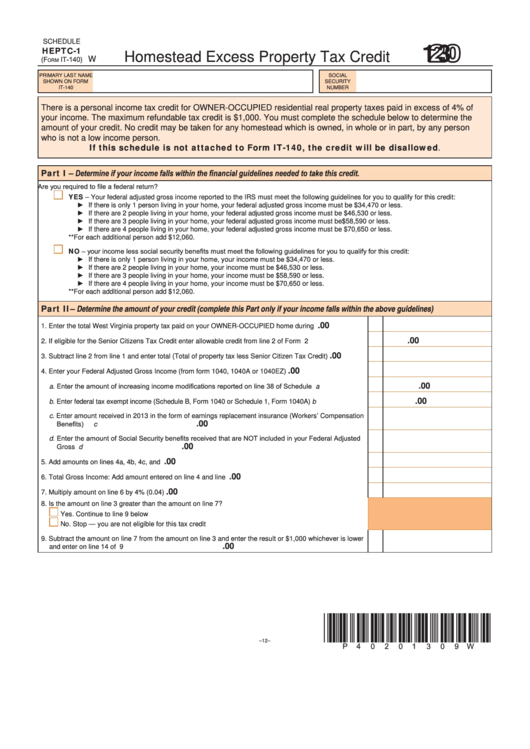

2013

SCHEDuLE

hePTc-1

Homestead Excess Property Tax Credit

IT-140)

W

(F

orm

PRIMaRY LaST NaME

SOCIaL

SHOWN ON FORM

SECuRITY

IT-140

NuMbER

There is a personal income tax credit for OWNER-OCCuPIED residential real property taxes paid in excess of 4% of

your income. The maximum refundable tax credit is $1,000. You must complete the schedule below to determine the

amount of your credit. No credit may be taken for any homestead which is owned, in whole or in part, by any person

who is not a low income person.

if this schedule is not attached to form iT-140, the credit will be disallowed.

Part i – Determine if your income falls within the financial guidelines needed to take this credit.

Are you required to file a federal return?

yes – Your federal adjusted gross income reported to the IRS must meet the following guidelines for you to qualify for this credit:

► If there is only 1 person living in your home, your federal adjusted gross income must be $34,470 or less.

► If there are 2 people living in your home, your federal adjusted gross income must be $46,530 or less.

► If there are 3 people living in your home, your federal adjusted gross income must be $58,590 or less.

► If there are 4 people living in your home, your federal adjusted gross income must be $70,650 or less.

**For each additional person add $12,060.

nO – your income less social security benefits must meet the following guidelines for you to qualify for this credit:

► If there is only 1 person living in your home, your income must be $34,470 or less.

► If there are 2 people living in your home, your income must be $46,530 or less.

► If there are 3 people living in your home, your income must be $58,590 or less.

► If there are 4 people living in your home, your income must be $70,650 or less.

**For each additional person add $12,060.

Part ii – determine the amount of your credit (complete this Part only if your income falls within the above guidelines)

.00

1. Enter the total West Virginia property tax paid on your OWNER-OCCuPIED home during 2013..................

1

.00

2. If eligible for the Senior Citizens Tax Credit enter allowable credit from line 2 of Form SCTC-1.....................

2

.00

3. Subtract line 2 from line 1 and enter total (Total of property tax less Senior Citizen Tax Credit).....................

3

.00

4. Enter your Federal adjusted gross Income (from form 1040, 1040a or 1040EZ)...........................................

4

a. Enter the amount of increasing income modifications reported on line 38 of Schedule M..........................

.00

a

.00

b. Enter federal tax exempt income (Schedule b, Form 1040 or Schedule 1, Form 1040a)..............................

b

c. Enter amount received in 2013 in the form of earnings replacement insurance (Workers’ Compensation

Benefits)......................................................................................................................................................

.00

c

d. Enter the amount of Social Security benefits received that are NOT included in your Federal Adjusted

.00

gross Income..............................................................................................................................................

d

.00

5. add amounts on lines 4a, 4b, 4c, and 4d........................................................................................................

5

.00

6. Total gross Income: add amount entered on line 4 and line 5........................................................................

6

.00

7. Multiply amount on line 6 by 4% (0.04)...........................................................................................................

7

8. Is the amount on line 3 greater than the amount on line 7?

Yes. Continue to line 9 below

No. Stop — you are not eligible for this tax credit

9. Subtract the amount on line 7 from the amount on line 3 and enter the result or $1,000 whichever is lower

.00

and enter on line 14 of IT-140..........................................................................................................................

9

*p40201309W*

–12–

1

1