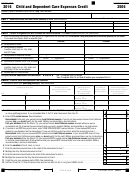

Line 16. If you had an employer-provided dependent care plan, enter the total of the following amounts included on line 14:

•

Any amount you forfeited (if you did not receive it because you did not incur the expense). Do not include amounts

you expect to receive at a future date; and

•

Any amount you did not receive but are permitted by your employer to carry forward and use in the following year

during a grace period.

Example. Under your employer’s dependent care plan, you chose to have your employer set aside $5,000 to cover your

2014 dependent care expenses. The $5,000 is shown on your Form W-2, in box 10. In 2014, you incurred and were

reimbursed for $4,950 of qualified expenses. Enter $5,000 on line 14, and $50, the amount forfeited, on line 16. Also,

enter $50 on line 16 if, instead of forfeiting the amount, your employer permitted you to carry the $50 forward to use

during the grace period in 2015.

Line 17. Add the amounts on lines 14 and 15, and subtract the line 16 amount.

Line 18. Enter the total of all qualified expenses incurred in 2014 for the care of your qualifying persons. It does not matter

when the expenses were paid.

Example. You received $2,000 in cash under your employer's dependent care plan for 2014. The $2,000 is shown

on your Form W-2 in box 10. Only $900 of qualified expenses were incurred in 2014 for the care of your 5-year-old

dependent child. Enter $2,000 on line 14 and $900 on line 18.

Line 19. Enter the smaller of line 17 or line 18.

Line 20. Enter your earned income as defined in the federal instructions for Federal Form 2441. If you are filing a married,

filing jointly return, calculate the earned income of you and your spouse separately and enter your spouse’s earned income

on line 5. See Note if you were a student or disabled.

Line 21. Enter your spouse’s earned income as defined in the federal instructions for Federal Form 2441. See Note if your

spouse was a student or disabled.

Note: If, in the same month, both you and your spouse were either full-time students or disabled, only one of you can be

treated as having earned income in that month.

If you or your spouse was a full-time student or disabled, calculate that person’s earned income on a monthly basis.

For purposes of this calculation:

•

A person would be considered a full-time student if he or she was enrolled as a full-time student at a school for

some part of each of five calendar months during 2014. The months do not need to be consecutive. A school does

not include an on-the-job training course, a correspondence school, or a school offering courses only through

the Internet.

•

A person would be considered disabled if he or she was not physically or mentally capable of self-care.

Line 22. Enter the smallest of lines 19, 20, or 21.

Line 23. Enter $5,000 (or $2,500 if your filing status is married, filing separately) AND you were required to enter your

spouse’s earned income on line 21.

Line 24. Enter the amount, if any, from line 14 that you received from your sole proprietorship or partnership.

Line 25. Enter the result of line 17 minus line 24.

Line 26. Enter the smallest of lines 22, 23, or 24.

Line 27. Enter the smaller of lines 22 or 23.

Line 28. Enter the amount from line 26.

Line 29. Enter the result of line 27 minus line 28. If the result is less than zero, enter -0-.

Line 30. Enter the result of line 25 minus line 29. If the result is less than zero, enter -0-.

Line 31. Enter $3,000 if you have one qualifying person, or enter $6,000 if you have two or more qualifying persons.

Line 32. Enter the result of line 26 plus line 29.

Line 33. Enter the result of line 31 minus line 32. If this result is zero or less, Stop. You cannot take this credit, unless you

paid 2013 expenses in 2014. Refer to the instructions for line 10.

Line 34. Enter the total of all amounts shown on line 2, column C, Form 2441N. Amounts shown on line 32, Form 2441N

should not be included in line 2, column C, Form 2441N.

Line 35. Enter the smaller of line 33 or 34. Also enter this amount from line 3, Form 2441N, and complete lines 4 through 12.

1

1 2

2 3

3 4

4 5

5