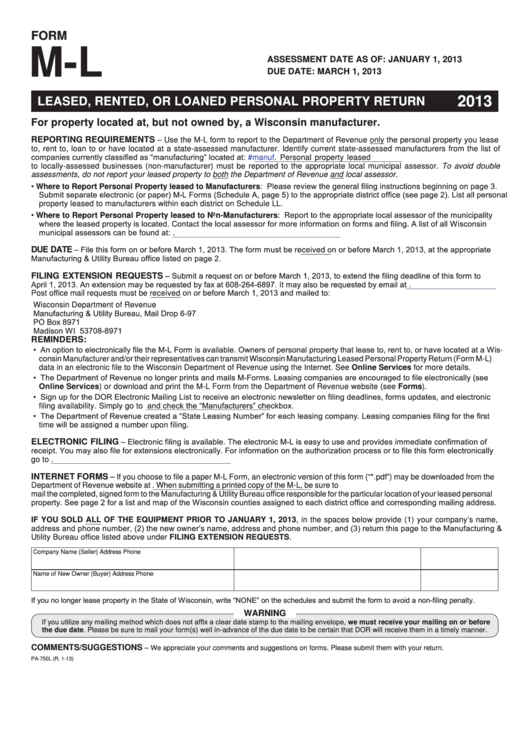

Form M-L - Wisconsin Leased, Rented, Or Loaned Personal Property Return - 2013

ADVERTISEMENT

FORM

M-L

ASSESSMENT DATE AS OF:

JANUARY 1, 2013

DUE DATE:

MARCH 1, 2013

2013

LEASED, RENTED, OR LOANED PERSONAL PROPERTY RETURN

For property located at, but not owned by, a Wisconsin manufacturer.

REPORTING REQUIREMENTS

– Use the M-L form to report to the Department of Revenue only the personal property you lease

to, rent to, loan to or have located at a state-assessed manufacturer. Identify current state-assessed manufacturers from the list of

companies currently classified as “manufacturing” located at: Personal property leased

to locally-assessed businesses (non-manufacturer) must be reported to the appropriate local municipal assessor. To avoid double

assessments, do not report your leased property to both the Department of Revenue and local assessor.

• Where to Report Personal Property leased to Manufacturers: Please review the general filing instructions beginning on page 3.

Submit separate electronic (or paper) M-L Forms (Schedule A, page 5) to the appropriate district office (see page 2). List all personal

property leased to manufacturers within each district on Schedule LL.

• Where to Report Personal Property leased to Non-Manufacturers: Report to the appropriate local assessor of the municipality

where the leased property is located. Contact the local assessor for more information on forms and filing. A list of all Wisconsin

municipal assessors can be found at:

– File this form on or before March 1, 2013. The form must be received on or before March 1, 2013, at the appropriate

DUE DATE

Manufacturing & Utility Bureau office listed on page 2.

– Submit a request on or before March 1, 2013, to extend the filing deadline of this form to

FILING EXTENSION REQUESTS

April 1, 2013. An extension may be requested by fax at 608-264-6897. It may also be requested by email at mfgtelco@revenue.wi.gov.

Post office mail requests must be received on or before March 1, 2013 and mailed to:

Wisconsin Department of Revenue

Manufacturing & Utility Bureau, Mail Drop 6-97

PO Box 8971

Madison WI 53708-8971

REMINDERS:

• An option to electronically file the M-L Form is available. Owners of personal property that lease to, rent to, or have located at a Wis-

consin Manufacturer and/or their representatives can transmit Wisconsin Manufacturing Leased Personal Property Return (Form M-L)

data in an electronic file to the Wisconsin Department of Revenue using the Internet. See Online Services for more details.

• The Department of Revenue no longer prints and mails M-Forms. Leasing companies are encouraged to file electronically (see

Online Services) or download and print the M-L Form from the Department of Revenue website (see Forms).

• Sign up for the DOR Electronic Mailing List to receive an electronic newsletter on filing deadlines, forms updates, and electronic

and check the “Manufacturers” checkbox.

filing availability. Simply go to

• The Department of Revenue created a “State Leasing Number” for each leasing company. Leasing companies filing for the first

time will be assigned a number upon filing.

– Electronic filing is available. The electronic M-L is easy to use and provides immediate confirmation of

ELECTRONIC FILING

receipt. You may also file for extensions electronically. For information on the authorization process or to file this form electronically

go to

INTERNET FORMS

– If you choose to file a paper M-L Form, an electronic version of this form (“*.pdf”) may be downloaded from the

Department of Revenue website at When submitting a printed copy of the M-L, be sure to

mail the completed, signed form to the Manufacturing & Utility Bureau office responsible for the particular location of your leased personal

property. See page 2 for a list and map of the Wisconsin counties assigned to each district office and corresponding mailing address.

IF YOU SOLD ALL OF THE EQUIPMENT PRIOR TO JANUARY 1, 2013, in the spaces below provide (1) your company’s name,

address and phone number, (2) the new owner’s name, address and phone number, and (3) return this page to the Manufacturing &

Utility Bureau office listed above under FILING EXTENSION REQUESTS.

Company Name (Seller)

Address

Phone

Name of New Owner (Buyer)

Address

Phone

If you no longer lease property in the State of Wisconsin, write “NONE” on the schedules and submit the form to avoid a non-filing penalty.

WARNING

If you utilize any mailing method which does not affix a clear date stamp to the mailing envelope, we must receive your mailing on or before

the due date. Please be sure to mail your form(s) well in-advance of the due date to be certain that DOR will receive them in a timely manner.

COMMENTS/SUGGESTIONS

–

We appreciate your comments and suggestions on forms. Please submit them with your return.

PA-750L (R. 1-13)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8