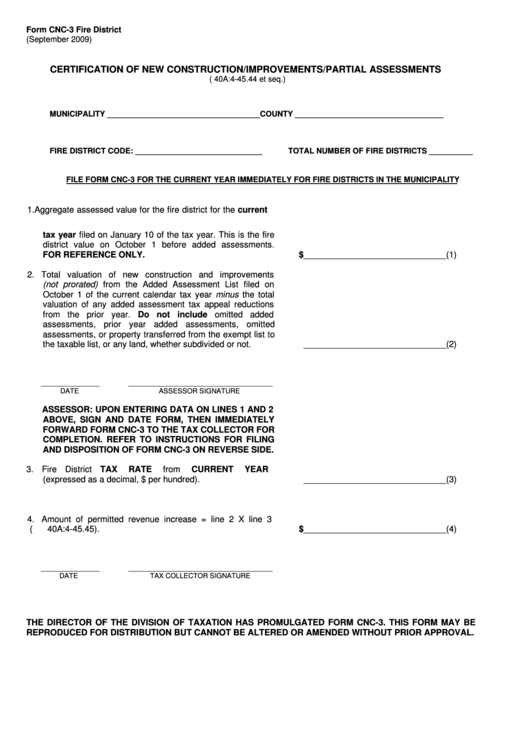

Form CNC-3 Fire District

(September 2009)

CERTIFICATION OF NEW CONSTRUCTION/IMPROVEMENTS/PARTIAL ASSESSMENTS

(N.J.S.A. 40A:4-45.44 et seq.)

MUNICIPALITY ___________________________________

COUNTY __________________________________

FIRE DISTRICT CODE: _____________________________

TOTAL NUMBER OF FIRE DISTRICTS __________

FILE FORM CNC-3 FOR THE CURRENT YEAR IMMEDIATELY FOR FIRE DISTRICTS IN THE MUNICIPALITY

1. Aggregate assessed value for the fire district for the current

tax year filed on January 10 of the tax year. This is the fire

district value on October 1 before added assessments.

FOR REFERENCE ONLY.

$______________________________(1)

2. Total valuation of new construction and improvements

(not prorated) from the Added Assessment List filed on

October 1 of the current calendar tax year minus the total

valuation of any added assessment tax appeal reductions

from the prior year. Do not include omitted added

assessments, prior year added assessments, omitted

assessments, or property transferred from the exempt list to

the taxable list, or any land, whether subdivided or not.

______________________________(2)

_______________

_____________________________________

DATE

ASSESSOR SIGNATURE

ASSESSOR: UPON ENTERING DATA ON LINES 1 AND 2

ABOVE, SIGN AND DATE FORM, THEN IMMEDIATELY

FORWARD FORM CNC-3 TO THE TAX COLLECTOR FOR

COMPLETION. REFER TO INSTRUCTIONS FOR FILING

AND DISPOSITION OF FORM CNC-3 ON REVERSE SIDE.

3. Fire

District

TAX

RATE

from

CURRENT

YEAR

(expressed as a decimal, $ per hundred).

______________________________(3)

4.

Amount of permitted revenue increase = line 2 X line 3

(N.J.S.A. 40A:4-45.45).

$______________________________(4)

_______________

_____________________________________

DATE

TAX COLLECTOR SIGNATURE

THE DIRECTOR OF THE DIVISION OF TAXATION HAS PROMULGATED FORM CNC-3. THIS FORM MAY BE

REPRODUCED FOR DISTRIBUTION BUT CANNOT BE ALTERED OR AMENDED WITHOUT PRIOR APPROVAL.

1

1 2

2