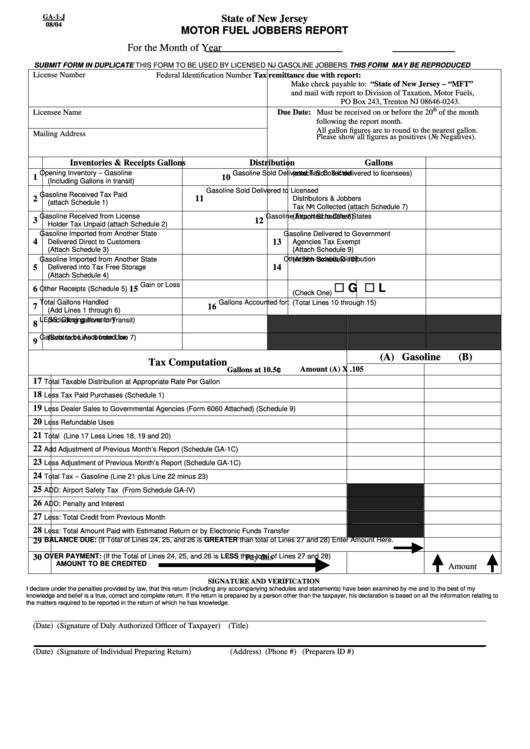

GA-1-J

State of New Jersey

08/04

MOTOR FUEL JOBBERS REPORT

For the Month of

Year

SUBMIT FORM IN DUPLICATE

THIS FORM TO BE USED BY LICENSED NJ GASOLINE JOBBERS THIS FORM MAY BE REPRODUCED

License Number

Federal Identification Number

Tax remittance due with report:

Make check payable to: “State of New Jersey – “MFT”

and mail with report to Division of Taxation, Motor Fuels,

PO Box 243, Trenton NJ 08646-0243.

th

Licensee Name

Due Date: Must be received on or before the 20

of the month

following the report month.

All gallon figures are to round to the nearest gallon.

Mailing Address

Please show all figures as positives (No Negatives).

Inventories & Receipts

Gallons

Distribution

Gallons

Opening Inventory – Gasoline

Gasoline Sold Delivered Tax Collected

1

10

(Including Gallons in transit)

(attach Sch. 6 if delivered to licensees)

Gasoline Sold Delivered to Licensed

Gasoline Received Tax Paid

2

11

Distributors & Jobbers

(attach Schedule 1)

Tax Not Collected (attach Schedule 7)

Gasoline Received from License

Gasoline Exported to Other States

3

12

Holder Tax Unpaid (attach Schedule 2)

(Attach Schedule 8)

Gasoline Imported from Another State

Gasoline Delivered to Government

4

13

Delivered Direct to Customers

Agencies Tax Exempt

(Attach Schedule 3)

(Attach Schedule 9)

Gasoline Imported from Another State

Other Non-taxable Distribution

5

Delivered into Tax Free Storage

14

(Attach Schedule 10)

(Attach Schedule 4)

Gain or Loss

G

L

6

15

Other Receipts (Schedule 5)

(Check One)

Total Gallons Handled

Gallons Accounted for:

7

16

(Add Lines 1 through 6)

(Total Lines 10 through 15)

LESS: Closing Inventory

8

(Including gallons in Transit)

Gallons to be Accounted for:

9

(Subtract Line 8 from Line 7)

(A) Gasoline

(B)

Tax Computation

Amount (A) X .105

Gallons at 10.5¢

17

Total Taxable Distribution at Appropriate Rate Per Gallon

18

Less Tax Paid Purchases (Schedule 1)

19

Less Dealer Sales to Governmental Agencies (Form 6060 Attached) (Schedule 9)

20

Less Refundable Uses

21

Total (Line 17 Less Lines 18, 19 and 20)

22

Add Adjustment of Previous Month’s Report (Schedule GA-1C)

23

Less Adjustment of Previous Month’s Report (Schedule GA-1C)

24

Total Tax – Gasoline (Line 21 plus Line 22 minus 23)

25

ADD: Airport Safety Tax (From Schedule GA-IV)

26

ADD: Penalty and Interest

27

Less: Total Credit from Previous Month

28

Less: Total Amount Paid with Estimated Return or by Electronic Funds Transfer

BALANCE DUE: (If Total of Lines 24, 25, and 26 is GREATER than total of Lines 27 and 28) Enter Amount Here.

29

OVER PAYMENT: (If the Total of Lines 24, 25, and 26 is LESS than total of Lines 27 and 28)

30

Pay this

AMOUNT TO BE CREDITED

Amount

SIGNATURE AND VERIFICATION

I declare under the penalties provided by law, that this return (including any accompanying schedules and statements) have been examined by me and to the best of my

knowledge and belief is a true, correct and complete return. If the return is prepared by a person other than the taxpayer, his declaration is based on all the information relating to

the matters required to be reported in the return of which he has knowledge.

(Date)

(Signature of Duly Authorized Officer of Taxpayer)

(Title)

(Date)

(Signature of Individual Preparing Return)

(Address)

(Phone #)

(Preparers ID #)

1

1