Form Ls-001 - Lessor Data Report - Wisconsin Department Of Revenue

ADVERTISEMENT

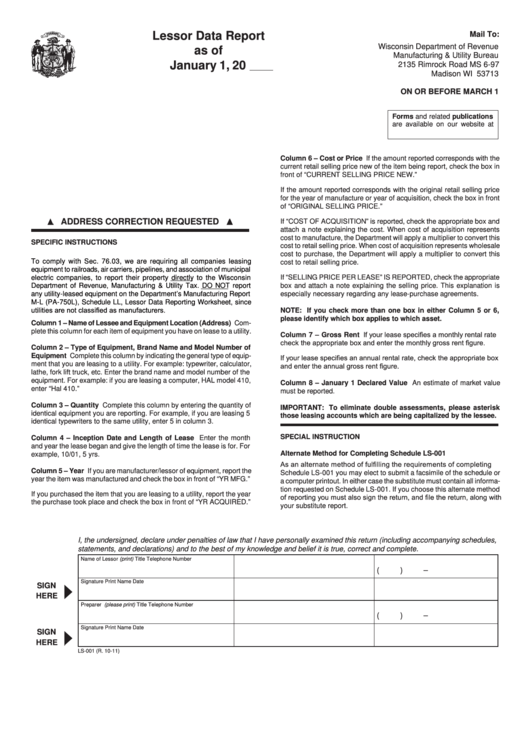

Lessor Data Report

Mail To:

Wisconsin Department of Revenue

as of

Manufacturing & Utility Bureau

January 1, 20

2135 Rimrock Road MS 6-97

Madison WI 53713

ON OR BEFORE MARCH 1

Forms and related publications

are available on our website at

Column 6 – Cost or Price If the amount reported corresponds with the

current retail selling price new of the item being report, check the box in

front of “CURRENT SELLING PRICE NEW.”

If the amount reported corresponds with the original retail selling price

for the year of manufacture or year of acquisition, check the box in front

of “ORIGINAL SELLING PRICE.”

ADDRESS CORRECTION REQUESTED

If “COST OF ACQUISITION” is reported, check the appropriate box and

attach a note explaining the cost. When cost of acquisition represents

cost to manufacture, the Department will apply a multiplier to convert this

SPECIFIC INSTRUCTIONS

cost to retail selling price. When cost of acquisition represents wholesale

cost to purchase, the Department will apply a multiplier to convert this

To comply with Sec. 76.03, we are requiring all companies leasing

cost to retail selling price.

equipment to railroads, air carriers, pipelines, and association of municipal

electric companies, to report their property directly to the Wisconsin

If “SELLING PRICE PER LEASE” IS REPORTED, check the appropriate

Department of Revenue, Manufacturing & Utility Tax. DO NOT report

box and attach a note explaining the selling price. This explanation is

especially necessary regarding any lease-purchase agreements.

any utility-leased equipment on the Department’s Manufacturing Report

M-L (PA-750L), Schedule LL, Lessor Data Reporting Worksheet, since

utilities are not classified as manufacturers.

NOTE: If you check more than one box in either Column 5 or 6,

please identify which box applies to which asset.

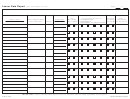

Column 1 – Name of Lessee and Equipment Location (Address) Com-

plete this column for each item of equipment you have on lease to a utility.

Column 7 – Gross Rent If your lease specifies a monthly rental rate

check the appropriate box and enter the monthly gross rent figure.

Column 2 – Type of Equipment, Brand Name and Model Number of

Equipment Complete this column by indicating the general type of equip-

If your lease specifies an annual rental rate, check the appropriate box

ment that you are leasing to a utility. For example: typewriter, calculator,

and enter the annual gross rent figure.

lathe, fork lift truck, etc. Enter the brand name and model number of the

equipment. For example: if you are leasing a computer, HAL model 410,

Column 8 – January 1 Declared Value An estimate of market value

enter “Hal 410.”

must be reported.

Column 3 – Quantity Complete this column by entering the quantity of

IMPORTANT: To eliminate double assessments, please asterisk

identical equipment you are reporting. For example, if you are leasing 5

those leasing accounts which are being capitalized by the lessee.

identical typewriters to the same utility, enter 5 in column 3.

SPECIAL INSTRUCTION

Column 4 – Inception Date and Length of Lease Enter the month

and year the lease began and give the length of time the lease is for. For

Alternate Method for Completing Schedule LS-001

example, 10/01, 5 yrs.

As an alternate method of fulfilling the requirements of completing

Column 5 – Year If you are manufacturer/lessor of equipment, report the

Schedule LS-001 you may elect to submit a facsimile of the schedule or

year the item was manufactured and check the box in front of “YR MFG.”

a computer printout. In either case the substitute must contain all informa-

tion requested on Schedule LS-001. If you choose this alternate method

If you purchased the item that you are leasing to a utility, report the year

of reporting you must also sign the return, and file the return, along with

the purchase took place and check the box in front of “YR ACQUIRED.”

your substitute report.

I, the undersigned, declare under penalties of law that I have personally examined this return (including accompanying schedules,

statements, and declarations) and to the best of my knowledge and belief it is true, correct and complete.

Name of Lessor (print)

Title

Telephone Number

(

)

–

Signature

Print Name

Date

SIGN

HERE

Preparer (please print)

Title

Telephone Number

(

)

–

Signature

Print Name

Date

SIGN

HERE

LS-001 (R. 10-11)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2