Form Com/rad 007a - Instructions For Maryland Form 500jr - Job Creation And Recovery Tax Credit

ADVERTISEMENT

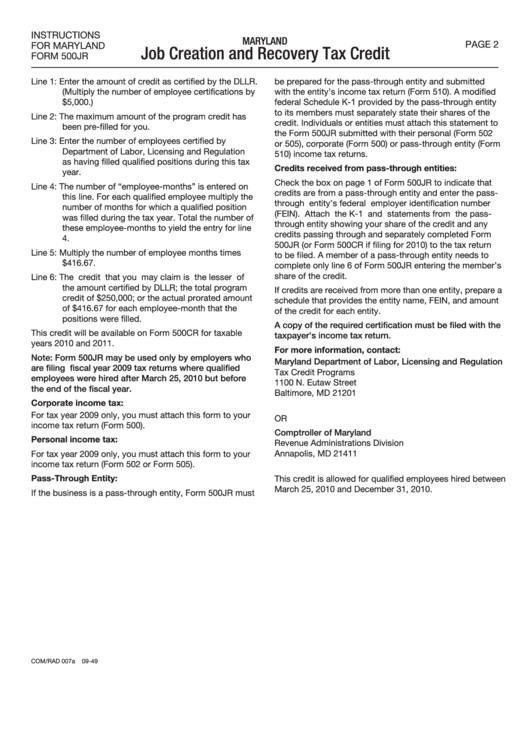

INSTRUCTIONS

MARYLAND

PAGE 2

FOR MARYLAND

Job Creation and Recovery Tax Credit

FORM 500JR

Line 1: Enter the amount of credit as certified by the DLLR.

be prepared for the pass-through entity and submitted

(Multiply the number of employee certifications by

with the entity’s income tax return (Form 510). A modified

$5,000.)

federal Schedule K-1 provided by the pass-through entity

to its members must separately state their shares of the

Line 2: The maximum amount of the program credit has

credit. Individuals or entities must attach this statement to

been pre-filled for you.

the Form 500JR submitted with their personal (Form 502

Line 3: Enter the number of employees certified by

or 505), corporate (Form 500) or pass-through entity (Form

Department of Labor, Licensing and Regulation

510) income tax returns.

as having filled qualified positions during this tax

Credits received from pass-through entities:

year.

Check the box on page 1 of Form 500JR to indicate that

Line 4: The number of “employee-months” is entered on

credits are from a pass-through entity and enter the pass-

this line. For each qualified employee multiply the

through entity’s federal employer identification number

number of months for which a qualified position

(FEIN). Attach the K-1 and statements from the pass-

was filled during the tax year. Total the number of

through entity showing your share of the credit and any

these employee-months to yield the entry for line

credits passing through and separately completed Form

4.

500JR (or Form 500CR if filing for 2010) to the tax return

Line 5: Multiply the number of employee months times

to be filed. A member of a pass-through entity needs to

$416.67.

complete only line 6 of Form 500JR entering the member’s

share of the credit.

Line 6: The credit that you may claim is the lesser of

the amount certified by DLLR; the total program

If credits are received from more than one entity, prepare a

credit of $250,000; or the actual prorated amount

schedule that provides the entity name, FEIN, and amount

of $416.67 for each employee-month that the

of the credit for each entity.

positions were filled.

A copy of the required certification must be filed with the

This credit will be available on Form 500CR for taxable

taxpayer’s income tax return.

years 2010 and 2011.

For more information, contact:

Note: Form 500JR may be used only by employers who

Maryland Department of Labor, Licensing and Regulation

are filing fiscal year 2009 tax returns where qualified

Tax Credit Programs

employees were hired after March 25, 2010 but before

1100 N. Eutaw Street

the end of the fiscal year.

Baltimore, MD 21201

Corporate income tax:

For tax year 2009 only, you must attach this form to your

OR

income tax return (Form 500).

Comptroller of Maryland

Personal income tax:

Revenue Administrations Division

Annapolis, MD 21411

For tax year 2009 only, you must attach this form to your

income tax return (Form 502 or Form 505).

Pass-Through Entity:

This credit is allowed for qualified employees hired between

March 25, 2010 and December 31, 2010.

If the business is a pass-through entity, Form 500JR must

COM/RAD 007a 09-49

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1