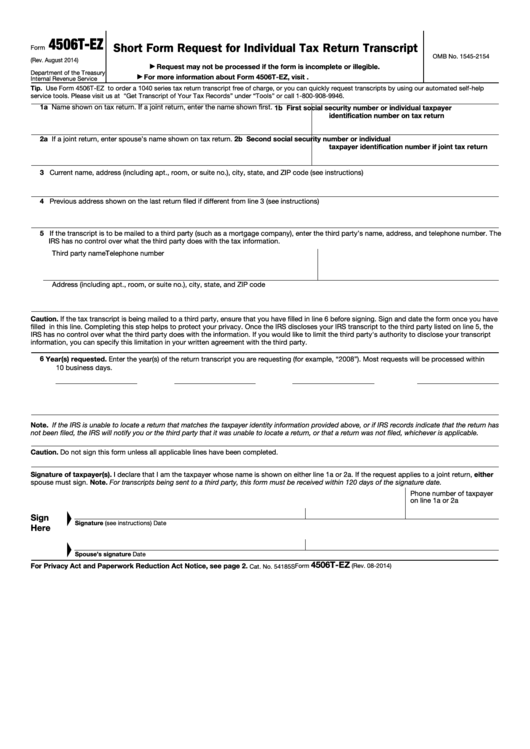

4506T-EZ

Short Form Request for Individual Tax Return Transcript

Form

OMB No. 1545-2154

(Rev. August 2014)

Request may not be processed if the form is incomplete or illegible.

▶

Department of the Treasury

For more information about Form 4506T-EZ, visit

▶

Internal Revenue Service

Tip. Use Form 4506T-EZ to order a 1040 series tax return transcript free of charge, or you can quickly request transcripts by using our automated self-help

service tools. Please visit us at IRS.gov and click on “Get Transcript of Your Tax Records” under “Tools” or call 1-800-908-9946.

1a Name shown on tax return. If a joint return, enter the name shown first.

1b First social security number or individual taxpayer

identification number on tax return

2a If a joint return, enter spouse’s name shown on tax return.

2b Second social security number or individual

taxpayer identification number if joint tax return

3 Current name, address (including apt., room, or suite no.), city, state, and ZIP code (see instructions)

4 Previous address shown on the last return filed if different from line 3 (see instructions)

5 If the transcript is to be mailed to a third party (such as a mortgage company), enter the third party’s name, address, and telephone number. The

IRS has no control over what the third party does with the tax information.

Third party name

Telephone number

Address (including apt., room, or suite no.), city, state, and ZIP code

Caution. If the tax transcript is being mailed to a third party, ensure that you have filled in line 6 before signing. Sign and date the form once you have

filled in this line. Completing this step helps to protect your privacy. Once the IRS discloses your IRS transcript to the third party listed on line 5, the

IRS has no control over what the third party does with the information. If you would like to limit the third party's authority to disclose your transcript

information, you can specify this limitation in your written agreement with the third party.

6

Year(s) requested. Enter the year(s) of the return transcript you are requesting (for example, “2008”). Most requests will be processed within

10 business days.

Note. If the IRS is unable to locate a return that matches the taxpayer identity information provided above, or if IRS records indicate that the return has

not been filed, the IRS will notify you or the third party that it was unable to locate a return, or that a return was not filed, whichever is applicable.

Caution. Do not sign this form unless all applicable lines have been completed.

Signature of taxpayer(s). I declare that I am the taxpayer whose name is shown on either line 1a or 2a. If the request applies to a joint return, either

spouse must sign. Note. For transcripts being sent to a third party, this form must be received within 120 days of the signature date.

Phone number of taxpayer

on line 1a or 2a

Sign

Signature (see instructions)

Date

Here

Spouse’s signature

Date

4506T-EZ

For Privacy Act and Paperwork Reduction Act Notice, see page 2.

Form

(Rev. 08-2014)

Cat. No. 54185S

1

1 2

2