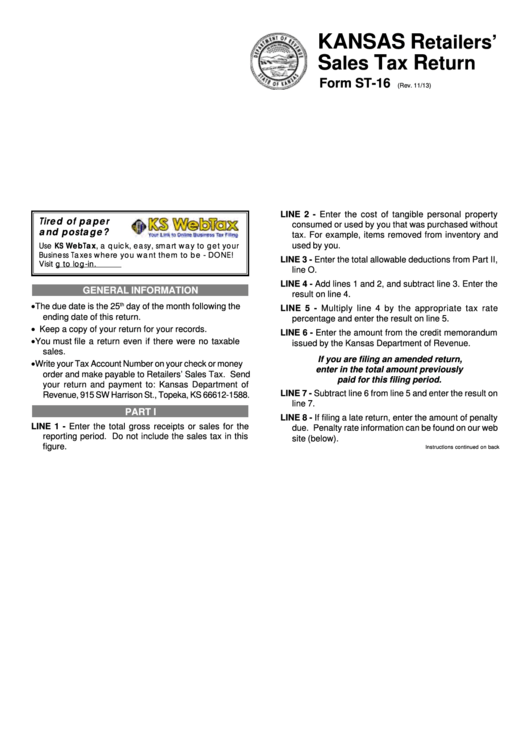

KANSAS R

etailers’

S

T

R

ales

ax

eturn

Form ST-16

(Rev. 11/13)

LINE 2 - Enter the cost of tangible personal property

Tired of paper

consumed or used by you that was purchased without

and postage?

tax. For example, items removed from inventory and

used by you.

Use KS WebTax, a quick, easy, smart way to get your

Business Taxes where you want them to be - DONE!

LINE 3 - Enter the total allowable deductions from Part II,

Visit to log-in.

line O.

LINE 4 - Add lines 1 and 2, and subtract line 3. Enter the

GENERAL INFORMATION

result on line 4.

• The due date is the 25

th

day of the month following the

LINE 5 - Multiply line 4 by the appropriate tax rate

ending date of this return.

percentage and enter the result on line 5.

• Keep a copy of your return for your records.

LINE 6 - Enter the amount from the credit memorandum

• You must file a return even if there were no taxable

issued by the Kansas Department of Revenue.

sales.

If you are filing an amended return,

• Write your Tax Account Number on your check or money

enter in the total amount previously

order and make payable to Retailers’ Sales Tax. Send

paid for this filing period.

your return and payment to: Kansas Department of

LINE 7 - Subtract line 6 from line 5 and enter the result on

Revenue, 915 SW Harrison St., Topeka, KS 66612-1588.

line 7.

PART I

LINE 8 - If filing a late return, enter the amount of penalty

LINE 1 - Enter the total gross receipts or sales for the

due. Penalty rate information can be found on our web

reporting period. Do not include the sales tax in this

site (below).

figure.

Instructions continued on back

1

1 2

2 3

3 4

4