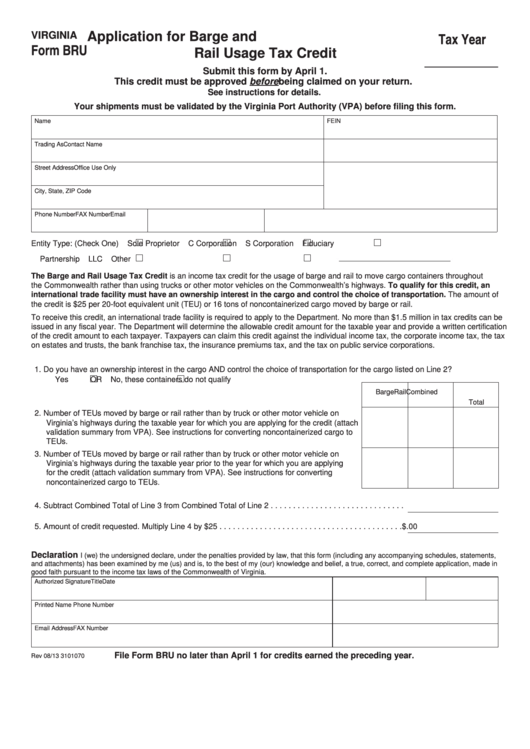

VIRGINIA

Application for Barge and

Tax Year

Form BRU

Rail Usage Tax Credit

___________

Submit this form by April 1.

This credit must be approved before being claimed on your return.

See instructions for details.

Your shipments must be validated by the Virginia Port Authority (VPA) before filing this form.

Name

FEIN

Trading As

Contact Name

Street Address

Office Use Only

City, State, ZIP Code

Phone Number

FAX Number

Email

Entity Type: (Check One)

Sole Proprietor

C Corporation

S Corporation

Fiduciary

Partnership

LLC

Other

The Barge and Rail Usage Tax Credit is an income tax credit for the usage of barge and rail to move cargo containers throughout

the Commonwealth rather than using trucks or other motor vehicles on the Commonwealth’s highways. To qualify for this credit, an

international trade facility must have an ownership interest in the cargo and control the choice of transportation. The amount of

the credit is $25 per 20-foot equivalent unit (TEU) or 16 tons of noncontainerized cargo moved by barge or rail.

To receive this credit, an international trade facility is required to apply to the Department. No more than $1.5 million in tax credits can be

issued in any fiscal year. The Department will determine the allowable credit amount for the taxable year and provide a written certification

of the credit amount to each taxpayer. Taxpayers can claim this credit against the individual income tax, the corporate income tax, the tax

on estates and trusts, the bank franchise tax, the insurance premiums tax, and the tax on public service corporations.

1. Do you have an ownership interest in the cargo AND control the choice of transportation for the cargo listed on Line 2?

Yes

OR

No, these containers do not qualify

Barge

Rail

Combined

Total

2. Number of TEUs moved by barge or rail rather than by truck or other motor vehicle on

Virginia’s highways during the taxable year for which you are applying for the credit (attach

validation summary from VPA). See instructions for converting noncontainerized cargo to

TEUs.

3. Number of TEUs moved by barge or rail rather than by truck or other motor vehicle on

Virginia’s highways during the taxable year prior to the year for which you are applying

for the credit (attach validation summary from VPA). See instructions for converting

noncontainerized cargo to TEUs.

4. Subtract Combined Total of Line 3 from Combined Total of Line 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5. Amount of credit requested. Multiply Line 4 by $25 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

.00

Declaration

I (we) the undersigned declare, under the penalties provided by law, that this form (including any accompanying schedules, statements,

and attachments) has been examined by me (us) and is, to the best of my (our) knowledge and belief, a true, correct, and complete application, made in

good faith pursuant to the income tax laws of the Commonwealth of Virginia.

Authorized Signature

Title

Date

Printed Name

Phone Number

Email Address

FAX Number

File Form BRU no later than April 1 for credits earned the preceding year.

Rev 08/13 3101070

1

1 2

2 3

3