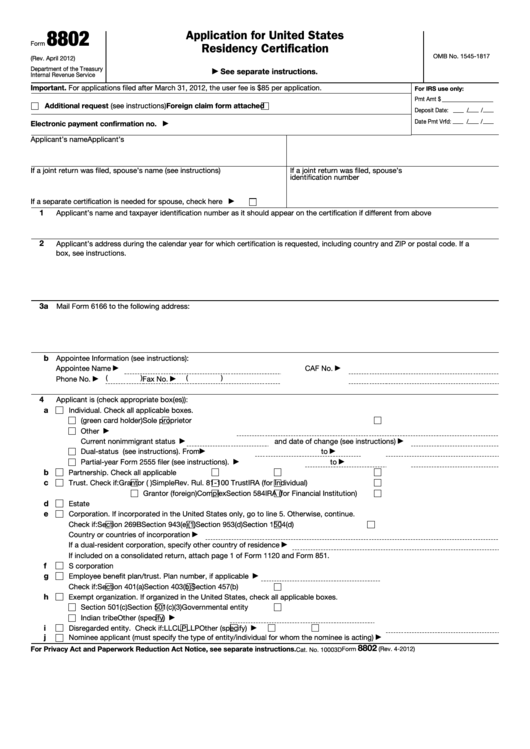

8802

Application for United States

Form

Residency Certification

OMB No. 1545-1817

(Rev. April 2012)

Department of the Treasury

See separate instructions.

▶

Internal Revenue Service

Important. For applications filed after March 31, 2012, the user fee is $85 per application.

For IRS use only:

Pmt Amt $

.

Additional request (see instructions)

Foreign claim form attached

Deposit Date:

/

/

Date Pmt Vrfd:

/

/

Electronic payment confirmation no.

▶

Applicant’s name

Applicant’s U.S. taxpayer identification number

If a joint return was filed, spouse’s name (see instructions)

If a joint return was filed, spouse’s U.S. taxpayer

identification number

If a separate certification is needed for spouse, check here

▶

1

Applicant’s name and taxpayer identification number as it should appear on the certification if different from above

2

Applicant’s address during the calendar year for which certification is requested, including country and ZIP or postal code. If a P.O.

box, see instructions.

3a

Mail Form 6166 to the following address:

b

Appointee Information (see instructions):

Appointee Name

CAF No.

▶

▶

(

)

(

)

Phone No.

Fax No.

▶

▶

4

Applicant is (check appropriate box(es)):

a

Individual. Check all applicable boxes.

U.S. citizen

U.S. lawful permanent resident (green card holder)

Sole proprietor

Other U.S. resident alien. Type of entry visa

▶

Current nonimmigrant status

and date of change (see instructions)

▶

▶

Dual-status U.S. resident (see instructions). From

to

▶

to

Partial-year Form 2555 filer (see instructions). U.S. resident from

▶

▶

b

Partnership. Check all applicable boxes.

U.S.

Foreign

LLC

c

Trust. Check if:

Grantor (U.S.)

Simple

Rev. Rul. 81-100 Trust

IRA (for Individual)

Grantor (foreign)

Complex

Section 584

IRA (for Financial Institution)

d

Estate

e

Corporation. If incorporated in the United States only, go to line 5. Otherwise, continue.

Check if:

Section 269B

Section 943(e)(1)

Section 953(d)

Section 1504(d)

Country or countries of incorporation

▶

If a dual-resident corporation, specify other country of residence

▶

If included on a consolidated return, attach page 1 of Form 1120 and Form 851.

f

S corporation

g

Employee benefit plan/trust. Plan number, if applicable

▶

Check if:

Section 401(a)

Section 403(b)

Section 457(b)

h

Exempt organization. If organized in the United States, check all applicable boxes.

Section 501(c)

Section 501(c)(3)

Governmental entity

Indian tribe

Other (specify)

▶

i

Disregarded entity. Check if:

LLC

LP

LLP

Other (specify)

▶

j

Nominee applicant (must specify the type of entity/individual for whom the nominee is acting)

▶

8802

For Privacy Act and Paperwork Reduction Act Notice, see separate instructions.

Form

(Rev. 4-2012)

Cat. No. 10003D

1

1 2

2 3

3