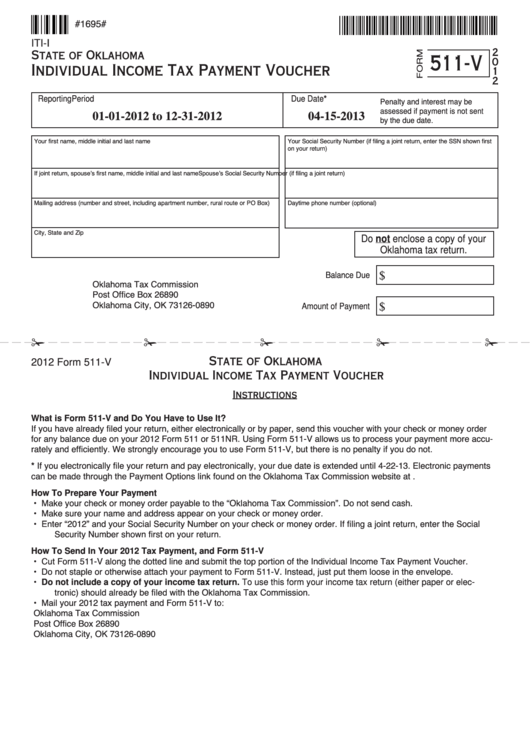

#1695#

ITI-I

2

State of Oklahoma

511-V

0

Individual Income Tax Payment Voucher

1

2

Reporting Period

Due Date*

Penalty and interest may be

assessed if payment is not sent

01-01-2012 to 12-31-2012

04-15-2013

by the due date.

Your first name, middle initial and last name

Your Social Security Number (if filing a joint return, enter the SSN shown first

on your return)

If joint return, spouse’s first name, middle initial and last name

Spouse’s Social Security Number (if filing a joint return)

Mailing address (number and street, including apartment number, rural route or PO Box)

Daytime phone number (optional)

City, State and Zip

Do not enclose a copy of your

Oklahoma tax return.

Balance Due

$

Oklahoma Tax Commission

Post Office Box 26890

Oklahoma City, OK 73126-0890

Amount of Payment

$

!

!

!

!

!

State of Oklahoma

2012 Form 511-V

Individual Income Tax Payment Voucher

Instructions

What is Form 511-V and Do You Have to Use It?

If you have already filed your return, either electronically or by paper, send this voucher with your check or money order

for any balance due on your 2012 Form 511 or 511NR. Using Form 511-V allows us to process your payment more accu-

rately and efficiently. We strongly encourage you to use Form 511-V, but there is no penalty if you do not.

* If you electronically file your return and pay electronically, your due date is extended until 4-22-13. Electronic payments

can be made through the Payment Options link found on the Oklahoma Tax Commission website at

How To Prepare Your Payment

• Make your check or money order payable to the “Oklahoma Tax Commission”. Do not send cash.

• Make sure your name and address appear on your check or money order.

• Enter “2012” and your Social Security Number on your check or money order. If filing a joint return, enter the Social

Security Number shown first on your return.

How To Send In Your 2012 Tax Payment, and Form 511-V

• Cut Form 511-V along the dotted line and submit the top portion of the Individual Income Tax Payment Voucher.

• Do not staple or otherwise attach your payment to Form 511-V. Instead, just put them loose in the envelope.

• Do not include a copy of your income tax return. To use this form your income tax return (either paper or elec-

tronic) should already be filed with the Oklahoma Tax Commission.

• Mail your 2012 tax payment and Form 511-V to:

Oklahoma Tax Commission

Post Office Box 26890

Oklahoma City, OK 73126-0890

1

1