Form It-Rd - Research Tax Credit Page 2

ADVERTISEMENT

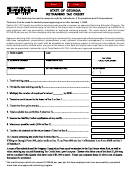

IT-RD (10/08)

Department of Revenue

Income Tax Division

Example

Section 48-7-40.12

This example is based on the following assumptions:

1. The current year's (2001) Georgia Taxable Net Income = $800,000

2. 2001 Research expenses in Georgia

=$325,000

3. The total of all other credits was

=$ 30,000

4. The credit carry-over from prior year is

=$ 10,000

Section 2. Ratio Calculation

(A) Previous 3 Years

(B) Georgia Research Expense

(C) Georgia Taxable

Equals Ratio (D)

Net Income

(Col. B - Col.C)

2000

300,000

750,000

0.4000

1999

200,000

600,000

0.3333

1998

150,000

500,000

0.3000

(E) Total from Column (D)

1.0333

Section 3. Calculation of Average

Total from (E)

Divided by 3

Equals Average Research Ratio (F)

1.0333

0.3444

3

Section 4. Calculation of Base Amount

Current Year Georgia Taxable Net Income

Multiplied by (F) or .300, whichever is less

Base Amount (G)

$800,000

$240,000

0.300

Section 5. Calculation of Tax Credit

Current Year Research

Minus Base Amount (G)

Equals (H)

Multiply (H) by .10

Equals Tax Credit (I)

Expense

$

325,000

$

240,000

$

85,000

$

8,500

0.10

Section 6. Application of Credit and Carry-Forward

$

48,000

(1) Current Tax Liability without any Credits

$

30,000

(2) Value of All other Credits Claimed

$

18,000

(3) Subtract line (2) from line (1), this is the remaining tax liability

$

9,000

(4) Multiply line (3) by 50%, maximum credit allowed

$

8,500

(5) Enter Research Tax Credit from line (I) above

$

10,000

(5a) Enter amounts of tax credit carried over from prior year

(6) Total available Research Tax Credit, line 5 & 5a

$

18,500

$

9,000

(7) Credit to be claimed on return, lessor or line (4) or line (6)

$

9,500

(8) If line (6) exceeds line (7), Unused Credit or Carry-Forward

In the instance of an S Corporation or other pass-through entity, the credit on line 7 above would first be applied to any income

tax at the entity level and then apportioned to shareholders or partners. For the purposes of the calculation, such a business

enterprise’s “Georgia taxable net income” shall be its total net income as allocated and /or apportioned to Georgia. The term

“business enterprise” is defined in O.C.G.A. § 48-7-40-.12. Column (C) Section 2 must show positive Georgia Taxable Net

Income for all three years in order to qualify. (See Reg. 560-7-8-.42)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2