Form Cert-105 - Commercial Motor Vehicle Purchased Within Connecticut For Use Exclusively In The Carriage Of Freight In Interstate Commerce

ADVERTISEMENT

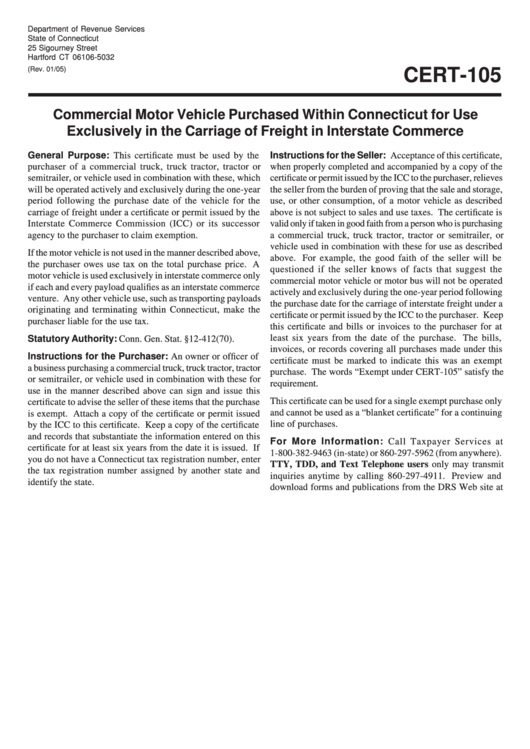

Department of Revenue Services

State of Connecticut

25 Sigourney Street

Hartford CT 06106-5032

(Rev. 01/05)

CERT-105

Commercial Motor Vehicle Purchased Within Connecticut for Use

Exclusively in the Carriage of Freight in Interstate Commerce

General Purpose: This certificate must be used by the

Instructions for the Seller: Acceptance of this certificate,

purchaser of a commercial truck, truck tractor, tractor or

when properly completed and accompanied by a copy of the

semitrailer, or vehicle used in combination with these, which

certificate or permit issued by the ICC to the purchaser, relieves

will be operated actively and exclusively during the one-year

the seller from the burden of proving that the sale and storage,

period following the purchase date of the vehicle for the

use, or other consumption, of a motor vehicle as described

carriage of freight under a certificate or permit issued by the

above is not subject to sales and use taxes. The certificate is

Interstate Commerce Commission (ICC) or its successor

valid only if taken in good faith from a person who is purchasing

agency to the purchaser to claim exemption.

a commercial truck, truck tractor, tractor or semitrailer, or

vehicle used in combination with these for use as described

If the motor vehicle is not used in the manner described above,

above. For example, the good faith of the seller will be

the purchaser owes use tax on the total purchase price. A

questioned if the seller knows of facts that suggest the

motor vehicle is used exclusively in interstate commerce only

commercial motor vehicle or motor bus will not be operated

if each and every payload qualifies as an interstate commerce

actively and exclusively during the one-year period following

venture. Any other vehicle use, such as transporting payloads

the purchase date for the carriage of interstate freight under a

originating and terminating within Connecticut, make the

certificate or permit issued by the ICC to the purchaser. Keep

purchaser liable for the use tax.

this certificate and bills or invoices to the purchaser for at

least six years from the date of the purchase. The bills,

Statutory Authority: Conn. Gen. Stat. §12-412(70).

invoices, or records covering all purchases made under this

Instructions for the Purchaser: An owner or officer of

certificate must be marked to indicate this was an exempt

a business purchasing a commercial truck, truck tractor, tractor

purchase. The words “Exempt under CERT-105” satisfy the

or semitrailer, or vehicle used in combination with these for

requirement.

use in the manner described above can sign and issue this

This certificate can be used for a single exempt purchase only

certificate to advise the seller of these items that the purchase

and cannot be used as a “blanket certificate” for a continuing

is exempt. Attach a copy of the certificate or permit issued

line of purchases.

by the ICC to this certificate. Keep a copy of the certificate

and records that substantiate the information entered on this

For More Information: Call Taxpayer Services at

certificate for at least six years from the date it is issued. If

1-800-382-9463 (in-state) or 860-297-5962 (from anywhere).

you do not have a Connecticut tax registration number, enter

TTY, TDD, and Text Telephone users only may transmit

the tax registration number assigned by another state and

inquiries anytime by calling 860-297-4911. Preview and

identify the state.

download forms and publications from the DRS Web site at

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2