Form Wb-101 - Mtq - Montana Employer'S Quarterly Tax Report - Unemployment Insurance/withholding

ADVERTISEMENT

Quarter End

Due Date

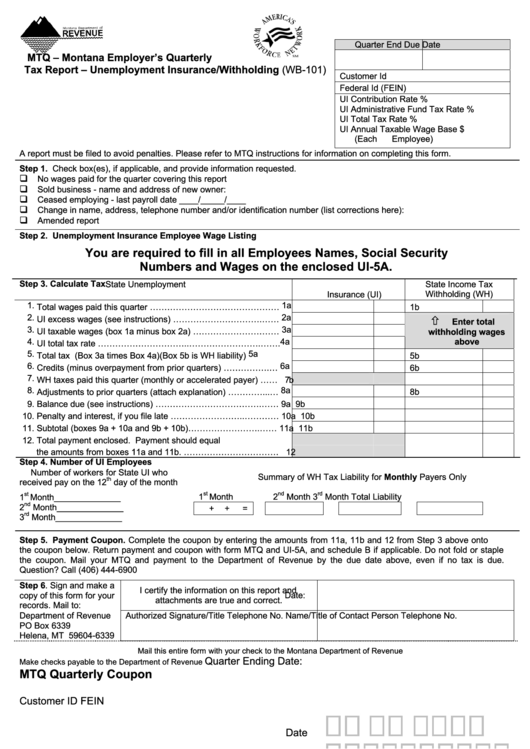

MTQ – Montana Employer’s Quarterly

Tax Report – Unemployment Insurance/Withholding (WB-101)

Customer Id

Federal Id (FEIN)

UI Contribution Rate

%

UI Administrative Fund Tax Rate

%

UI Total Tax Rate

%

UI Annual Taxable Wage Base

$

(Each Employee)

A report must be filed to avoid penalties. Please refer to MTQ instructions for information on completing this form.

Step 1. Check box(es), if applicable, and provide information requested.

No wages paid for the quarter covering this report

Sold business - name and address of new owner:

Ceased employing - last payroll date ____/_____/____

Change in name, address, telephone number and/or identification number (list corrections here):

Amended report

Step 2. Unemployment Insurance Employee Wage Listing

You are required to fill in all Employees Names, Social Security

Numbers and Wages on the enclosed UI-5A.

Step 3. Calculate Tax

State Income Tax

State Unemployment

Withholding (WH)

Insurance (UI)

1.

1a

Total wages paid this quarter ………………………………………

1b

2.

2a

UI excess wages (see instructions) ………………………….……

Enter total

3.

3a

UI taxable wages (box 1a minus box 2a) …………………………

withholding wages

4.

4a

above

UI total tax rate …………………………..…………………….…….

5.

5a

Total tax (Box 3a times Box 4a)(Box 5b is WH liability)

5b

6.

6a

Credits (minus overpayment from prior quarters) …………….…

6b

7.

WH taxes paid this quarter (monthly or accelerated payer) ……

7b

8.

8a

Adjustments to prior quarters (attach explanation) …………...…

8b

9.

Balance due (see instructions) ……………………………….……

9a

9b

10.

Penalty and interest, if you file late ……………………..…………

10a

10b

11.

Subtotal (boxes 9a + 10a and 9b + 10b)…………………….……

11a

11b

12.

Total payment enclosed. Payment should equal

the amounts from boxes 11a and 11b. ……………………………

12

Step 4. Number of UI Employees

Number of workers for State UI who

Summary of WH Tax Liability for Monthly Payers Only

th

received pay on the 12

day of the month

st

nd

rd

st

1

Month

2

Month

3

Month

Total Liability

1

Month______________

nd

2

Month______________

+

+

=

rd

3

Month______________

Step 5. Payment Coupon.

Complete the coupon by entering the amounts from 11a, 11b and 12 from Step 3 above onto

the coupon below. Return payment and coupon with form MTQ and UI-5A, and schedule B if applicable. Do not fold or staple

the coupon. Mail your MTQ and payment to the Department of Revenue by the due date above, even if no tax is due.

Question? Call (406) 444-6900

Step 6. Sign and make a

I certify the information on this report and

copy of this form for your

Date:

attachments are true and correct.

records. Mail to:

Department of Revenue

Authorized Signature/Title

Telephone No.

Name/Title of Contact Person

Telephone No.

PO Box 6339

Helena, MT 59604-6339

Mail this entire form with your check to the Montana Department of Revenue

Quarter Ending Date:

Make checks payable to the Department of Revenue

MTQ Quarterly Coupon

Customer ID

FEIN

Date

,

,

.

11a UI

,

,

.

Department of Revenue

11b WH

Do not staple your

check or

PO Box 6339

correspondence to

this coupon.

Helena MT 59604-6339

,

,

.

12 Total

22101010000000001505893033120007585113510101000000400000000000

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1