Form Ct-1120 Xch - Application For Exchange Of Research And Development Or Research And Experimental Expenditures Tax Credits By A Qualified Small Business - 2013 Page 2

ADVERTISEMENT

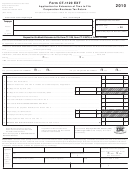

Part II - Computation of Exchange Amount

1a. Enter the amount of 2013 Research and Experimental

1a.

Expenditures Tax Credit from Form CT-1120RC, Part I, Line 4.

Enter the amount of 2013 Research and Experimental

1b.

Expenditures Tax Credit applied from Form CT-1120RC,

1b.

Part II, Line 16, Column D.

1. Enter the amount of 2013 Research and Experimental Expenditures Tax Credit available for exchange.

1.

Subtract Line 1b from Line 1a.

2a. Enter the amount of 2013 Research and Development Tax Credit

2a.

from Form CT-1120 RDC, Part II, Line 2.

2b. Enter the amount of 2013 Research and Development Tax Credit

2b.

applied from Form CT-1120 RDC, Part III, Line 19, Column D.

2. Enter the amount of 2013 Research and Development Tax Credit available for exchange.

2.

Subtract Line 2b from Line 2a.

3. Add Line 1 and Line 2.

3.

4.

4. Total credit refund requested: Multiply amount on Line 3 by 65% (.65). Do not exceed $1.5 million.

Part III - Required Attachments

In addition to Form CT-1120RC, Form CT-1120 RDC, or both if applicable, attach detailed schedules supporting the claimed research

expenditures. The detailed schedules must include:

•

A full and complete description of the nature of the research projects conducted by the company during the income year and the

location(s) where the research is conducted;

•

A full and complete description of the methods used to obtain: (a) the amount spent directly on research and experimental expenditures

conducted in Connecticut, in accordance with Conn. Gen. Stat. §12-217j; and (b) the total expenditures and payments for research

and experimentation, and basic research conducted in Connecticut, in accordance with Conn. Gen. Stat. §12-217n;

•

A detailed description of each source of information used to compute the credit, including the methods and calculations of expense

allocation, if any; and

•

The job title and detailed job description of each employee whose wages are included in the research expenditures.

Contact Person

Name

Telephone number

(

)

Title

Address (number and street)

PO Box

City or town

State

Zip code

Form CT-1120 XCH Back (Rev. 12/13)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2