Form Ct-1120 Sbj - Qualified Small Business Job Creation Tax Credit - 2013

ADVERTISEMENT

Department of Revenue Services

2013

State of Connecticut

Form CT-1120 SBJ

(Rev. 12/13)

Qualified Small Business Job Creation Tax Credit

For Income Year Beginning: _______________________ , 2013 and Ending: ________________________ , _________ .

Name of corporation or business entity

Connecticut Tax Registration Number

Credit Computation

Complete this form in blue or black ink only.

A qualified small business may earn a tax credit equal to $200 per

Use Form CT-1120 SBJ to claim the credit allowed under Conn.

Gen. Stat. §12-217nn. This form must be used to claim the tax

month for hiring a Connecticut resident. The new employee must

be hired to fill a full-time job during the income years beginning

credit against the taxes imposed under Chapter 207 (insurance

premiums tax; health care centers tax), Chapter 208 (corporation

on or after January 1, 2010, and before January 1, 2013. The tax

business tax), or Chapter 229 (income tax) of the Connecticut

credit can be claimed in the income year of the hire and the next two

income years. No qualified small business may claim a tax credit

General Statutes.

for a new employee who is an owner, member, or partner in the

Definitions

business or who is not employed at the close of the income year of

the qualified small business.

Full-time job means a job in which an employee is required to

work at least 35 or more hours per week for not less than 48 weeks

To be eligible to claim this credit an application must be submitted

in a calendar year. Full-time job does not include temporary or

to and approved by the Department of Economic and Community

seasonal work.

Development (DECD).

Qualified small business means an employer who employs less

Additional Information

than 50 employees in Connecticut and is subject to tax under Conn.

Contact DECD, Office of Business & Industry Development, 505

Gen. Stat. Chapters 207, 208, or 229.

Hudson Street, Hartford, CT 06106, 860-270-8215; see the Guide

New employee means a person hired after May 6, 2010, by a

to Connecticut Business Tax Credits available on the Department

qualified small business. It does not include a person who was

of Revenue Services (DRS) website at or contact

employed in Connecticut by a person related to the qualified small

DRS at 1-800-382-9463 (Connecticut calls outside the Greater

business during the prior 12 months.

Hartford calling area only) or 860-297-5962 (from anywhere).

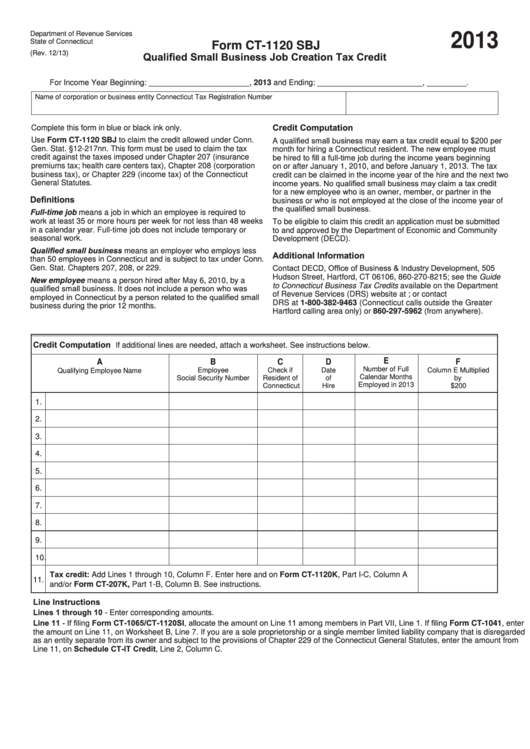

Credit Computation

If additional lines are needed, attach a worksheet. See instructions below.

E

A

B

C

D

F

Number of Full

Employee

Check if

Date

Column E Multiplied

Qualifying Employee Name

Calendar Months

Social Security Number

Resident of

of

by

$200

Employed in 2013

Connecticut

Hire

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

Tax credit: Add Lines 1 through 10, Column F. Enter here and on Form CT-1120K, Part I-C, Column A

11.

and/or Form CT-207K, Part 1-B, Column B. See instructions.

Line Instructions

Lines 1 through 10 - Enter corresponding amounts.

Line 11 - If filing Form CT-1065/CT-1120SI, allocate the amount on Line 11 among members in Part VII, Line 1. If filing Form CT-1041, enter

the amount on Line 11, on Worksheet B, Line 7. If you are a sole proprietorship or a single member limited liability company that is disregarded

as an entity separate from its owner and subject to the provisions of Chapter 229 of the Connecticut General Statutes, enter the amount from

Line 11, on Schedule CT-IT Credit, Line 2, Column C.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1