Instructions For Form Pa-20s/pa-65 - Schedule Oc - Other Credits - 2013

ADVERTISEMENT

2013

Pennsylvania Department of Revenue

Instructions for PA-20S/PA-65 Schedule OC

Other Credits

WHAT’S NEW

The portion of the tax credit that ex-

must submit with PA-20S/PA-65 Sched-

ceeds the tax liability of the awardee of

ule OC and the certificate or notification

The Organ & Bone Marrow Tax Credit has

the tax credit may be carried forward

that approved each tax credit claimed.

been removed from the Schedule OC.

unless the awardee elects to sell or as-

Following is some general information

sign the tax credit or pass it through to

GENERAL INFORMATION

regarding tax credits.

its owners.

PURPOSE OF SCHEDULE

● All of the restricted tax credits

Special rules apply for taxpayers that

A PA S corporation, partnership and

can be claimed against any class

sell/assign restricted tax credits as well

limited liability company filing as a

of income.

as the taxpayers who purchase them or

partnership or PA S corporation for fed-

to whom tax credits are assigned. The

● Restricted tax credits are nonre-

eral income tax purposes uses PA-

rules apply to all taxpayers, whether or

fundable. If applicable, other non-

20S/PA-65 Schedule OC to enter its

not they are incorporated. For specific

refundable credits must be applied

share for each tax credit received after

information regarding these rules, re-

to the account before restricted

applying the tax credit to the entity’s

view Corporation Tax Bulletin 2011-03

tax credits.

corporate liability, if any.

on the Department of Revenue’s web-

site,

● The request to pass through tax

A tax credit passed through from an-

credit to an entity owner is irrevo-

other entity can only be applied to tax

Tax credits are often sold through credit

cable, therefore the entity should

liability resulting from the RCT-101, PA

brokers; however, a credit broker is not

not pass through more than the

Corporate Tax Report. Do not report a

a requirement of sale. For additional in-

owner can use in any single year.

tax credit passed through from another

formation about using purchased or as-

entity on PA-20S/PA-65 Schedule OC.

signed tax credits, see the specific

● Tax credits passed through from

section for each tax credit.

REDUCTION IN EXPENSES

pass through entities to other pass

through entities or to estates or

Pennsylvania does not allow the deduc-

PERSONAL INCOME TAX

trusts may not be passed through

tion of certain expenses used to qualify

REPORTING REQUIREMENTS

to owners or beneficiaries.

for the Neighborhood Assistance Pro-

FOR SALE OF RESTRICTED

gram and the Educational Improvement

TAX CREDITS

SALEABLE OR ASSIGNABLE

tax credits. If the expenses were de-

TAX CREDITS

Seller of a Restricted Tax Credit

ducted in calculating federal-taxable in-

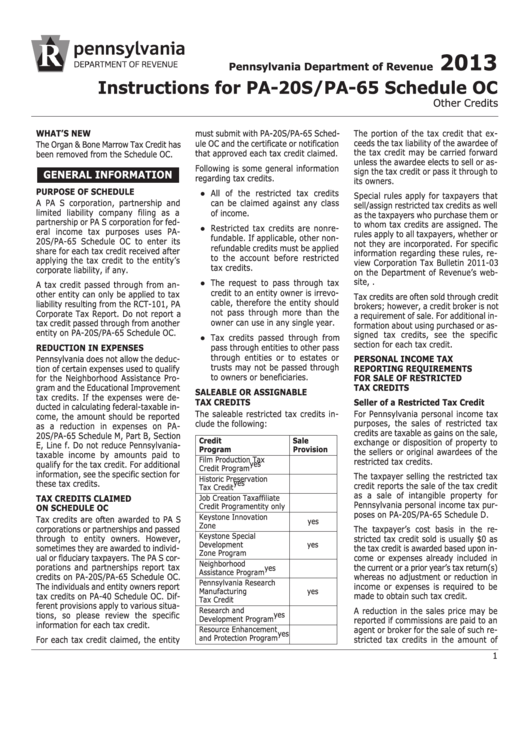

The saleable restricted tax credits in-

For Pennsylvania personal income tax

come, the amount should be reported

purposes, the sales of restricted tax

clude the following:

as a reduction in expenses on PA-

credits are taxable as gains on the sale,

20S/PA-65 Schedule M, Part B, Section

Credit

Sale

exchange or disposition of property to

E, Line f. Do not reduce Pennsylvania-

Program

Provision

the sellers or original awardees of the

taxable income by amounts paid to

Film Production Tax

restricted tax credits.

yes

qualify for the tax credit. For additional

Credit Program

information, see the specific section for

The taxpayer selling the restricted tax

Historic Preservation

these tax credits.

yes

credit reports the sale of the tax credit

Tax Credit

as a sale of intangible property for

Job Creation Tax

affiliate

TAX CREDITS CLAIMED

Pennsylvania personal income tax pur-

Credit Program

entity only

ON SCHEDULE OC

poses on PA-20S/PA-65 Schedule D.

Keystone Innovation

Tax credits are often awarded to PA S

yes

Zone

corporations or partnerships and passed

The taxpayer’s cost basis in the re-

Keystone Special

through to entity owners. However,

stricted tax credit sold is usually $0 as

Development

yes

sometimes they are awarded to individ-

the tax credit is awarded based upon in-

Zone Program

ual or fiduciary taxpayers. The PA S cor-

come or expenses already included in

Neighborhood

porations and partnerships report tax

the current or a prior year’s tax return(s)

yes

Assistance Program

credits on PA-20S/PA-65 Schedule OC.

whereas no adjustment or reduction in

Pennsylvania Research

The individuals and entity owners report

income or expenses is required to be

Manufacturing

yes

made to obtain such tax credit.

tax credits on PA-40 Schedule OC. Dif-

Tax Credit

ferent provisions apply to various situa-

Research and

A reduction in the sales price may be

yes

tions, so please review the specific

Development Program

reported if commissions are paid to an

information for each tax credit.

Resource Enhancement

agent or broker for the sale of such re-

yes

and Protection Program

stricted tax credits in the amount of

For each tax credit claimed, the entity

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11