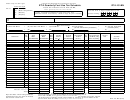

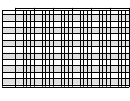

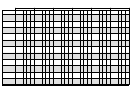

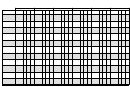

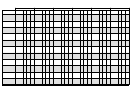

Use for 4th Quarter 2012 only.

IFTA Final Fuel Use Tax Rate and Rate Code Table 1

IFTA-105

Note: Only use this rate schedule for the period October 1 - December 31, 2012.

Note: Gallon

Liter

U.S./Canada exchange rate 0.9723 - 1.0285

- U.S. $ per gallon (p/g);

- Canadian $ per liter (p/l)

D (Diesel)

G (Motor Fuel Gasoline)

E (Ethanol)

P (Propane (LPG))

C (CNG (Natural Gas))

J (Biodiesel)

Effective

Effective

Effective

Effective

Effective

Effective

Rate

Rate

Rate

Rate

Rate

Rate

Date**

Code

Gallon

Liter

Date**

Code

Gallon

Liter

Date**

Code

Gallon

Liter

Date**

Code

Gallon

Liter

Date**

Code

Gallon

Liter

Date**

Code

Gallon

Liter

Jurisdiction

Alabama

068

.19

.0488

068

.16

.0411

068

.16

.0411

068

.19

.0488

068

.19

.0488

026

.19

.0488

AL

†

†

†

†

Alberta

070

.3504

.09

070

.3504

.09

070

.3504

.09

070

.253

.065

069

N/A

N/A

026

.3504

.09

AB

†

†

†

†

†

†

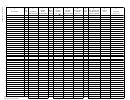

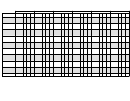

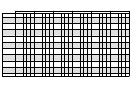

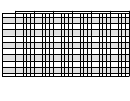

Arizona

079

.26

.0668

070

.18

.0463

070

N/A

N/A

079

N/A

N/A

072

N/A

N/A

026

.26

.0668

AZ

Arkansas

070

.225

.0578

070

.215

.0552

070

.215

.0552

070

.165

.0424

070

.05

.0128

026

.225

.0578

AR

†

†

†

†

†

†

†

†

British Columbia

069

.8825

.2267

069

.8241

.2117

067

N/A

N/A

069

.1799

.0462

068

N/A

N/A

026

N/A

N/A

BC

†

†

California

068

.405

.104

068

N/A

N/A

068

.09

.0231

068

.06

.0155

068

.07

.018

026

.405

.104

CA

Colorado

070

.205

.0527

070

.22

.0565

069

.22

.0565

070

.205

.0527

070

.205

.0527

026

.205

.0527

CO

†

†

†

†

Connecticut

069

.512

.1316

068

.25

.0643

068

.25

.0643

068

.26

.0668

068

.26

.0668

026

.512

.1316

CT

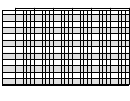

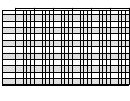

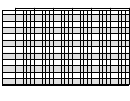

Delaware

066

.22

.0565

066

.23

.0591

066

.23

.0591

066

.22

.0565

066

.22

.0565

026

.22

.0565

DE

Florida

070

.3257

.0837

070

.3047

.0783

070

N/A

N/A

069

N/A

N/A

068

.3257

.0837

026

.3257

.0837

FL

Georgia

070

.182

.0468

074

.166

.0427

074

.165

.0424

069

.134

.0344

074

.165

.0424

027

.182

.0468

GA

†

†

Idaho

070

.25

.0643

068

N/A

N/A

068

N/A

N/A

070

.181

.0465

070

.197

.0506

026

.25

.0643

ID

Illinois

070

.411

.1056

070

.40

.1028

070

.40

.1028

070

.328

.0843

070

.328

.0843

026

.411

.1056

IL

Indiana

139

.16

.0411

139

.18

.0463

139

.16

.0411

139

.16

.0411

139

.16

.0411

046

.16

.0411

IN

*

Indiana

140

.11

.0283

140

.11

.0283

140

.11

.0283

140

.11

.0283

140

.11

.0283

047

.11

.0283

IN

Iowa

070

.225

.0578

070

.21

.054

070

.19

.0488

070

.20

.0513

069

.16

.0411

026

.225

.0578

IA

Kansas

070

.26

.0668

070

.24

.0616

070

.24

.0616

070

.23

.0591

070

.23

.0591

026

.26

.0668

KS

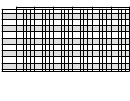

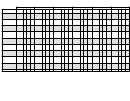

Kentucky

131

.255

.0655

131

.285

.0732

131

.285

.0732

131

.285

.0732

131

.255

.0655

026

N/A

N/A

KY

*

Kentucky

132

.123

.0316

132

.052

.0133

132

.052

.0133

132

.052

.0133

132

.123

.0316

N/A

N/A

N/A

KY

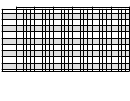

Louisiana

070

.20

.0513

070

.20

.0513

070

.20

.0513

070

.16

.0411

070

.16

.0411

026

.20

.0513

LA

†

†

Maine

065

.312

.0801

064

N/A

N/A

065

.198

.0509

065

.219

.0563

065

.243

.0624

026

.312

.0801

ME

Manitoba

MB

072

.545

.14

071

.545

.14

071

.545

.14

071

.1168

.03

069

.545

.14

027

.545

.14

Maryland

068

.2425

.0623

068

.235

.0604

068

.235

.0604

068

.235

.0604

068

.235

.0604

026

.2425

.0623

MD

Massachusetts

068

.21

.054

068

.21

.054

068

.21

.054

068

.229

.0588

068

.229

.0588

026

.21

.054

MA

Michigan

MI

092

.369

.0948

069

N/A

N/A

069

N/A

N/A

069

N/A

N/A

069

N/A

N/A

026

.369

.0948

†

†

Minnesota

071

.285

.0732

071

.285

.0732

071

.285

.0732

071

.2135

.0548

071

.2474

.0636

027

.285

.0732

MN

†

†

Mississippi

070

.18

.0463

070

.18

.0463

070

.18

.0463

070

.17

.0437

070

.18

.0463

026

.18

.0463

MS

†

†

Missouri

†

†

MO

070

.17

.0437

069

.17

.0437

068

.17

.0437

070

.17

.0437

070

.17

.0437

026

N/A

N/A

†

†

†

†

Montana

070

.2775

.0713

070

N/A

N/A

070

N/A

N/A

068

.0518

.0133

069

.07

.018

026

N/A

N/A

MT

Nebraska

070

.262

.0673

070

.262

.0673

070

.262

.0673

070

.262

.0673

070

.262

.0673

026

.262

.0673

NE

Nevada

070

.27

.0693

068

.23

.0591

068

.23

.0591

070

.22

.0565

070

.21

.054

026

.27

.0693

NV

New Brunswick

068

.7474

.192

068

.5295

.136

068

.7474

.192

068

.2608

.067

068

.7474

.192

026

.7474

.192

NB

Newfoundland

068

.6423

.165

068

.6423

.165

068

N/A

N/A

068

.2725

.07

068

N/A

N/A

026

N/A

N/A

NL

*

Surcharge

**

Period rate change is effective

†

FOR FOOTNOTES CONCERNING EACH OF THESE TAX RATES, GO TO AND CLICK ON TAX RATES.

N/C = No Change

IFTA-105

(12/12)

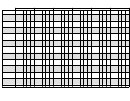

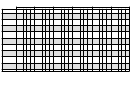

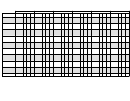

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22