2016 Ia 8801 Iowa Alternative Minimum Tax Credit Instructions

ADVERTISEMENT

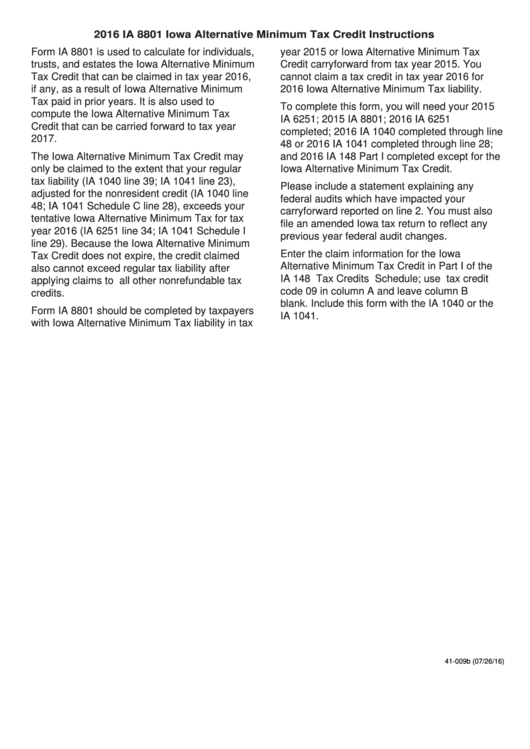

2016 IA 8801 Iowa Alternative Minimum Tax Credit Instructions

Form IA 8801 is used to calculate for individuals,

year 2015 or Iowa Alternative Minimum Tax

trusts, and estates the Iowa Alternative Minimum

Credit carryforward from tax year 2015. You

Tax Credit that can be claimed in tax year 2016,

cannot claim a tax credit in tax year 2016 for

if any, as a result of Iowa Alternative Minimum

2016 Iowa Alternative Minimum Tax liability.

Tax paid in prior years. It is also used to

To complete this form, you will need your 2015

compute the Iowa Alternative Minimum Tax

IA 6251; 2015 IA 8801; 2016 IA 6251

Credit that can be carried forward to tax year

completed; 2016 IA 1040 completed through line

2017.

48 or 2016 IA 1041 completed through line 28;

The Iowa Alternative Minimum Tax Credit may

and 2016 IA 148 Part I completed except for the

only be claimed to the extent that your regular

Iowa Alternative Minimum Tax Credit.

tax liability (IA 1040 line 39; IA 1041 line 23),

Please include a statement explaining any

adjusted for the nonresident credit (IA 1040 line

federal audits which have impacted your

48; IA 1041 Schedule C line 28), exceeds your

carryforward reported on line 2. You must also

tentative Iowa Alternative Minimum Tax for tax

file an amended Iowa tax return to reflect any

year 2016 (IA 6251 line 34; IA 1041 Schedule I

previous year federal audit changes.

line 29). Because the Iowa Alternative Minimum

Enter the claim information for the Iowa

Tax Credit does not expire, the credit claimed

Alternative Minimum Tax Credit in Part I of the

also cannot exceed regular tax liability after

IA 148 Tax Credits Schedule; use tax credit

applying claims to all other nonrefundable tax

code 09 in column A and leave column B

credits.

blank. Include this form with the IA 1040 or the

Form IA 8801 should be completed by taxpayers

IA 1041.

with Iowa Alternative Minimum Tax liability in tax

41-009b (07/26/16)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1