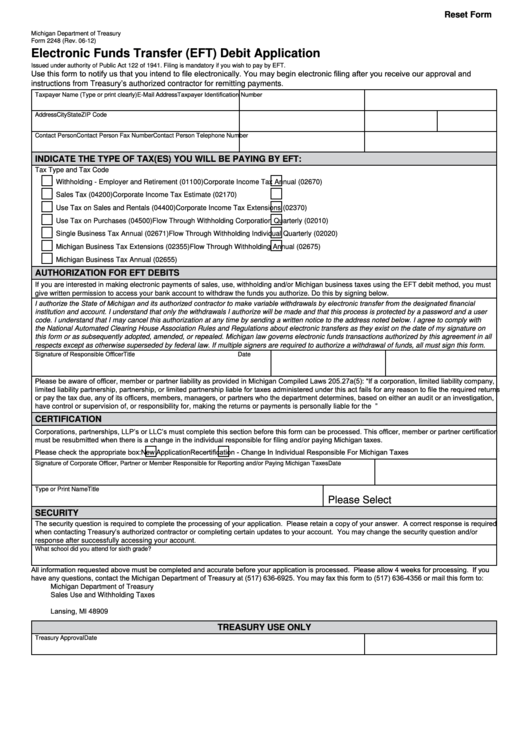

Reset Form

Michigan Department of Treasury

Form 2248 (Rev. 06-12)

Electronic Funds Transfer (EFT) Debit Application

Issued under authority of Public Act 122 of 1941. Filing is mandatory if you wish to pay by EFT.

Use this form to notify us that you intend to file electronically. You may begin electronic filing after you receive our approval and

instructions from Treasury’s authorized contractor for remitting payments.

Taxpayer Identification Number

Taxpayer Name (Type or print clearly)

E-Mail Address

Address

City

State

ZIP Code

Contact Person

Contact Person Fax Number

Contact Person Telephone Number

INDICATE THE TYPE OF TAX(ES) YOU WILL BE PAYING BY EFT:

Tax Type and Tax Code

Withholding - Employer and Retirement (01100)

Corporate Income Tax Annual (02670)

Sales Tax (04200)

Corporate Income Tax Estimate (02170)

Use Tax on Sales and Rentals (04400)

Corporate Income Tax Extensions (02370)

Use Tax on Purchases (04500)

Flow Through Withholding Corporation Quarterly (02010)

Single Business Tax Annual (02671)

Flow Through Withholding Individual Quarterly (02020)

Michigan Business Tax Extensions (02355)

Flow Through Withholding Annual (02675)

Michigan Business Tax Annual (02655)

AUTHORIZATION FOR EFT DEBITS

If you are interested in making electronic payments of sales, use, withholding and/or Michigan business taxes using the EFT debit method, you must

give written permission to access your bank account to withdraw the funds you authorize. Do this by signing below.

I authorize the State of Michigan and its authorized contractor to make variable withdrawals by electronic transfer from the designated financial

institution and account. I understand that only the withdrawals I authorize will be made and that this process is protected by a password and a user

code. I understand that I may cancel this authorization at any time by sending a written notice to the address noted below. I agree to comply with

the National Automated Clearing House Association Rules and Regulations about electronic transfers as they exist on the date of my signature on

this form or as subsequently adopted, amended, or repealed. Michigan law governs electronic funds transactions authorized by this agreement in all

respects except as otherwise superseded by federal law. If multiple signers are required to authorize a withdrawal of funds, all must sign this form.

Signature of Responsible Officer

Title

Date

Please be aware of officer, member or partner liability as provided in Michigan Compiled Laws 205.27a(5): “If a corporation, limited liability company,

limited liability partnership, partnership, or limited partnership liable for taxes administered under this act fails for any reason to file the required returns

or pay the tax due, any of its officers, members, managers, or partners who the department determines, based on either an audit or an investigation,

have control or supervision of, or responsibility for, making the returns or payments is personally liable for the failure.......”

CERTIFICATION

Corporations, partnerships, LLP’s or LLC’s must complete this section before this form can be processed. This officer, member or partner certification

must be resubmitted when there is a change in the individual responsible for filing and/or paying Michigan taxes.

Please check the appropriate box:

Recertification - Change In Individual Responsible For Michigan Taxes

New Application

Signature of Corporate Officer, Partner or Member Responsible for Reporting and/or Paying Michigan Taxes

Date

Type or Print Name

Title

Please Select

SECURITY

The security question is required to complete the processing of your application. Please retain a copy of your answer. A correct response is required

when contacting Treasury’s authorized contractor or completing certain updates to your account. You may change the security question and/or

response after successfully accessing your account.

What school did you attend for sixth grade?

All information requested above must be completed and accurate before your application is processed. Please allow 4 weeks for processing. If you

have any questions, contact the Michigan Department of Treasury at (517) 636-6925. You may fax this form to (517) 636-4356 or mail this form to:

Michigan Department of Treasury

Sales Use and Withholding Taxes

P.O. Box 30427

Lansing, MI 48909

TREASURY USE ONLY

Treasury Approval

Date

1

1