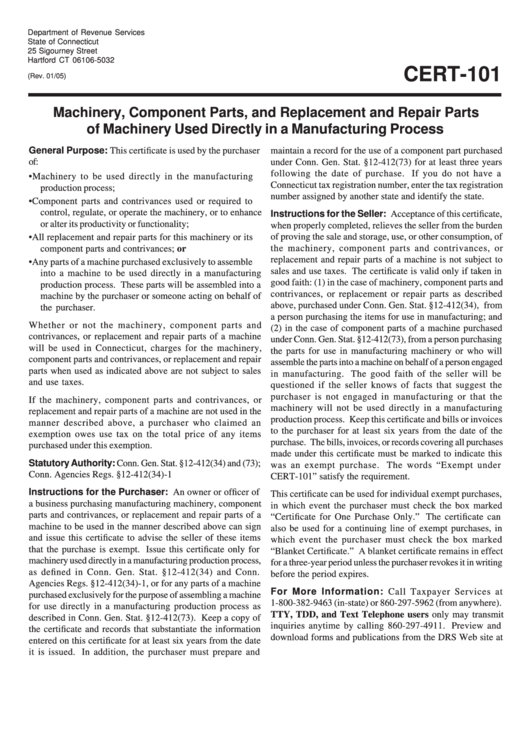

Form Cert-101 - Machinery, Component Parts, And Replacement And Repair Parts Of Machinery Used Directly In A Manufacturing Process

ADVERTISEMENT

Department of Revenue Services

State of Connecticut

25 Sigourney Street

Hartford CT 06106-5032

CERT-101

(Rev. 01/05)

Machinery, Component Parts, and Replacement and Repair Parts

of Machinery Used Directly in a Manufacturing Process

General Purpose: This certificate is used by the purchaser

maintain a record for the use of a component part purchased

of:

under Conn. Gen. Stat. §12-412(73) for at least three years

following the date of purchase. If you do not have a

• Machinery to be used directly in the manufacturing

Connecticut tax registration number, enter the tax registration

production process;

number assigned by another state and identify the state.

• Component parts and contrivances used or required to

control, regulate, or operate the machinery, or to enhance

Instructions for the Seller: Acceptance of this certificate,

or alter its productivity or functionality;

when properly completed, relieves the seller from the burden

of proving the sale and storage, use, or other consumption, of

• All replacement and repair parts for this machinery or its

the machinery, component parts and contrivances, or

component parts and contrivances; or

replacement and repair parts of a machine is not subject to

• Any parts of a machine purchased exclusively to assemble

sales and use taxes. The certificate is valid only if taken in

into a machine to be used directly in a manufacturing

good faith: (1) in the case of machinery, component parts and

production process. These parts will be assembled into a

contrivances, or replacement or repair parts as described

machine by the purchaser or someone acting on behalf of

above, purchased under Conn. Gen. Stat. §12-412(34), from

the purchaser.

a person purchasing the items for use in manufacturing; and

Whether or not the machinery, component parts and

(2) in the case of component parts of a machine purchased

contrivances, or replacement and repair parts of a machine

under Conn. Gen. Stat. §12-412(73), from a person purchasing

will be used in Connecticut, charges for the machinery,

the parts for use in manufacturing machinery or who will

component parts and contrivances, or replacement and repair

assemble the parts into a machine on behalf of a person engaged

parts when used as indicated above are not subject to sales

in manufacturing. The good faith of the seller will be

and use taxes.

questioned if the seller knows of facts that suggest the

purchaser is not engaged in manufacturing or that the

If the machinery, component parts and contrivances, or

machinery will not be used directly in a manufacturing

replacement and repair parts of a machine are not used in the

production process. Keep this certificate and bills or invoices

manner described above, a purchaser who claimed an

to the purchaser for at least six years from the date of the

exemption owes use tax on the total price of any items

purchase. The bills, invoices, or records covering all purchases

purchased under this exemption.

made under this certificate must be marked to indicate this

Statutory Authority: Conn. Gen. Stat. §12-412(34) and (73);

was an exempt purchase. The words “Exempt under

Conn. Agencies Regs. §12-412(34)-1

CERT-101” satisfy the requirement.

Instructions for the Purchaser: An owner or officer of

This certificate can be used for individual exempt purchases,

a business purchasing manufacturing machinery, component

in which event the purchaser must check the box marked

parts and contrivances, or replacement and repair parts of a

“Certificate for One Purchase Only.” The certificate can

machine to be used in the manner described above can sign

also be used for a continuing line of exempt purchases, in

and issue this certificate to advise the seller of these items

which event the purchaser must check the box marked

that the purchase is exempt. Issue this certificate only for

“Blanket Certificate.” A blanket certificate remains in effect

machinery used directly in a manufacturing production process,

for a three-year period unless the purchaser revokes it in writing

as defined in Conn. Gen. Stat. §12-412(34) and Conn.

before the period expires.

Agencies Regs. §12-412(34)-1, or for any parts of a machine

For More Information: Call Taxpayer Services at

purchased exclusively for the purpose of assembling a machine

1-800-382-9463 (in-state) or 860-297-5962 (from anywhere).

for use directly in a manufacturing production process as

TTY, TDD, and Text Telephone users only may transmit

described in Conn. Gen. Stat. §12-412(73). Keep a copy of

inquiries anytime by calling 860-297-4911. Preview and

the certificate and records that substantiate the information

download forms and publications from the DRS Web site at

entered on this certificate for at least six years from the date

it is issued. In addition, the purchaser must prepare and

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2