Form Ct-1120 Tce - Tax Credit Cap Expansion - 2012

ADVERTISEMENT

Department of Revenue Services

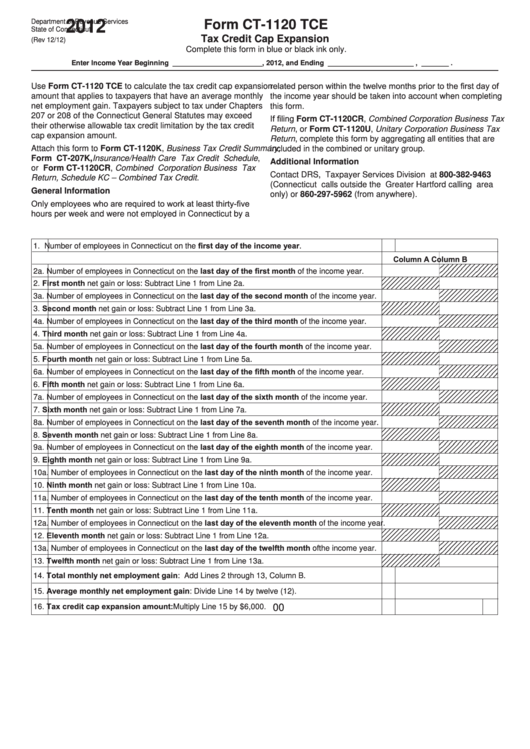

Form CT-1120 TCE

2012

State of Connecticut

Tax Credit Cap Expansion

(Rev 12/12)

Complete this form in blue or black ink only.

Enter Income Year Beginning _______________________, 2012, and Ending ______________________ , _______ .

related person within the twelve months prior to the first day of

Use Form CT-1120 TCE to calculate the tax credit cap expansion

amount that applies to taxpayers that have an average monthly

the income year should be taken into account when completing

net employment gain. Taxpayers subject to tax under Chapters

this form.

207 or 208 of the Connecticut General Statutes may exceed

If filing Form CT-1120CR, Combined Corporation Business Tax

their otherwise allowable tax credit limitation by the tax credit

Return, or Form CT-1120U, Unitary Corporation Business Tax

cap expansion amount.

Return, complete this form by aggregating all entities that are

Attach this form to Form CT-1120K, Business Tax Credit Summary,

included in the combined or unitary group.

Form CT-207K, Insurance/Health Care Tax Credit Schedule,

Additional Information

or Form CT-1120CR, Combined Corporation Business Tax

Contact DRS, Taxpayer Services Division at 800-382-9463

Return, Schedule KC – Combined Tax Credit.

(Connecticut calls outside the Greater Hartford calling area

General Information

only) or 860-297-5962 (from anywhere).

Only employees who are required to work at least thirty-five

hours per week and were not employed in Connecticut by a

1. Number of employees in Connecticut on the first day of the income year. ............................... 1.

Column A

Column B

2a. Number of employees in Connecticut on the last day of the first month of the income year.

2. First month net gain or loss: Subtract Line 1 from Line 2a.

3a. Number of employees in Connecticut on the last day of the second month of the income year.

3. Second month net gain or loss: Subtract Line 1 from Line 3a.

4a. Number of employees in Connecticut on the last day of the third month of the income year.

4. Third month net gain or loss: Subtract Line 1 from Line 4a.

5a. Number of employees in Connecticut on the last day of the fourth month of the income year.

5. Fourth month net gain or loss: Subtract Line 1 from Line 5a.

6a. Number of employees in Connecticut on the last day of the fifth month of the income year.

6. Fifth month net gain or loss: Subtract Line 1 from Line 6a.

7a. Number of employees in Connecticut on the last day of the sixth month of the income year.

7. Sixth month net gain or loss: Subtract Line 1 from Line 7a.

8a. Number of employees in Connecticut on the last day of the seventh month of the income year.

8. Seventh month net gain or loss: Subtract Line 1 from Line 8a.

9a. Number of employees in Connecticut on the last day of the eighth month of the income year.

9. Eighth month net gain or loss: Subtract Line 1 from Line 9a.

10a. Number of employees in Connecticut on the last day of the ninth month of the income year.

10. Ninth month net gain or loss: Subtract Line 1 from Line 10a.

11a. Number of employees in Connecticut on the last day of the tenth month of the income year.

11. Tenth month net gain or loss: Subtract Line 1 from Line 11a.

12a. Number of employees in Connecticut on the last day of the eleventh month of the income year.

12. Eleventh month net gain or loss: Subtract Line 1 from Line 12a.

13a. Number of employees in Connecticut on the last day of the twelfth month of the income year.

13. Twelfth month net gain or loss: Subtract Line 1 from Line 13a.

14. Total monthly net employment gain: Add Lines 2 through 13, Column B. ............................... 14.

15. Average monthly net employment gain: Divide Line 14 by twelve (12). ................................... 15.

16. Tax credit cap expansion amount: Multiply Line 15 by $6,000. ................................................ 16.

00

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1