THIS SPACE FOR DATE RECEIVED STAMP

20

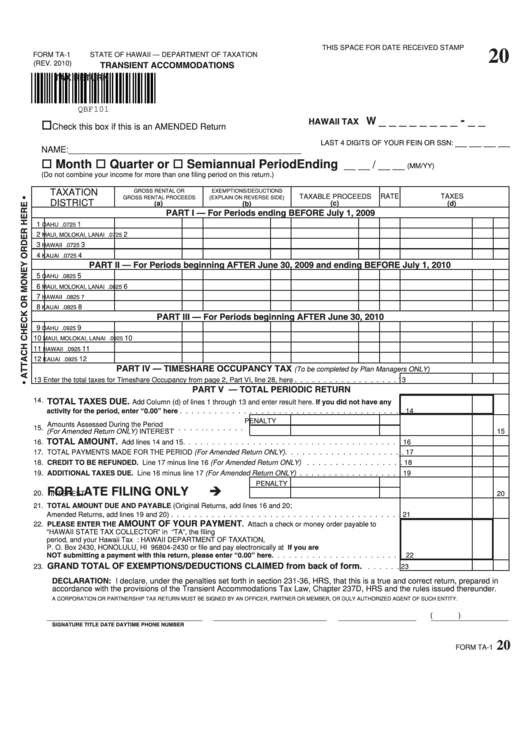

FORM TA-1

STATE OF HAWAII — DEPARTMENT OF TAXATION

TRANSIENT ACCOMMODATIONS

(REV. 2010)

TAX RETURN

QBF101

HAWAII TAX I.D. NO. W

_ _ _ _ _ _ _ _ - _ _

Check this box if this is an AMENDED Return

LAST 4 DIGITS OF YOUR FEIN OR SSN:

__ __ __ __

NAME:_________________________________________________

Month Quarter or Semiannual Period Ending

__ __ / __ __

(MM/YY)

(Do not combine your income for more than one filing period on this return.)

TAXATION

GROSS RENTAL OR

EXEMPTIONS/DEDUCTIONS

TAXABLE PROCEEDS

RATE

TAXES

GROSS RENTAL PROCEEDS

(EXPLAIN ON REVERSE SIDE)

DISTRICT

(b)

( a)

(c)

(d)

PART I — For Periods ending BEFORE July 1, 2009

1 OAHU

.0725

1

2 MAUI, MOLOKAI, LANAI

.0725

2

3 HAWAII

.0725

3

4 KAUAI

.0725

4

PART II — For Periods beginning AFTER June 30, 2009 and ending BEFORE July 1, 2010

5 OAHU

.0825

5

6 MAUI, MOLOKAI, LANAI

.0825

6

7 HAWAII

.0825

7

8 KAUAI

.0825

8

PART III — For Periods beginning AFTER June 30, 2010

9 OAHU

.0925

9

10 MAUI, MOLOKAI, LANAI

.0925

10

11 HAWAII

.0925

11

12 KAUAI

.0925

12

PART IV — TIMESHARE OCCUPANCY TAX

(To be completed by Plan Managers ONLY)

13 Enter the total taxes for Timeshare Occupancy from page 2, Part VI, line 28, here . . . . . . . . . . . . . . . . . .

13

PART V — TOTAL PERIODIC RETURN

TOTAL TAXES DUE.

14.

Add Column (d) of lines 1 through 13 and enter result here. If you did not have any

activity for the period, enter “0.00” here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14

PENALTY

15. Amounts Assessed During the Period . . . . . . . . . . . . . .

15

(For Amended Return ONLY)

INTEREST

TOTAL AMOUNT.

16.

Add lines 14 and 15. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16

17. TOTAL PAYMENTS MADE FOR THE PERIOD (For Amended Return ONLY). . . . . . . . . . . . . . . . . . . . .

17

18. CREDIT TO BE REFUNDED. Line 17 minus line 16 (For Amended Return ONLY) . . . . . . . . . . . . . . . . .

18

19. ADDITIONAL TAXES DUE. Line 16 minus line 17 (For Amended Return ONLY) . . . . . . . . . . . . . . . . . .

19

PENALTY

FOR LATE FILING ONLY

20.

INTEREST

20

21. TOTAL AMOUNT DUE AND PAYABLE (Original Returns, add lines 16 and 20;

Amended Returns, add lines 19 and 20) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

21

AMOUNT OF YOUR PAYMENT

22. PLEASE ENTER THE

. Attach a check or money order payable to

“HAWAII STATE TAX COLLECTOR” in U.S. dollars drawn on any U.S. bank to Form TA-1. Write “TA”, the filing

period, and your Hawaii Tax I.D. No. on your check or money order. Mail to: HAWAII DEPARTMENT OF TAXATION,

P. O. Box 2430, HONOLULU, HI 96804-2430 or file and pay electronically at If you are

NOT submitting a payment with this return, please enter “0.00” here. . . . . . . . . . . . . . . . . . . . . . .

22

GRAND TOTAL OF EXEMPTIONS/DEDUCTIONS CLAIMED from back of form.

23.

. . . . . .

23

DECLARATION: I declare, under the penalties set forth in section 231-36, HRS, that this is a true and correct return, prepared in

accordance with the provisions of the Transient Accommodations Tax Law, Chapter 237D, HRS and the rules issued thereunder.

A CORPORATION OR PARTNERSHIP TAX RETURN MUST BE SIGNED BY AN OFFICER, PARTNER OR MEMBER, OR DULY AUTHORIZED AGENT OF SUCH ENTITY.

(

)

SIGNATURE

TITLE

DATE

DAYTIME PHONE NUMBER

20

FORM TA-1

1

1 2

2