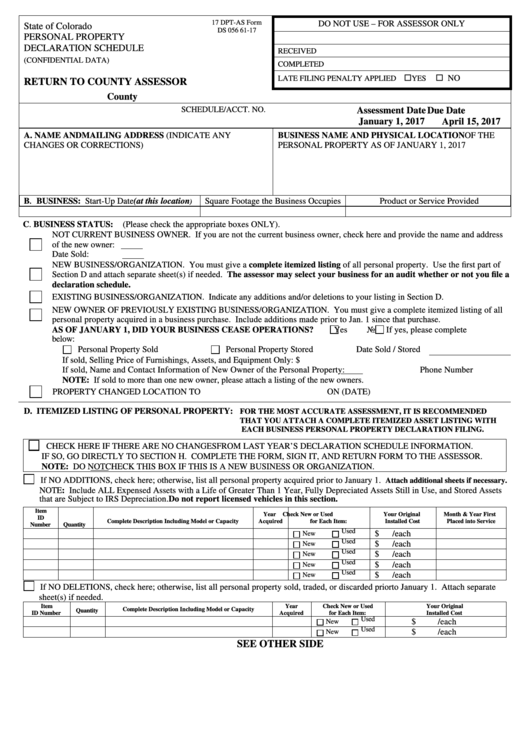

17 DPT-AS Form

DO NOT USE – FOR ASSESSOR ONLY

State of Colorado

DS 056 61-17

PERSONAL PROPERTY

DECLARATION SCHEDULE

RECEIVED

(CONFIDENTIAL DATA)

COMPLETED

NO

LATE FILING PENALTY APPLIED

YES

RETURN TO COUNTY ASSESSOR

County

B.A. CODE

T.A. CODE

SCHEDULE/ACCT. NO.

Assessment Date

Due Date

January 1, 2017

April 15, 2017

A. NAME AND MAILING ADDRESS (INDICATE ANY

BUSINESS NAME AND PHYSICAL LOCATION OF THE

CHANGES OR CORRECTIONS)

PERSONAL PROPERTY AS OF JANUARY 1, 2017

B

BUSINESS: Start-Up Date (at this location

Square Footage the Business Occupies

Product or Service Provided

.

)

C. BUSINESS STATUS:

(Please check the appropriate boxes ONLY).

NOT CURRENT BUSINESS OWNER. If you are not the current business owner, check here and provide the name and address

of the new owner:

Date Sold:

NEW BUSINESS/ORGANIZATION. You must give a complete itemized listing of all personal property. Use the first part of

Section D and attach separate sheet(s) if needed. The assessor may select your business for an audit whether or not you file a

declaration schedule.

EXISTING BUSINESS/ORGANIZATION. Indicate any additions and/or deletions to your listing in Section D.

NEW OWNER OF PREVIOUSLY EXISTING BUSINESS/ORGANIZATION. You must give a complete itemized listing of all

personal property acquired in a business purchase. Include additions made prior to Jan. 1 since that purchase.

AS OF JANUARY 1, DID YOUR BUSINESS CEASE OPERATIONS?

Yes

No

If yes, please complete

below:

Personal Property Sold

Personal Property Stored

Date Sold / Stored

If sold, Selling Price of Furnishings, Assets, and Equipment Only: $

If sold, Name and Contact Information of New Owner of the Personal Property:

Phone Number

NOTE: If sold to more than one new owner, please attach a listing of the new owners.

PROPERTY CHANGED LOCATION TO

ON (DATE)

D. ITEMIZED LISTING OF PERSONAL PROPERTY:

FOR THE MOST ACCURATE ASSESSMENT, IT IS RECOMMENDED

THAT YOU ATTACH A COMPLETE ITEMIZED ASSET LISTING WITH

EACH BUSINESS PERSONAL PROPERTY DECLARATION FILING.

CHECK HERE IF THERE ARE NO CHANGES FROM LAST YEAR’S DECLARATION SCHEDULE INFORMATION.

IF SO, GO DIRECTLY TO SECTION H. COMPLETE THE FORM, SIGN IT, AND RETURN FORM TO THE ASSESSOR.

NOTE: DO NOT CHECK THIS BOX IF THIS IS A NEW BUSINESS OR ORGANIZATION.

If NO ADDITIONS, check here; otherwise, list all personal property acquired prior to January 1.

Attach additional sheets if necessary.

NOTE: Include ALL Expensed Assets with a Life of Greater Than 1 Year, Fully Depreciated Assets Still in Use, and Stored Assets

that are Subject to IRS Depreciation. Do not report licensed vehicles in this section.

Item

Year

Check New or Used

Your Original

Month & Year First

ID

Complete Description Including Model or Capacity

Acquired

for Each Item:

Installed Cost

Placed into Service

Number

Quantity

$

/each

Used

New

$

/each

New

Used

$

/each

Used

New

$

/each

New

Used

$

/each

New

Used

If NO DELETIONS, check here; otherwise, list all personal property sold, traded, or discarded prior to January 1. Attach separate

sheet(s) if needed.

Item

Year

Check New or Used

Your Original

Complete Description Including Model or Capacity

ID Number

Quantity

Acquired

for Each Item:

Installed Cost

$

/each

New

Used

$

/each

New

Used

SEE OTHER SIDE

1

1 2

2