Form Rpd-41362 - Agricultural Biomass Tax Credit Approval

ADVERTISEMENT

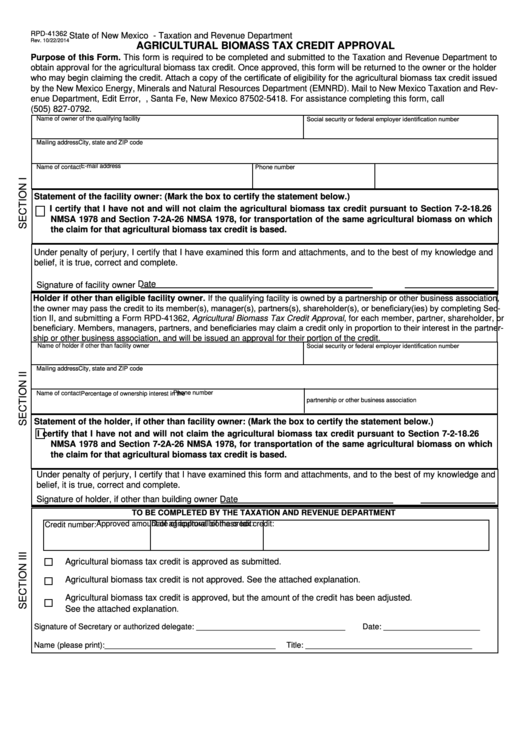

State of New Mexico - Taxation and Revenue Department

RPD-41362

Rev. 10/22/2014

AGRICULTURAL BIOMASS TAX CREDIT APPROVAL

Purpose of this Form. This form is required to be completed and submitted to the Taxation and Revenue Department to

obtain approval for the agricultural biomass tax credit. Once approved, this form will be returned to the owner or the holder

who may begin claiming the credit. Attach a copy of the certificate of eligibility for the agricultural biomass tax credit issued

by the New Mexico Energy, Minerals and Natural Resources Department (EMNRD). Mail to New Mexico Taxation and Rev-

enue Department, Edit Error, P.O. Box 5418, Santa Fe, New Mexico 87502-5418. For assistance completing this form, call

(505) 827-0792.

Name of owner of the qualifying facility

Social security or federal employer identification number

Mailing address

City, state and ZIP code

E-mail address

Phone number

Name of contact

Statement of the facility owner: (Mark the box to certify the statement below.)

I certify that I have not and will not claim the agricultural biomass tax credit pursuant to Section 7-2-18.26

NMSA 1978 and Section 7-2A-26 NMSA 1978, for transportation of the same agricultural biomass on which

the claim for that agricultural biomass tax credit is based.

Under penalty of perjury, I certify that I have examined this form and attachments, and to the best of my knowledge and

belief, it is true, correct and complete.

Date

Signature of facility owner

Holder if other than eligible facility owner. If the qualifying facility is owned by a partnership or other business association,

the owner may pass the credit to its member(s), manager(s), partners(s), shareholder(s), or beneficiary(ies) by completing Sec-

tion II, and submitting a Form RPD-41362, Agricultural Biomass Tax Credit Approval, for each member, partner, shareholder, or

beneficiary. Members, managers, partners, and beneficiaries may claim a credit only in proportion to their interest in the partner-

ship or other business association, and will be issued an approval for their portion of the credit.

Name of holder if other than facility owner

Social security or federal employer identification number

Mailing address

City, state and ZIP code

Phone number

Name of contact

Percentage of ownership interest in the

partnership or other business association

Statement of the holder, if other than facility owner: (Mark the box to certify the statement below.)

I certify that I have not and will not claim the agricultural biomass tax credit pursuant to Section 7-2-18.26

NMSA 1978 and Section 7-2A-26 NMSA 1978, for transportation of the same agricultural biomass on which

the claim for that agricultural biomass tax credit is based.

Under penalty of perjury, I certify that I have examined this form and attachments, and to the best of my knowledge and

belief, it is true, correct and complete.

Signature of holder, if other than building owner

Date

TO BE COMPLETED BY THE TAXATION AND REVENUE DEPARTMENT

Date of approval of the credit:

Approved amount of agricultural biomass tax credit:

Credit number:

Agricultural biomass tax credit is approved as submitted.

Agricultural biomass tax credit is not approved. See the attached explanation

.

Agricultural biomass tax credit is approved, but the amount of the credit has been adjusted

.

See the attached explanation

.

Signature of Secretary or authorized delegate: __________________________________

Date: ______________________

Name (please print):_______________________________________

Title: ______________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1