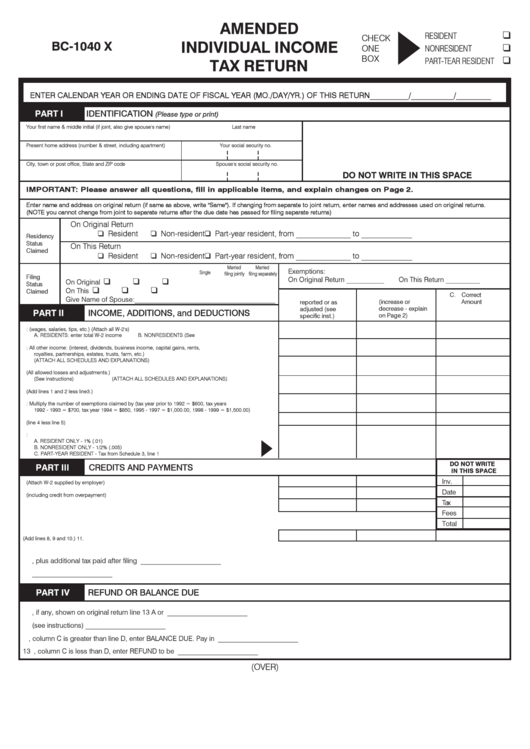

Form Bc-1040 X - Amended Individual Income Tax Return

ADVERTISEMENT

AMENDED

❑

RESIDENT

CHECK

INDIVIDUAL INCOME

BC-1040 X

❑

ONE

NONRESIDENT

BOX

❑

PART-TEAR RESIDENT

TAX RETURN

ENTER CALENDAR YEAR OR ENDING DATE OF FISCAL YEAR (MO./DAY/YR.) OF THIS RETURN__________/___________/_________

PART I

IDENTIFICATION

(Please type or print)

Your first name & middle initial (if joint, also give spouse's name)

Last name

Present home address (number & street, including apartment)

Your social security no.

City, town or post office, State and ZIP code

Spouse's social security no.

DO NOT WRITE IN THIS SPACE

IMPORTANT: Please answer all questions, fill in applicable items, and explain changes on Page 2.

Enter name and address on original return (if same as above, write "Same"). If changing from separate to joint return, enter names and addresses used on original returns.

(NOTE you cannot change from joint to separate returns after the due date has passed for filing separate returns)

On Original Return

❑ Resident

❑ Non-resident

❑ Part-year resident, from ______________ to _____________

Residency

Status

On This Return

Claimed

❑ Resident

❑ Non-resident

❑ Part-year resident, from ______________ to _____________

Married

Married

Exemptions:

Single

filing jointly

filing separately

Filing

On Original Return ___________

On This Return __________

❑

❑

❑

On Original Return ..................................

Status

❑

❑

❑

On This Return

..................................

Claimed

B. Net Change

C. Correct

A. As originally

Give Name of Spouse:_________________________________________

(increase or

Amount

reported or as

decrease - explain

adjusted (see

PART II

INCOME, ADDITIONS, and DEDUCTIONS

on Page 2)

specific inst.)

1. TOTAL W-2 INCOME: (wages, salaries, tips, etc.) (Attach all W-2's)

A. RESIDENTS: enter total W-2 income

B. NONRESIDENTS (See instructions ................................... 1.

2. ADDITIONS TO INCOME: All other income: (interest, dividends, business income, capital gains, rents,

royalties, partnerships, estates, trusts, farm, etc.) ......................................................................................... 2.

(ATTACH ALL SCHEDULES AND EXPLANATIONS)

3. SUBTRACTIONS FROM INCOME (All allowed losses and adjustments.) ...................................................... 3.

(See instructions)

(ATTACH ALL SCHEDULES AND EXPLANATIONS)

4. ADJUSTED INCOME (Add lines 1 and 2 less line3.) ....................................................................................... 4.

5. EXEMPTIONS: Multiply the number of exemptions claimed by (tax year prior to 1992 = $600, tax years

1992 - 1993 = $700, tax year 1994 = $850, 1995 - 1997 = $1,000.00, 1998 - 1999 = $1,500.00) .................. 5.

6. TAXABLE INCOME (line 4 less line 5) .............................................................................................................. 6.

7. TAX - Multiply amount on line 6 by one of the following:

A. RESIDENT ONLY - 1% (.01) ........................................................................................................................ 7.

B. NONRESIDENT ONLY - 1/2% (.005) .............................................................................................................

C. PART-YEAR RESIDENT - Tax from Schedule 3, line 1 ...................................................................................

DO NOT WRITE

PART III

CREDITS AND PAYMENTS

IN THIS SPACE

Inv.

8. Battle Creek tax withheld (Attach W-2 supplied by employer) ....................................................................... 8.

Date

9. Estimate payments (including credit from overpayment) ............................................................................... 9.

Tax

10. Credits for income tax paid to another Michigan municipality or by a partnership ...................................... 10.

Fees

Total

11. TOTAL PAYMENTS AND CREDITS (Add lines 8, 9 and 10.) ......................................................................... 11.

A. Amount paid with original return, plus additional tax paid after filing ........................................................................................ A.

_______________________

B. Total credits and payments. Add lines 11 and A of column C ................................................................................................... B.

_______________________

PART IV

REFUND OR BALANCE DUE

C. Refund, if any, shown on original return line 13 A or B .............................................................................................................. C.

_______________________

D. Enter the difference between lines B and C (see instructions) .................................................................................................. D.

_______________________

12. If line 7, column C is greater than line D, enter BALANCE DUE. Pay in full .............................................................................. 12.

_______________________

13 A. If line 7, column C is less than D, enter REFUND to be received ......................................................................................... 13 A.

_______________________

(OVER)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2