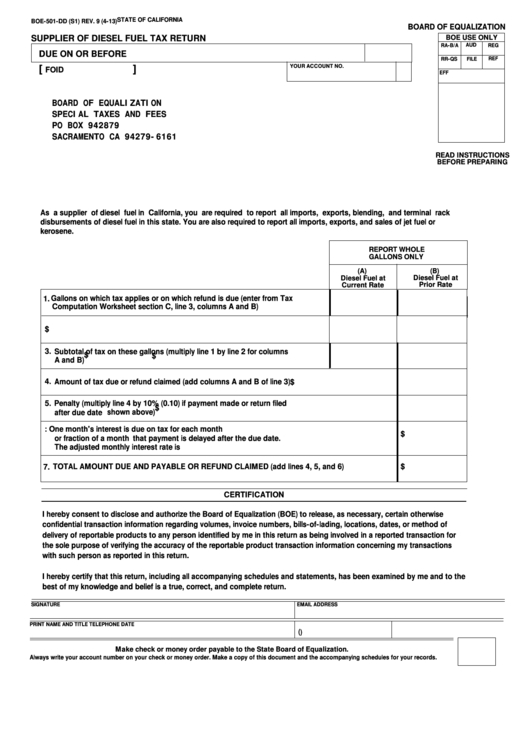

STATE OF CALIFORNIA

BOE-501-DD (S1) REV. 9 (4-13)

BOARD OF EQUALIZATION

SUPPLIER OF DIESEL FUEL TAX RETURN

BOE USE ONLY

AUD

RA-B/A

REG

DUE ON OR BEFORE

FILE

REF

RR-QS

YOUR ACCOUNT NO.

[

]

FOID

EFF

BOARD OF EQUALIZATION

SPECIAL TAXES AND FEES

PO BOX 942879

SACRAMENTO CA 94279-6161

READ INSTRUCTIONS

BEFORE PREPARING

As a supplier of diesel fuel in California, you are required to report all imports, exports, blending, and terminal rack

disbursements of diesel fuel in this state. You are also required to report all imports, exports, and sales of jet fuel or

kerosene.

REPORT WHOLE

GALLONS ONLY

(B)

(A)

Diesel Fuel at

Diesel Fuel at

Prior Rate

Current Rate

1. Gallons on which tax applies or on which refund is due (enter from Tax

Computation Worksheet section C, line 3, columns A and B)

2. Rates of tax per gallon

$

3. Subtotal of tax on these gallons (multiply line 1 by line 2 for columns

$

$

A and B)

4. Amount of tax due or refund claimed (add columns A and B of line 3)

$

5. Penalty (multiply line 4 by 10% (0.10) if payment made or return filed

$

after due date shown above)

6. INTEREST: One month's interest is due on tax for each month

$

or fraction of a month

that payment is delayed after the due date.

The adjusted monthly interest rate is

$

7. TOTAL AMOUNT DUE AND PAYABLE OR REFUND CLAIMED (add lines 4, 5, and 6)

CERTIFICATION

I hereby consent to disclose and authorize the Board of Equalization (BOE) to release, as necessary, certain otherwise

confidential transaction information regarding volumes, invoice numbers, bills-of-lading, locations, dates, or method of

delivery of reportable products to any person identified by me in this return as being involved in a reported transaction for

the sole purpose of verifying the accuracy of the reportable product transaction information concerning my transactions

with such person as reported in this return.

I hereby certify that this return, including all accompanying schedules and statements, has been examined by me and to the

best of my knowledge and belief is a true, correct, and complete return.

SIGNATURE

EMAIL ADDRESS

TELEPHONE

DATE

PRINT NAME AND TITLE

(

)

Make check or money order payable to the State Board of Equalization.

Always write your account number on your check or money order. Make a copy of this document and the accompanying schedules for your records.

true

1

1 2

2 3

3 4

4