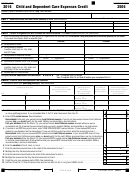

Instructions

Nebraska generally follows federal definitions. For additional information, see the instructions for Federal Form 2441.

Who May File. You may file Form 2441N to take the credit or the exclusion if all five of the following apply.

1.

Your filing status is single, head of household, qualifying widow(er) with dependent child, or married, filing jointly.

If your filing status is married, filing separately, see “Married Persons, Filing Separately” below.

2.

The care was provided so you (and your spouse, if filing jointly) could work or look for work. However, if you did

not find a job and have no earned income for the year, you cannot take the credit or the exclusion. If you or your

spouse were a full-time student or disabled, see the instructions for lines 4 and 5.

3.

The care must be for one or more qualifying persons.

4.

The person who provided the care was not your spouse, the parent of your qualifying child, or a person whom you

can claim as a dependent. If your child provided the care, he or she must have been age 19 or older by the end of

2014, and he or she cannot be your dependent.

5.

You report the required information about the care provider on line 1, and if taking the credit, the information about

the qualifying person on line 2.

Married Persons, Filing Separately. Generally, married persons must file a married, filing jointly return to claim the

credit. If your filing status is married, filing separately and all of the following apply, you are considered unmarried for

purposes of claiming the credit or exclusion on Form 2441N.

•

You lived apart from your spouse during the last 6 months of 2014.

•

Your home was the qualifying person's main home for more than half of 2014.

•

You paid more than half of the cost of keeping up that home for 2014.

If you meet all the requirements to be treated as unmarried and meet items 2 through 5 under “Who May File,” you may take

the credit or the exclusion. If you do not meet all the requirements to be treated as unmarried, you cannot take the credit;

however, you may take the exclusion if you also meet items 2 through 5 under “Who May File.”

Line Instructions

Line 1. Complete columns (A) through (D) for each person or organization that provided the care.

You can use any of the following sources to get this information:

•

Federal Form W-10, Dependent Care Provider's Identification and Certification;

•

A copy of the provider’s Social Security card or driver’s license that includes his or her Social Security number (SSN);

•

A recently printed letterhead or printed invoice that shows the provider’s name, address, and Taxpayer ID

Number (TIN); and

•

A copy of the statement provided by your employer if you were covered by your employer’s dependent care plan

and your employer furnished the care (either at your workplace or by hiring a care provider).

If you do not give correct or complete information, your credit or exclusion will be disallowed.

If you have more than two care providers, attach a statement to your return with the required information for each provider.

Be sure to put your name and SSN on the statement. Also, enter “See Attached” near the “Caution” under line 1.

Columns (A) and (B). Enter the care provider's name and address.

Column (C). If the care provider is an individual, enter his or her SSN. Otherwise, enter the provider's employer ID number

(EIN). If the provider is a tax-exempt organization, enter “Tax-Exempt” in column (C).

Column (D). Enter the total amount you actually paid to the care provider in 2014 and any amounts your employer paid

to a third party on your behalf. It does not matter when the expenses were incurred. Do not reduce this amount by any

reimbursement you received.

Line 2. Complete columns (A) through (C) for each qualifying person. If you have more than three qualifying persons,

attach a statement to your return with the required information. Be sure to put your name and SSN on the statement. In

column (C) , enter the qualified expenses you incurred and paid in 2014 for the person listed in column (A). Prepaid expenses

are treated as paid in the year the care is provided.

Line 3. Add the amounts in line 2, column (C). Do not enter more than $3,000 for one qualifying person, or $6,000 for two

or more qualifying persons. If you completed Part III, enter the amount from line 35.

Line 4. Enter your earned income as defined in the instructions for Federal Form 2441. If you are filing a married, filing

jointly return, calculate the earned income of you and your spouse separately and enter your spouse’s earned income on

line 5. See Note if you were a student or disabled.

1

1 2

2 3

3 4

4 5

5