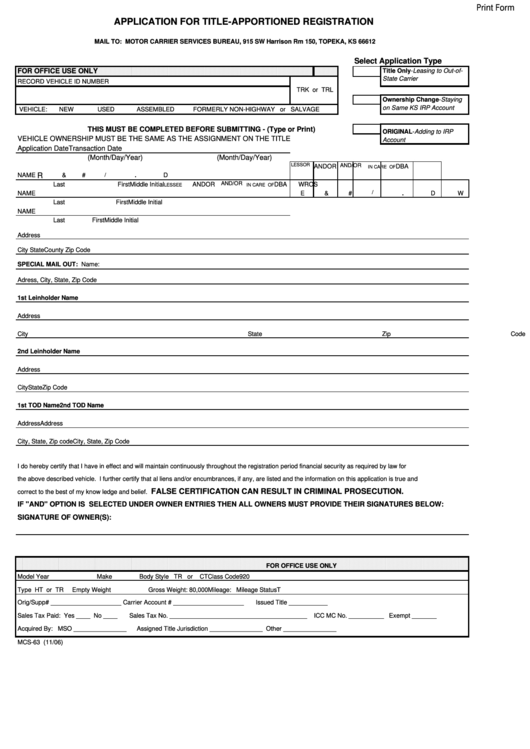

Print Form

APPLICATION FOR TITLE-APPORTIONED REGISTRATION

MAIL TO: MOTOR CARRIER SERVICES BUREAU, 915 SW Harrison Rm 150, TOPEKA, KS 66612

Select Application Type

FOR OFFICE USE ONLY

Title Only-Leasing to Out-of-

State Carrier

RECORD VEHICLE ID NUMBER

TRK or TRL

Ownership Change-Staying

on Same KS IRP Account

VEHICLE:

NEW

USED

ASSEMBLED

FORMERLY NON-HIGHWAY or SALVAGE

THIS MUST BE COMPLETED BEFORE SUBMITTING - (Type or Print)

ORIGINAL-Adding to IRP

VEHICLE OWNERSHIP MUST BE THE SAME AS THE ASSIGNMENT ON THE TITLE

Account

Application Date

Transaction Date

(Month/Day/Year)

(Month/Day/Year)

LESSOR

AND/OR

AND

OR

DBA

IN CARE OF

/

NAME

R

&

#

.

D

AND/OR

Last

First

Middle Initial

AND

OR

DBA

WROS

LESSEE

IN CARE OF

/

NAME

E

&

#

.

D

W

Last

First

Middle Initial

NAME

Last

First

Middle Initial

Address

City

State

County

Zip Code

SPECIAL MAIL OUT: Name:

Adress, City, State, Zip Code

1st Leinholder Name

Address

City

State

Zip Code

2nd Leinholder Name

Address

City

State

Zip Code

1st TOD Name

2nd TOD Name

Address

Address

City, State, Zip code

City, State, Zip Code

I do hereby certify that I have in effect and will maintain continuously throughout the registration period financial security as required by law for

the above described vehicle. I further certify that al liens and/or encumbrances, if any, are listed and the information on this application is true and

FALSE CERTIFICATION CAN RESULT IN CRIMINAL PROSECUTION.

correct to the best of my know ledge and belief.

IF "AND" OPTION IS SELECTED UNDER OWNER ENTRIES THEN ALL OWNERS MUST PROVIDE THEIR SIGNATURES BELOW:

SIGNATURE OF OWNER(S):

FOR OFFICE USE ONLY

Model Year

Make

Body Style TR or

CT

Class Code

920

Type HT or TR

Empty Weight

Gross Weight: 80,000

Mileage:

Mileage Status

T

Orig/Supp# ____________________ Carrier Account # ____________________

Issued Title ___________

Sales Tax Paid: Yes ____ No ____

Sales Tax No. _______________________________________

ICC MC No. __________ Exempt _______

Acquired By: MSO _______________

Assigned Title Jurisdiction _______________ Other _______________

MCS-63 (11/06)

1

1