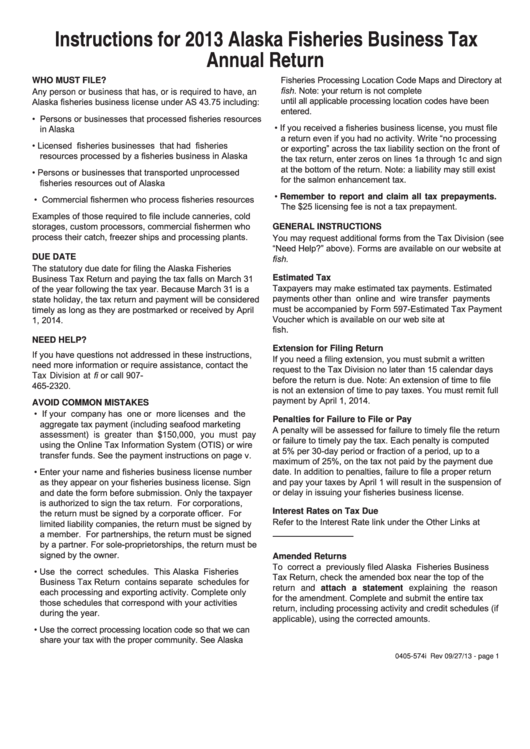

Instructions For 2013 Alaska Fisheries Business Tax Annual Return

ADVERTISEMENT

Instructions for 2013 Alaska Fisheries Business Tax

Annual Return

Fisheries Processing Location Code Maps and Directory at

WHO MUST FILE?

Note: your return is not complete

Any person or business that has, or is required to have, an

until all applicable processing location codes have been

Alaska fisheries business license under AS 43.75 including:

entered.

• Persons or businesses that processed fisheries resources

• If you received a fisheries business license, you must file

in Alaska

a return even if you had no activity. Write “no processing

• Licensed

fisheries businesses

that had

fisheries

or exporting” across the tax liability section on the front of

resources processed by a fisheries business in Alaska

the tax return, enter zeros on lines 1a through 1c and sign

at the bottom of the return. Note: a liability may still exist

• Persons or businesses that transported unprocessed

for the salmon enhancement tax.

fisheries resources out of Alaska

• Remember to report and claim all tax prepayments.

• Commercial fishermen who process fisheries resources

The $25 licensing fee is not a tax prepayment.

Examples of those required to file include canneries, cold

storages, custom processors, commercial fishermen who

GENERAL INSTRUCTIONS

process their catch, freezer ships and processing plants.

You may request additional forms from the Tax Division (see

“Need Help?” above). Forms are available on our website at

DUE DATE

The statutory due date for filing the Alaska Fisheries

Business Tax Return and paying the tax falls on March 31

Estimated Tax

Taxpayers may make estimated tax payments. Estimated

of the year following the tax year. Because March 31 is a

payments other than online and wire transfer payments

state holiday, the tax return and payment will be considered

must be accompanied by Form 597-Estimated Tax Payment

timely as long as they are postmarked or received by April

Voucher which is available on our web site at

1, 2014.

alaska.gov/fish.

NEED HELP?

Extension for Filing Return

If you have questions not addressed in these instructions,

If you need a filing extension, you must submit a written

need more information or require assistance, contact the

request to the Tax Division no later than 15 calendar days

Tax Division at dor.tax.fishexcise@alaska.gov or call 907-

before the return is due. Note: An extension of time to file

465-2320.

is not an extension of time to pay taxes. You must remit full

payment by April 1, 2014.

AVOID COMMON MISTAKES

• If your company has one or more licenses and the

Penalties for Failure to File or Pay

aggregate tax payment (including seafood marketing

A penalty will be assessed for failure to timely file the return

assessment) is greater than $150,000, you must pay

or failure to timely pay the tax. Each penalty is computed

using the Online Tax Information System (OTIS) or wire

at 5% per 30-day period or fraction of a period, up to a

transfer funds. See the payment instructions on page v.

maximum of 25%, on the tax not paid by the payment due

date. In addition to penalties, failure to file a proper return

• Enter your name and fisheries business license number

and pay your taxes by April 1 will result in the suspension of

as they appear on your fisheries business license. Sign

and date the form before submission. Only the taxpayer

or delay in issuing your fisheries business license.

is authorized to sign the tax return. For corporations,

the return must be signed by a corporate officer. For

Interest Rates on Tax Due

Refer to the Interest Rate link under the Other Links at

limited liability companies, the return must be signed by

a member. For partnerships, the return must be signed

alaska.gov.

by a partner. For sole-proprietorships, the return must be

signed by the owner.

Amended Returns

To correct a previously filed Alaska Fisheries Business

• Use the correct schedules. This Alaska Fisheries

Tax Return, check the amended box near the top of the

Business Tax Return contains separate schedules for

return and attach a statement explaining the reason

each processing and exporting activity. Complete only

for the amendment. Complete and submit the entire tax

those schedules that correspond with your activities

return, including processing activity and credit schedules (if

during the year.

applicable), using the corrected amounts.

• Use the correct processing location code so that we can

share your tax with the proper community. See Alaska

0405-574i Rev 09/27/13 - page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8