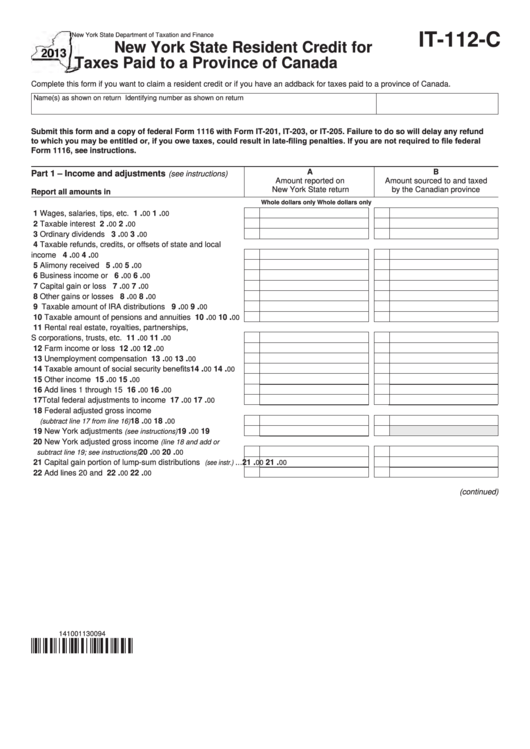

New York State Department of Taxation and Finance

IT-112-C

New York State Resident Credit for

Taxes Paid to a Province of Canada

Complete this form if you want to claim a resident credit or if you have an addback for taxes paid to a province of Canada.

Name(s) as shown on return

Identifying number as shown on return

Submit this form and a copy of federal Form 1116 with Form IT-201, IT-203, or IT-205. Failure to do so will delay any refund

to which you may be entitled or, if you owe taxes, could result in late-filing penalties. If you are not required to file federal

Form 1116, see instructions.

A

B

Part 1 – Income and adjustments

(see instructions)

Amount reported on

Amount sourced to and taxed

New York State return

by the Canadian province

Report all amounts in U.S. dollars.

Whole dollars only

Whole dollars only

1 Wages, salaries, tips, etc. ................................................

00

00

.

.

1

1

2 Taxable interest income....................................................

00

00

.

.

2

2

3 Ordinary dividends ...........................................................

00

00

.

.

3

3

4 Taxable refunds, credits, or offsets of state and local

income taxes.................................................................

00

00

.

.

4

4

5 Alimony received ..............................................................

00

00

.

.

5

5

6 Business income or loss...................................................

00

00

.

.

6

6

7 Capital gain or loss ...........................................................

00

00

.

.

7

7

8 Other gains or losses .......................................................

00

00

.

.

8

8

9 Taxable amount of IRA distributions .................................

00

00

.

.

9

9

10 Taxable amount of pensions and annuities ...................... 10

00

00

.

.

10

11 Rental real estate, royalties, partnerships,

S corporations, trusts, etc. ............................................ 11

00

00

.

.

11

12 Farm income or loss ......................................................... 12

00

00

.

.

12

13 Unemployment compensation .......................................... 13

00

00

.

.

13

14 Taxable amount of social security benefits ....................... 14

00

00

.

.

14

15 Other income .................................................................... 15

00

00

.

.

15

16 Add lines 1 through 15 ..................................................... 16

00

00

.

.

16

17 Total federal adjustments to income ................................. 17

00

00

.

.

17

18 Federal adjusted gross income

............................................ 18

00

00

.

.

18

(subtract line 17 from line 16)

19 New York adjustments

............................ 19

00

.

19

(see instructions)

20 New York adjusted gross income

(line 18 and add or

....................................... 20

00

00

.

.

20

subtract line 19; see instructions)

21 Capital gain portion of lump-sum distributions

... 21

00

00

.

.

21

(see instr.)

22 Add lines 20 and 21.......................................................... 22

00

00

.

.

22

(continued)

141001130094

1

1 2

2 3

3