Instructions For Form 3150 - Idaho Ifta Tax Return

ADVERTISEMENT

EIN00040

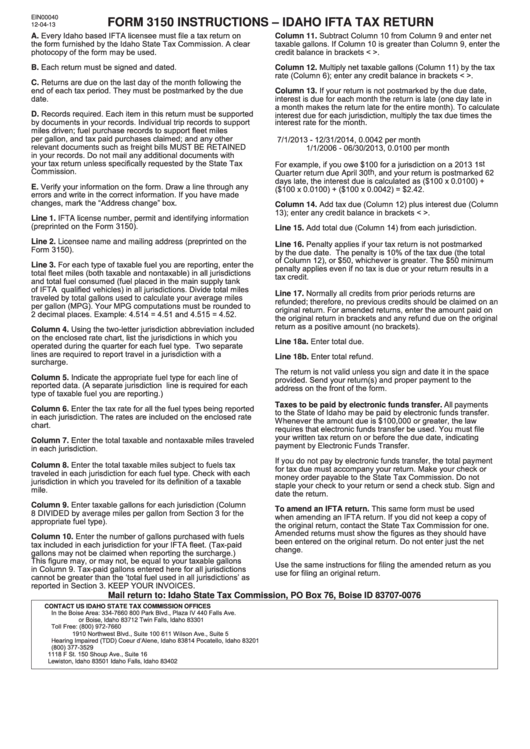

FORM 3150 INSTRUCTIONS – IDAHO IFTA TAX RETURN

12-04-13

A. Every Idaho based IFTA licensee must file a tax return on

Column 11. Subtract Column 10 from Column 9 and enter net

the form furnished by the Idaho State Tax Commission. A clear

taxable gallons. If Column 10 is greater than Column 9, enter the

photocopy of the form may be used.

credit balance in brackets < >.

B. Each return must be signed and dated.

Column 12. Multiply net taxable gallons (Column 11) by the tax

rate (Column 6); enter any credit balance in brackets < >.

C. Returns are due on the last day of the month following the

end of each tax period. They must be postmarked by the due

Column 13. If your return is not postmarked by the due date,

date.

interest is due for each month the return is late (one day late in

a month makes the return late for the entire month). To calculate

D. Records required. Each item in this return must be supported

interest due for each jurisdiction, multiply the tax due times the

by documents in your records. Individual trip records to support

interest rate for the month.

miles driven; fuel purchase records to support fleet miles

per gallon, and tax paid purchases claimed; and any other

7/1/2013 - 12/31/2014, 0.0042 per month

1/1/2006 - 06/30/2013, 0.0100 per month

relevant documents such as freight bills MUST BE RETAINED

in your records. Do not mail any additional documents with

your tax return unless specifically requested by the State Tax

For example, if you owe $100 for a jurisdiction on a 2013 1 st

Commission.

Quarter return due April 30 th , and your return is postmarked 62

days late, the interest due is calculated as ($100 x 0.0100) +

E. Verify your information on the form. Draw a line through any

($100 x 0.0100) + ($100 x 0.0042) = $2.42.

errors and write in the correct information. If you have made

changes, mark the “Address change” box.

Column 14. Add tax due (Column 12) plus interest due (Column

13); enter any credit balance in brackets < >.

Line 1. IFTA license number, permit and identifying information

(preprinted on the Form 3150).

Line 15. Add total due (Column 14) from each jurisdiction.

Line 2. Licensee name and mailing address (preprinted on the

Line 16. Penalty applies if your tax return is not postmarked

Form 3150).

by the due date. The penalty is 10% of the tax due (the total

of Column 12), or $50, whichever is greater. The $50 minimum

Line 3. For each type of taxable fuel you are reporting, enter the

penalty applies even if no tax is due or your return results in a

total fleet miles (both taxable and nontaxable) in all jurisdictions

tax credit.

and total fuel consumed (fuel placed in the main supply tank

of IFTA qualified vehicles) in all jurisdictions. Divide total miles

Line 17. Normally all credits from prior periods returns are

traveled by total gallons used to calculate your average miles

refunded; therefore, no previous credits should be claimed on an

per gallon (MPG). Your MPG computations must be rounded to

original return. For amended returns, enter the amount paid on

2 decimal places. Example: 4.514 = 4.51 and 4.515 = 4.52.

the original return in brackets and any refund due on the original

return as a positive amount (no brackets).

Column 4. Using the two-letter jurisdiction abbreviation included

on the enclosed rate chart, list the jurisdictions in which you

Line 18a. Enter total due.

operated during the quarter for each fuel type. Two separate

lines are required to report travel in a jurisdiction with a

Line 18b. Enter total refund.

surcharge.

The return is not valid unless you sign and date it in the space

Column 5. Indicate the appropriate fuel type for each line of

provided. Send your return(s) and proper payment to the

reported data. (A separate jurisdiction line is required for each

address on the front of the form.

type of taxable fuel you are reporting.)

Taxes to be paid by electronic funds transfer. All payments

Column 6. Enter the tax rate for all the fuel types being reported

to the State of Idaho may be paid by electronic funds transfer.

in each jurisdiction. The rates are included on the enclosed rate

Whenever the amount due is $100,000 or greater, the law

chart.

requires that electronic funds transfer be used. You must file

your written tax return on or before the due date, indicating

Column 7. Enter the total taxable and nontaxable miles traveled

payment by Electronic Funds Transfer.

in each jurisdiction.

If you do not pay by electronic funds transfer, the total payment

Column 8. Enter the total taxable miles subject to fuels tax

for tax due must accompany your return. Make your check or

traveled in each jurisdiction for each fuel type. Check with each

money order payable to the State Tax Commission. Do not

jurisdiction in which you traveled for its definition of a taxable

staple your check to your return or send a check stub. Sign and

mile.

date the return.

Column 9. Enter taxable gallons for each jurisdiction (Column

To amend an IFTA return. This same form must be used

8 DIVIDED by average miles per gallon from Section 3 for the

when amending an IFTA return. If you did not keep a copy of

appropriate fuel type).

the original return, contact the State Tax Commission for one.

Amended returns must show the figures as they should have

Column 10. Enter the number of gallons purchased with fuels

been entered on the original return. Do not enter just the net

tax included in each jurisdiction for your IFTA fleet. (Tax-paid

change.

gallons may not be claimed when reporting the surcharge.)

This figure may, or may not, be equal to your taxable gallons

Use the same instructions for filing the amended return as you

in Column 9. Tax-paid gallons entered here for all jurisdictions

use for filing an original return.

cannot be greater than the ‘total fuel used in all jurisdictions’ as

reported in Section 3. KEEP YOUR INVOICES.

Mail return to: Idaho State Tax Commission, PO Box 76, Boise ID 83707-0076

CONTACT US

IDAHO STATE TAX COMMISSION OFFICES

In the Boise Area: 334-7660

800 Park Blvd., Plaza IV

440 Falls Ave.

or

Boise, Idaho 83712

Twin Falls, Idaho 83301

Toll Free: (800) 972-7660

1910 Northwest Blvd., Suite 100

611 Wilson Ave., Suite 5

Hearing Impaired (TDD)

Coeur d’Alene, Idaho 83814

Pocatello, Idaho 83201

(800) 377-3529

1118 F St.

150 Shoup Ave., Suite 16

Lewiston, Idaho 83501

Idaho Falls, Idaho 83402

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1