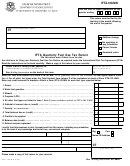

IFTA-101-I-MN

Instructions for Form IFTA-101-MN

IFTA Quarterly Fuel Use Tax Schedule

A separate Form IFTA-101-MN must be used for each fuel type.

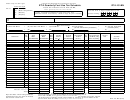

Column K - Divide the amount in column I by the amount in

Refer to Form IFTA-105, Final Fuel Use Tax Rate and Rate Code

column J to determine the total taxable gallons of fuel consumed

1

Table 1, when completing schedules for Diesel, Motor Fuel

in each IFTA jurisdiction. For surcharge taxable gallons, enter

Gasoline, Ethanol, Propane and CNG. For all other fuel types

the taxable gallons from the same jurisdiction's fuel use tax line,

refer to the IFTA-105, Final Fuel Use Tax Rate and Rate Code

Column K. Round gallons to the nearest whole gallon

Table 2. Check the appropriate box for the fuel type you are

(e.g., 123.4 = 123.).

reporting. When reporting a fuel other than those listed, check

Column L - Enter the total tax-paid gallons of fuel purchased and

the box next to the blank line and enter in the Fuel Type Code

placed in the propulsion tank of a qualified motor vehicle in each

and Fuel Type as shown on the back of these instructions.

IFTA jurisdiction. (Enter "0" in column L if this line represents a

surcharge, since a surcharge cannot be prepaid.) Keep your

Enter the quarter ending date of the period covered by this

receipts for each purchase claimed. When using bulk storage,

return.

report only tax-paid gallons removed for use in your qualified

motor vehicles. Fuel remaining in storage cannot be claimed

Enter your licensee IFTA identification number. This is your

until it is used.

federal employer identification number, social security number

Round gallons to the nearest whole gallon (e.g., 123.4 = 123).

or other jurisdiction assigned identification number as it appears

on your IFTA license.

Column M - Subtract the amounts in column L from column

K for each jurisdiction. Enter '0' on a surcharge line.

Enter your legal name as it appears on your IFTA License.

-

If column K is greater than column L, enter the

(A) Total IFTA Miles - Enter the total miles traveled in IFTA

taxable gallons.

jurisdictions by all qualified motor vehicles in your fleet using

the fuel type indicated on each form/schedule (total from column

-

If column L is greater than column K, enter the

H). Report all miles traveled whether the miles are taxable or

credit gallons. Use brackets to indicate credit

nontaxable. Round mileage to the nearest whole miles

gallons.

(e.g., 1234.5 = 1235).

Column N - Enter the rate for the appropriate fuel type from

(B) Total NON-IFTA Miles - Enter the total miles traveled in

Form IFTA-105 or IFTA-105.1 for the quarter you are

non-IFTA jurisdictions by all qualified motor vehicles in your

1

preparing. Where a surcharge is applicable, enter the

fleet using the fuel type indicated on each form/schedule. Report

appropriate surcharge rate from Form IFTA-105 or

all miles traveled whether the miles are taxable or nontaxable.

IFTA-105.1 for the quarter you are preparing.

Round mileage to the nearest whole mile (e.g., 1234.5 = 1235).

Column O - Multiply the amount in column M by the tax rate

(C) Total Miles - Add the amount in item (A) and the amount in

for that jurisdiction in column N to determine the tax or

item (B) to determine total miles traveled by all qualified motor

credit. Enter any credit amount in brackets. Where a

vehicles in your fleet.

1

surcharge is applicable, multiply the amount in Column K

(D) Total Gallons - Enter the total gallons of fuel placed in the

by the surcharge rate for that jurisdiction in Column N.

propulsion tank in both IFTA and non-IFTA jurisdictions for all

Column P - If you file late, compute interest on any tax due

qualified motor vehicles in your fleet using the fuel type

for each jurisdiction for each fuel type indicated on each

indicated. Round gallons to the nearest whole gallon

form/schedule. Interest is computed on tax due from the due

(e.g., 123.4 = 123).

date of the return until the date payment is received. Interest

(E) Average Fleet MPG - Divide item (C) by item (D). Round to

is computed at 1% per month or part of a month, to a

2 decimal places (e.g., 4.567 = 4.57).

maximum of 12% per year. Returns must be postmarked no

later than the last day of the month following the end of the

Column F - Enter the name of each IFTA jurisdiction that you

quarter to be timely.

operated in during the period. Enter the jurisdiction's name on

two(2) consecutive lines if the traveled jurisdiction administers

Column Q - For each jurisdiction add the amounts in column

1

a surcharge in addition to their regular fuel tax. Enter the

O and column P, and enter the total dollar amount due or

jurisdiction's two letter abbreviation from Form IFTA-105 or

credit amount. Enter any credit amount in brackets.

IFTA-105.1 for the quarter you are preparing.

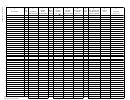

Subtotals - Add the amounts in columns H, O, P and Q on the

Column G - Enter the rate code of the appropriate fuel type for

front of the schedule and enter on the Subtotals line in the

each IFTA jurisdiction from Form IFTA-105 or IFTA-105.1 for the

appropriate columns. Add the amounts in columns H, O, P

quarter you are preparing.

and Q on the back of the schedule and enter in the applicable

columns on the Subtotals line below. Enter these amounts in

Column H - Enter the total miles traveled (taxable and

the applicable columns on the front of the schedule on the

nontaxable) in each IFTA jurisdiction for this fuel type only. Enter

Subtotals from back line.

'0' on a surcharge line. Round mileage to the nearest whole

miles (e.g., 1234.5 = 1235).

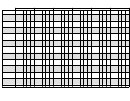

Totals - Add the Subtotals and the Subtotals from back to

determine the Totals. The total in column Q is the difference

Column I - Enter the IFTA taxable miles for each IFTA

of all credits and taxes due for all jurisdictions. Transfer the

jurisdiction. Do not include fuel use trip permit miles. Enter '0'

Totals from Column Q for each fuel type reported to the

on a surcharge line. Round mileage to the nearest whole miles

corresponding line of Form IFTA-100-MN. For all other fuel

(e.g., 1234.5 = 1235).

types, add the Subtotals and the Subtotals from back, and

transfer the Total from column Q for each of these fuel types

Column J - Enter your average fleet miles per gallon (mpg) from

to the corresponding line in column S of the worksheet on

item (E) above. Enter '0' on a surcharge line.

the back of these instructions.

1

Jurisdictions with surcharge: Indiana, Kentucky and Virginia.

IFTA-101-I-MN (4/06)

Make a copy of this return for your records.

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22