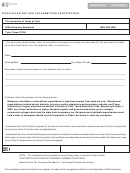

PRINT FORM

CLEAR FORM

01-925

(Rev.11-11/2)

Texas Timber Operations Sales and Use Tax Exemption Certification

This completed form must be provided to retailers when claiming an exemption from sales and use tax on the purchase of qualifying

items used in the production of timber for sale. The certificate may serve as a blanket certificate covering all qualifying purchases.

This form may not be used to claim exemption from tax on motor vehicles, including trailers. Motor vehicle tax exemptions must be

claimed with the local County Tax Assessor-Collector at the time of registration and/or titling.

Name of retailer

Address (Street and number, P.O. Box or route number)

City, State, ZIP code

Important information regarding use of this certificate:

Purchasers issuing this certificate must be familiar with the timber exemptions available for the items claimed on

this form. Please review Rule 3.367 at Timber exemptions only apply if an item is purchased

for EXCLUSIVE use in an exempt manner. Any personal or non-timber use disqualifies the purchase from

exemption. See back for qualifying and non-qualifying items.

Retailers may accept this certificate as a blanket certificate covering all sales of items that can reasonably be used

in the production of timber products for sale in the regular course of business. Retailers must collect tax on all other

items such as jewelry, furniture, guns and clothing.

Name of purchaser

Address (Street and number, P.O. Box or route number)

City, State, ZIP code

Phone (Area code and number)

Ag/Timber number

Name of person to whom number is registered, if different than purchaser

I understand that I am required to keep records to verify eligibility for the exemption(s) and that I will be required to pay sales or use tax

on purchases that do not qualify for the exemption(s), in addition to any applicable interest and penalties.

I understand that it is a criminal offense to issue an exemption certificate to the seller for taxable items that I know will be used in a

manner that does not qualify for the exemptions found in Tax Code Sec. 151.316. The offense may range from a Class C misdemeanor

to a felony of the second degree.

Purchaser's signature

Purchaser's name (print or type)

Date

This certificate should be furnished to the retailer. Do not send the completed certificate to the Comptroller of Public Accounts.

1

1 2

2