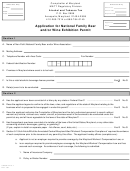

INSTRUCTIONS FOR COMPLETING FORM COM/ATT-010-6

APPLICATION FOR FUEL - ALCOHOL PERMIT

SECTION 1

I)

State in whose name the permit is to be issued. If applicant is a corporation, the corporate name should be listed and corporate officers should be

listed on a separate sheet. If the applicant is a partnership, the permit must be issued in the names of all partners. If an LLC, indicate the managing

members’ names on a separate sheet.

J)

State the applicant’s telephone number including area code and fax number, if applicable.

K)

Indicate the address where mail will reach the applicant showing street and number or Post Office Box, City, County, State and nine digit Zip Code.

L)

List the applicant’s Social Security Number and Federal Employer Identification Number, if applicable.

M)

State whether the applicant is the holder of any type of alcoholic beverage license or permit under the authority of the State of Maryland, the United

States Government, or any other State or subdivision thereof. If the applicant is the holder of such a permit or license, list all such permits or

licensing in the space provided. If the applicant does not hold any such permits, list “none”. Note: See Special Instructions below pertaining to

your federal permit for fuel-alcohol use.

N)

Indicate whether or not the applicant has ever been convicted of a felony in any State or federal court.

O)

The applicant’s signature at the bottom of the application indicates his willingness to conform to all the laws of the State of Maryland and any rules

or regulations which have been or may hereafter be promulgated concerning alcoholic beverages generally and this class of permit particularly.

P)

The applicant’s signature at the bottom of this application signifies his consent to the search without a warrant of any premises which are used in the

conduct of the business engaged in under this permit at any and all hours by the Comptroller of his duly authorized personnel. Note: Section 2 of

this application must also be completed.

Q)

If the applicant has ever been convicted in any State or federal court for violation of the laws pertaining to alcoholic beverages, gaming or gambling

indicate the name under which the applicant was convicted, the offense, the court where the applicant was convicted and the date of conviction on a

separate piece of paper.

R)

The applicant is to complete either (a) or (b) indicating his compliance with the Maryland Workmen’s Compensation Law.

SECTION 2

I)

Indicate the exact site location of the permit premises showing street or number, if any, or if none, indicate the distance and direction of the nearest

prominent landmark. Also, show the City and County where the premises is located.

II)

Indicate the physical description of the premises.

III)

Indicate the owner of the permit premises and his mailing address. If the applicant is the owner, so state.

IV)

List the mailing address of the owner.

V)

The owner of the permit premises (whether he is the applicant or another person), must execute a Certificate of Consent for a search of the premises.

Date and sign it in the presence of a witness.

SECTION 3

In this section, you are to sign and date the application.

SPECIAL NOTES FOR FUEL-ALCOHOL PERMIT APPLICANTS

F)

Attached to this application must be a copy of your federal permit to operate a fuel-alcohol operation. If you have not obtained such a permit, then

submit a copy of your application for same and submit copy of permit when received. This office will not issue a fuel-alcohol permit before

evidence is presented that you have obtained a federal permit.

G)

There is no fee for this type of permit. The duration of the permit is perpetual unless the permit is suspended or revoked by the Comptroller.

H)

As a permittee, you will be required to comply with certain requirements of this office. Please refer to ADDITIONAL INFORMATION below for

complete details.

I)

Any questions pertaining to this permit application or the activities thereunder should be directed to the Alcohol and Tobacco Tax office at

(410) 260-7327.

ADDITIONAL INFORMATION

The holder (or potential holder) of a Fuel-Alcohol Permit shall be aware of and comply with the following:

A)

Before a permit will be issued by the Alcohol and Tobacco Tax office, evidence must be made a part of the Application Form 10-6 ATT that the

applicant holds a federal Fuel-Alcohol Permit. This shall be in the form of a copy of the actual permit or authorization letter.

B)

Each application is subject to an investigation by representatives of the Field Enforcement Division prior to issuance. In any event, prior to initiating

operations under this permit, a 48-hour notice shall be given to the Field Enforcement Division (410-260-7388), so that they may arrange to have an

authorized representative on the site at that time.

C)

A yearly report of your activity is required. Report Form 22 ATT covering activity between November 1 through October 31 of each year (or that

portion of the year you held a permit) must be filed by November 15 annually. This form must be filed even if you had no activity under your

permit during your report period. Failure to file this report on a timely basis will subject your permit to suspension or revocation.

D)

Fuel-Alcohol Permits do not expire. They will continue in effect until suspended, revoked or you are otherwise notified by the Comptroller.

Permits no longer needed shall be immediately returned to the Alcohol and Tobacco Tax office for voluntary cancellation.

1

1 2

2