperwork Reduction Act unless the

compensation from you during that tax year. However, you are

form displays a valid OMB control number. Books or records

not an eligible small employer if, during the 3 tax years

relating to a form or its instructions must be retained as long as

preceding the first credit year, you established or maintained a

their contents may become material in the administration of any

qualified employer plan with respect to which contributions were

Internal Revenue law. Generally, tax returns and return

made, or benefits were accrued, for substantially the same

information are confidential, as required by section 6103.

employees as are in the new qualified employer plan. See

section 45E(c) for rules for controlled groups and predecessor

The time needed to complete and file this form will vary

employers.

depending on individual circumstances. The estimated burden

for individual taxpayers filing this form is approved under OMB

Qualified startup costs. Qualified startup costs are expenses

control number 1545-0074 and is included in the estimates

paid or incurred in connection with: (a) establishing or

shown in the instructions for their individual income tax return.

administering an eligible employer plan; or (b) the

The estimated burden for all other taxpayers who file this form is

retirement-related education of employees about the plan.

shown below.

Eligible employer plan. An eligible employer plan is a qualified

Recordkeeping

5 hr., 58 min.

employer plan (as defined in section 4972(d)) with at least one

Learning about the law or the form

53 min.

employee eligible to participate who is not a highly compensated

employee. All eligible employer plans of the same employer are

Preparing and sending the form to the IRS

1 hr., 1 min.

treated as one eligible employer plan.

If you have comments concerning the accuracy of these time

estimates or suggestions for making this form simpler, we would

be happy to hear from you. See the instructions for the tax

return with which this form is filed.

8881

Cat. No. 33435N

Form

(Rev. 12-2006)

1

1