Form It-Rhc - Rehabilitated Historic Credit Page 2

ADVERTISEMENT

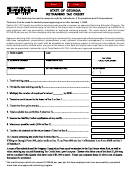

Part B - Historic Home Located in a Target Area

Determination of Substantial Rehabilitation

1. Amount of the

rehabilitation expenditures (line 2e. II.

__ _______________

2. Dollar limitation

$5,000

3. Subtract line 2 from line 1, if zero or less, STOP, you have not completed a

substantial rehabilitation and are not eligible for this portion of the credit

__ _______________

Amount of the Credit

_____________

3. Amount from Line 1

30%

4. Credit limitation

5. Multiply line 3 by line 4

__ _______________

Part C - Any Other

Structure

Determination of Substantial Rehabilitation

1. Amount of the

rehabilitation expenditures (Line 2e. II.

__ _______________

2. Adjusted basis of the home at the beginning of the 24 month

(or 60 month) rehabilitation period.

This is the basis used to

determine gain or loss for Federal income tax purposes (Line 2a.

______________

3. Dollar limitation

$5,000

4. Enter the greater of line 2 or line 3

__ _______________

5. Subtract line 4 from line 1, if zero or less, STOP, you have not completed a

substantial rehabilitation and are not eligible for this portion of the credit

__ _______________

Amount of the Credit

_____________

6. Amount from Line 1

7. Credit limitation

25%

8. Multiply line 6 by line 7

__ _______________

Summary for Historic Home

1. Enter the total of Part A - line 10 or Part B - line 5

__ _______________

2. Maximum Credit

$100,000

3. Enter the lesser of line 1 or line 2 here and on your income tax return

__ _______________

1. Enter the total of Part C- Line 8

__ _______________

2. Maximum Credit

$300,000

3. Enter the lesser of line 1 or line 2 here and on your income tax return

__ _______________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2