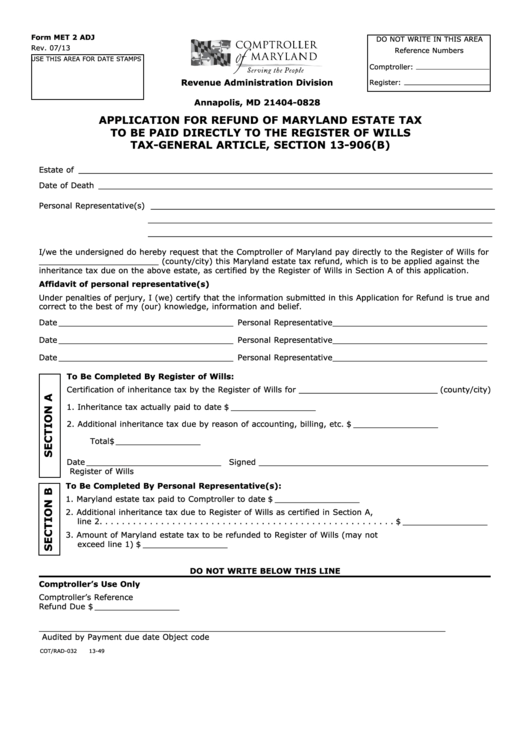

Form MET 2 ADJ

DO NOT WRITE IN THIS AREA

Rev. 07/13

Reference Numbers

USE THIS AREA FOR DATE STAMPS

Comptroller: __ __ ___ __ _______________

Revenue Administration Division

Register: _ ___ __ __ __ __ __ ______________

P.O. Box 828

Annapolis, MD 21404-0828

APPLICATION FOR REFUND OF MARYLAND ESTATE TAX

TO BE PAID DIRECTLY TO THE REGISTER OF WILLS

TAX-GENERAL ARTICLE, SECTION 13-906(B)

Estate of ___________________________________________________________________________________

Date of Death _______________________________________________________________________________

Personal Representative(s) _____________________________________________________________________

_____________________________________________________________________

_____________________________________________________________________

I/we the undersigned do hereby request that the Comptroller of Maryland pay directly to the Register of Wills for

________________________ (county/city) this Maryland estate tax refund, which is to be applied against the

inheritance tax due on the above estate, as certified by the Register of Wills in Section A of this application.

Affidavit of personal representative(s)

Under penalties of perjury, I (we) certify that the information submitted in this Application for Refund is true and

correct to the best of my (our) knowledge, information and belief.

Date ___________________________________

Personal Representative _______________________________

Date ___________________________________

Personal Representative _______________________________

Date ___________________________________

Personal Representative _______________________________

To Be Completed By Register of Wills:

Certification of inheritance tax by the Register of Wills for _ __ _ _ _ _ _ __ _ _ _ _ _ __ _ _ _ _ _ __ _ _ _ _ _ __ _ _ _ _ _ __ _ _ (county/city)

1. Inheritance tax actually paid to date . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ _________________

2. Additional inheritance tax due by reason of accounting, billing, etc. . . . . . . . . . $ _________________

Total . . . . . $ _________________

Date ___________________________

Signed ______________________________________________

Register of Wills

To Be Completed By Personal Representative(s):

1. Maryland estate tax paid to Comptroller to date . . . . . . . . . . . . . . . . . . . . . . . $ _________________

2. Additional inheritance tax due to Register of Wills as certified in Section A,

line 2. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ _________________

3. Amount of Maryland estate tax to be refunded to Register of Wills (may not

exceed line 1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ _________________

DO NOT WRITE BELOW THIS LINE

Comptroller’s Use Only

Comptroller’s Reference

Refund Due . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ _________________

_ _____________________ _____________________

______ __ _ __ _ _ __ __ _ _ _ _ __ _ _ _ _ _ __ _ _ _ _ _ __ _ _ _ _

_ __ _ _ _ _ _ __ _ _ _ _ _ __ _ _ _ _ _ __ _ _ _ _ _ __ _ _ _

Audited by

Payment due date

Object code

COT/RAD-032

13-49

1

1 2

2