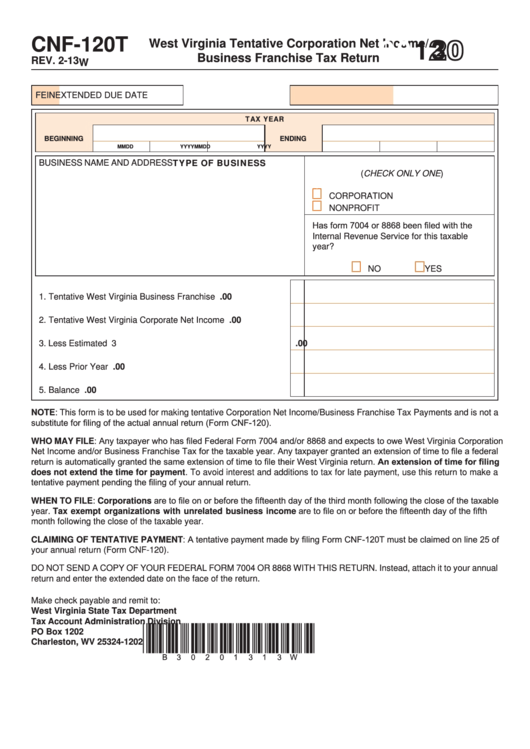

Form Cnf-120t - West Virginia Tentative Corporation Net Income/ Business Franchise Tax Return - 2013

ADVERTISEMENT

2013

CNF-120T

West Virginia Tentative Corporation Net Income/

Business Franchise Tax Return

REV. 2-13

W

FEIN

EXTENDED DUE DATE

TAX YEAR

BEGINNING

ENDING

MM

DD

YYYY

MM

DD

YYYY

TYPE OF BUSINESS

BUSINESS NAME AND ADDRESS

(CHECK ONLY ONE)

CORPORATION

NONPROFIT

Has form 7004 or 8868 been filed with the

Internal Revenue Service for this taxable

year?

NO

YES

1. Tentative West Virginia Business Franchise Tax........................ 1

.00

2. Tentative West Virginia Corporate Net Income Tax.................... 2

.00

3. Less Estimated Payments.......................................................... 3

.00

4. Less Prior Year Credit................................................................ 4

.00

5. Balance Due..............................................................................

5

.00

NOTE: This form is to be used for making tentative Corporation Net Income/Business Franchise Tax Payments and is not a

substitute for filing of the actual annual return (Form CNF-120).

WHO MAY FILE: Any taxpayer who has filed Federal Form 7004 and/or 8868 and expects to owe West Virginia Corporation

Net Income and/or Business Franchise Tax for the taxable year. Any taxpayer granted an extension of time to file a federal

return is automatically granted the same extension of time to file their West Virginia return. An extension of time for filing

does not extend the time for payment. To avoid interest and additions to tax for late payment, use this return to make a

tentative payment pending the filing of your annual return.

WHEN TO FILE: Corporations are to file on or before the fifteenth day of the third month following the close of the taxable

year. Tax exempt organizations with unrelated business income are to file on or before the fifteenth day of the fifth

month following the close of the taxable year.

CLAIMING OF TENTATIVE PAYMENT: A tentative payment made by filing Form CNF-120T must be claimed on line 25 of

your annual return (Form CNF-120).

DO NOT SEND A COPY OF YOUR FEDERAL FORM 7004 OR 8868 WITH THIS RETURN. Instead, attach it to your annual

return and enter the extended date on the face of the return.

Make check payable and remit to:

West Virginia State Tax Department

Tax Account Administration Division

*B30201313W*

PO Box 1202

Charleston, WV 25324-1202

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2