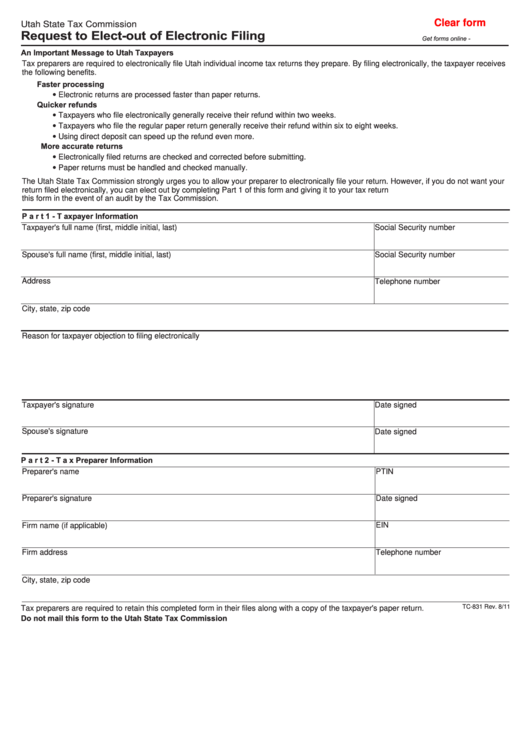

Clear form

Utah State Tax Commission

Request to Elect-out of Electronic Filing

Get forms online - tax.utah.gov

An Important Message to Utah Taxpayers

Tax preparers are required to electronically file Utah individual income tax returns they prepare. By filing electronically, the taxpayer receives

the following benefits.

Faster processing

·

Electronic returns are processed faster than paper returns.

Quicker refunds

·

Taxpayers who file electronically generally receive their refund within two weeks.

·

Taxpayers who file the regular paper return generally receive their refund within six to eight weeks.

·

Using direct deposit can speed up the refund even more.

More accurate returns

·

Electronically filed returns are checked and corrected before submitting.

·

Paper returns must be handled and checked manually.

The Utah State Tax Commission strongly urges you to allow your preparer to electronically file your return. However, if you do not want your

return filed electronically, you can elect out by completing Part 1 of this form and giving it to your tax return preparer. The preparer will retain

this form in the event of an audit by the Tax Commission.

Part 1 - Taxpayer Information

Taxpayer's full name (first, middle initial, last)

Social Security number

Spouse's full name (first, middle initial, last)

Social Security number

Address

Telephone number

City, state, zip code

Reason for taxpayer objection to filing electronically

Taxpayer's signature

Date signed

Spouse's signature

Date signed

Part 2 - Tax Preparer Information

Preparer's name

PTIN

Preparer's signature

Date signed

Firm name (if applicable)

EIN

Firm address

Telephone number

City, state, zip code

TC-831 Rev. 8/11

Tax preparers are required to retain this completed form in their files along with a copy of the taxpayer's paper return.

Do not mail this form to the Utah State Tax Commission

1

1