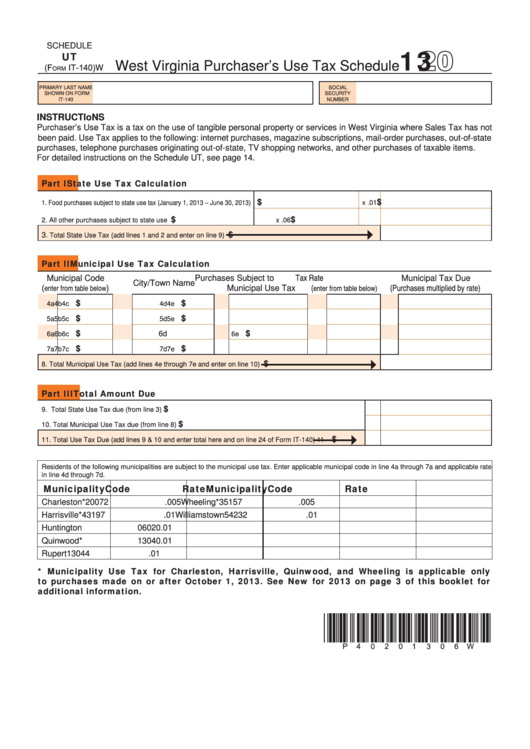

SCHEDuLE

13

uT

West Virginia Purchaser’s use Tax Schedule

IT-140)

(F

W

orm

PRIMaRY LaST NaME

SOCIaL

SHOWN ON FORM

SECuRITY

IT-140

NuMbER

INSTRUCTIoNS

Purchaser’s use Tax is a tax on the use of tangible personal property or services in West Virginia where Sales Tax has not

been paid. use Tax applies to the following: internet purchases, magazine subscriptions, mail-order purchases, out-of-state

purchases, telephone purchases originating out-of-state, TV shopping networks, and other purchases of taxable items.

For detailed instructions on the Schedule uT, see page 14.

Part i

state use Tax calculation

$

$

1. Food purchases subject to state use tax (January 1, 2013 – June 30, 2013)

x .01

$

$

2. all other purchases subject to state use tax.......................................

x .06

$

3

. Total State use Tax (add lines 1 and 2 and enter on line 9)

Part ii

municipal use Tax calculation

Tax Rate

Municipal Code

Purchases Subject to

Municipal Tax Due

City/Town Name

(

(Purchases multiplied by rate)

enter from table below

enter from table below)

(

)

Municipal use Tax

$

$

4a

4b

4c

4d

4e

$

$

5a

5b

5c

5d

5e

$

$

6d

6a

6b

6c

6e

$

$

7a

7b

7c

7d

7e

$

8. Total Municipal use Tax (add lines 4e through 7e and enter on line 10)

Part iii

Total amount Due

$

9. Total State use Tax due (from line 3)...........................................................................................................

9

$

10. Total Municipal use Tax due (from line 8)....................................................................................................

10

$

11. Total use Tax Due (add lines 9 & 10 and enter total here and on line 24 of Form IT-140)

11

Residents of the following municipalities are subject to the municipal use tax. Enter applicable municipal code in line 4a through 7a and applicable rate

in line 4d through 7d.

municipality

code

rate

municipality

code

rate

Charleston*

20072

.005

Wheeling*

35157

.005

Harrisville*

43197

.01

Williamstown

54232

.01

Huntington

06020

.01

Quinwood*

13040

.01

Rupert

13044

.01

* municipality use Tax for charleston, harrisville, Quinwood, and wheeling is applicable only

to purchases made on or after October 1, 2013. see new for 2013 on page 3 of this booklet for

additional information.

*p40201306W*

1

1