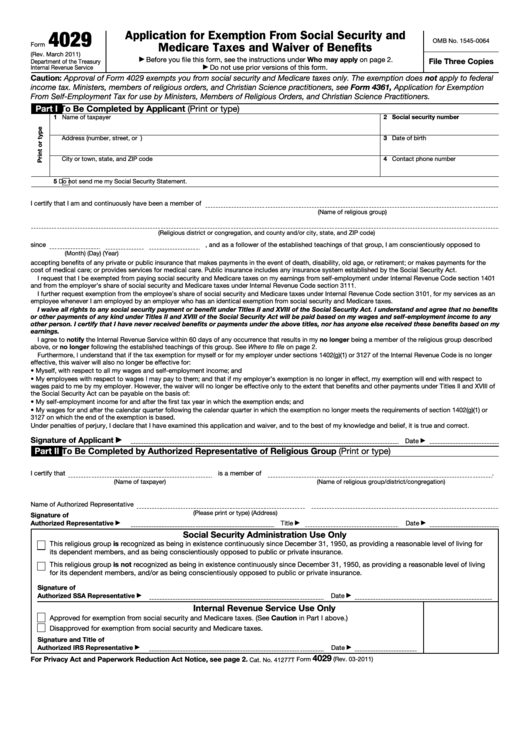

4029

Application for Exemption From Social Security and

OMB No. 1545-0064

Medicare Taxes and Waiver of Benefits

Form

(Rev. March 2011)

Before you file this form, see the instructions under Who may apply on page 2.

File Three Copies

▶

Department of the Treasury

Do not use prior versions of this form.

Internal Revenue Service

▶

Caution: Approval of Form 4029 exempts you from social security and Medicare taxes only. The exemption does not apply to federal

income tax. Ministers, members of religious orders, and Christian Science practitioners, see Form 4361, Application for Exemption

From Self-Employment Tax for use by Ministers, Members of Religious Orders, and Christian Science Practitioners.

Part I

To Be Completed by Applicant (Print or type)

1 Name of taxpayer

2 Social security number

Address (number, street, or P.O. box)

3 Date of birth

4 Contact phone number

City or town, state, and ZIP code

5

Do not send me my Social Security Statement.

I certify that I am and continuously have been a member of

(Name of religious group)

(Religious district or congregation, and county and/or city, state, and ZIP code)

since

, and as a follower of the established teachings of that group, I am conscientiously opposed to

(Month)

(Day)

(Year)

accepting benefits of any private or public insurance that makes payments in the event of death, disability, old age, or retirement; or makes payments for the

cost of medical care; or provides services for medical care. Public insurance includes any insurance system established by the Social Security Act.

I request that I be exempted from paying social security and Medicare taxes on my earnings from self-employment under Internal Revenue Code section 1401

and from the employer’s share of social security and Medicare taxes under Internal Revenue Code section 3111.

I further request exemption from the employee’s share of social security and Medicare taxes under Internal Revenue Code section 3101, for my services as an

employee whenever I am employed by an employer who has an identical exemption from social security and Medicare taxes.

I waive all rights to any social security payment or benefit under Titles II and XVIII of the Social Security Act. I understand and agree that no benefits

or other payments of any kind under Titles II and XVIII of the Social Security Act will be paid based on my wages and self-employment income to any

other person. I certify that I have never received benefits or payments under the above titles, nor has anyone else received these benefits based on my

earnings.

I agree to notify the Internal Revenue Service within 60 days of any occurrence that results in my no longer being a member of the religious group described

above, or no longer following the established teachings of this group. See Where to file on page 2.

Furthermore, I understand that if the tax exemption for myself or for my employer under sections 1402(g)(1) or 3127 of the Internal Revenue Code is no longer

effective, this waiver will also no longer be effective for:

• Myself, with respect to all my wages and self-employment income; and

• My employees with respect to wages I may pay to them; and that if my employer’s exemption is no longer in effect, my exemption will end with respect to

wages paid to me by my employer. However, the waiver will no longer be effective only to the extent that benefits and other payments under Titles II and XVIII of

the Social Security Act can be payable on the basis of:

• My self-employment income for and after the first tax year in which the exemption ends; and

• My wages for and after the calendar quarter following the calendar quarter in which the exemption no longer meets the requirements of section 1402(g)(1) or

3127 on which the end of the exemption is based.

Under penalties of perjury, I declare that I have examined this application and waiver, and to the best of my knowledge and belief, it is true and correct.

Signature of Applicant

▶

Date

▶

Part II

To Be Completed by Authorized Representative of Religious Group (Print or type)

I certify that

is a member of

.

(Name of taxpayer)

(Name of religious group/district/congregation)

Name of Authorized Representative

(Please print or type)

(Address)

Signature of

Authorized Representative

Title

Date

▶

▶

▶

Social Security Administration Use Only

This religious group is recognized as being in existence continuously since December 31, 1950, as providing a reasonable level of living for

its dependent members, and as being conscientiously opposed to public or private insurance.

This religious group is not recognized as being in existence continuously since December 31, 1950, as providing a reasonable level of living

for its dependent members, and/or as being conscientiously opposed to public or private insurance.

Signature of

Authorized SSA Representative

Date

▶

▶

Internal Revenue Service Use Only

Approved for exemption from social security and Medicare taxes. (See Caution in Part I above.)

Disapproved for exemption from social security and Medicare taxes.

Signature and Title of

Authorized IRS Representative

Date

▶

▶

4029

For Privacy Act and Paperwork Reduction Act Notice, see page 2.

Form

(Rev. 03-2011)

Cat. No. 41277T

1

1 2

2