Ach Credit Payment Instructions - Arkansas Department Of Finance And Administration

ADVERTISEMENT

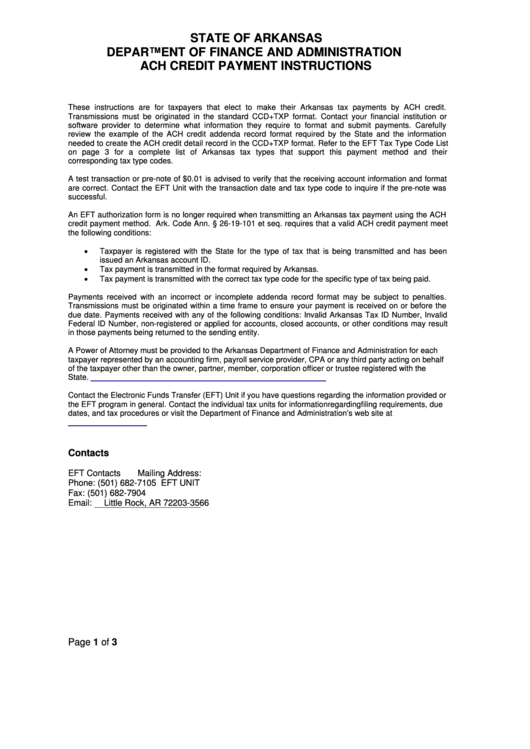

STATE OF ARKANSAS

DEPARTMENT OF FINANCE AND ADMINISTRATION

ACH CREDIT PAYMENT INSTRUCTIONS

These instructions are for taxpayers that elect to make their Arkansas tax payments by ACH credit.

Transmissions must be originated in the standard CCD+TXP format. Contact your financial institution or

software provider to determine what information they require to format and submit payments. Carefully

review the example of the ACH credit addenda record format required by the State and the information

needed to create the ACH credit detail record in the CCD+TXP format. Refer to the EFT Tax Type Code List

on page 3 for a complete list of Arkansas tax types that support this payment method and their

corresponding tax type codes.

A test transaction or pre-note of $0.01 is advised to verify that the receiving account information and format

are correct. Contact the EFT Unit with the transaction date and tax type code to inquire if the pre-note was

successful.

An EFT authorization form is no longer required when transmitting an Arkansas tax payment using the ACH

credit payment method. Ark. Code Ann. § 26-19-101 et seq. requires that a valid ACH credit payment meet

the following conditions:

•

Taxpayer is registered with the State for the type of tax that is being transmitted and has been

issued an Arkansas account ID.

•

Tax payment is transmitted in the format required by Arkansas.

•

Tax payment is transmitted with the correct tax type code for the specific type of tax being paid.

Payments received with an incorrect or incomplete addenda record format may be subject to penalties.

Transmissions must be originated within a time frame to ensure your payment is received on or before the

due date. Payments received with any of the following conditions: Invalid Arkansas Tax ID Number, Invalid

Federal ID Number, non-registered or applied for accounts, closed accounts, or other conditions may result

in those payments being returned to the sending entity.

A Power of Attorney must be provided to the Arkansas Department of Finance and Administration for each

taxpayer represented by an accounting firm, payroll service provider, CPA or any third party acting on behalf

of the taxpayer other than the owner, partner, member, corporation officer or trustee registered with the

State.

Contact the Electronic Funds Transfer (EFT) Unit if you have questions regarding the information provided or

the EFT program in general. Contact the individual tax units for information regarding filing requirements, due

dates, and tax procedures or visit the Department of Finance and Administration’s web site at

Contacts

EFT Contacts

Mailing Address:

Phone: (501) 682-7105

EFT UNIT

Fax: (501) 682-7904

P.O. Box 3566

Email:

EFTUnit@dfa.arkansas.gov

Little Rock, AR 72203-3566

Page 1 of 3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3