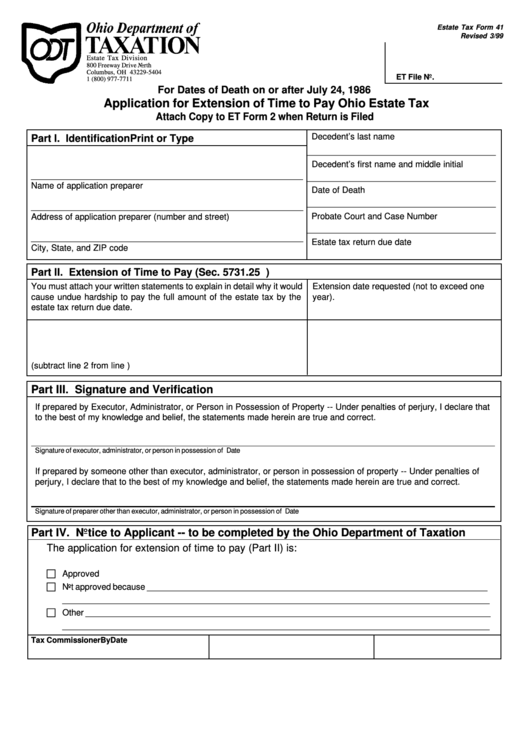

Estate Tax Form 41 - Application For Extension Of Time To Pay Ohio Estate Tax

ADVERTISEMENT

Estate Tax Form 41

Revised 3/99

Estate Tax Division

800 Freeway Drive North

Columbus, OH 43229-5404

ET File No.

1 (800) 977-7711

For Dates of Death on or after July 24, 1986

Application for Extension of Time to Pay Ohio Estate Tax

Attach Copy to ET Form 2 when Return is Filed

Decedent’s last name

Part I. Identification

Print or Type

__________________________________________

Decedent’s first name and middle initial

______________________________________________________________

__________________________________________

Name of application preparer

Date of Death

__________________________________________

__________________________________________________________

Probate Court and Case Number

Address of application preparer (number and street)

__________________________________________

__________________________________________________________

Estate tax return due date

City, State, and ZIP code

Part II. Extension of Time to Pay (Sec. 5731.25 O.R.C.)

You must attach your written statements to explain in detail why it would

Extension date requested (not to exceed one

cause undue hardship to pay the full amount of the estate tax by the

year).

estate tax return due date.

1. Amount of estate tax estimated to be due ....................................... _______________________________________

2. Tax amount not subject to deferral .................................................. _______________________________________

3. Tax shortage claimed (subtract line 2 from line ) ............................. _______________________________________

Part III. Signature and Verification

If prepared by Executor, Administrator, or Person in Possession of Property -- Under penalties of perjury, I declare that

to the best of my knowledge and belief, the statements made herein are true and correct.

Signature of executor, administrator, or person in possession of property.

Title

Date

If prepared by someone other than executor, administrator, or person in possession of property -- Under penalties of

perjury, I declare that to the best of my knowledge and belief, the statements made herein are true and correct.

Signature of preparer other than executor, administrator, or person in possession of property.

Title

Date

Part IV. Notice to Applicant -- to be completed by the Ohio Department of Taxation

The application for extension of time to pay (Part II) is:

c Approved

c Not approved because ________________________________________________________________________

___________________________________________________________________________________________

c Other ______________________________________________________________________________________

___________________________________________________________________________________________

Tax Commissioner

By

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1