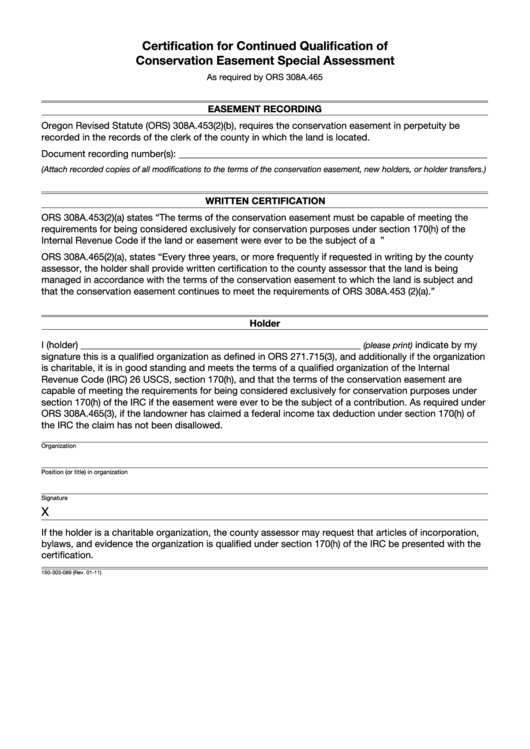

Clear Form

Certification for Continued Qualification of

Conservation Easement Special Assessment

As required by ORS 308A.465

EASEMENT RECORDING

Oregon Revised Statute (ORS) 308A.453(2)(b), requires the conservation easement in perpetuity be

recorded in the records of the clerk of the county in which the land is located.

Document recording number(s): _________________________________________________________________

(Attach recorded copies of all modifications to the terms of the conservation easement, new holders, or holder transfers.)

WRITTEN CERTIFICATION

ORS 308A.453(2)(a) states “The terms of the conservation easement must be capable of meeting the

requirements for being considered exclusively for conservation purposes under section 170(h) of the

Internal Revenue Code if the land or easement were ever to be the subject of a contribution...”

ORS 308A.465(2)(a), states “Every three years, or more frequently if requested in writing by the county

assessor, the holder shall provide written certification to the county assessor that the land is being

managed in accordance with the terms of the conservation easement to which the land is subject and

that the conservation easement continues to meet the requirements of ORS 308A.453 (2)(a).”

Holder

I (holder) ___________________________________________________________

indicate by my

(please print)

signature this is a qualified organization as defined in ORS 271.715(3), and additionally if the organization

is charitable, it is in good standing and meets the terms of a qualified organization of the Internal

Revenue Code (IRC) 26 USCS, section 170(h), and that the terms of the conservation easement are

capable of meeting the requirements for being considered exclusively for conservation purposes under

section 170(h) of the IRC if the easement were ever to be the subject of a contribution. As required under

ORS 308A.465(3), if the landowner has claimed a federal income tax deduction under section 170(h) of

the IRC the claim has not been disallowed.

Organization

Position (or title) in organization

Signature

X

If the holder is a charitable organization, the county assessor may request that articles of incorporation,

bylaws, and evidence the organization is qualified under section 170(h) of the IRC be presented with the

certification.

150-303-089 (Rev. 01-11)

1

1