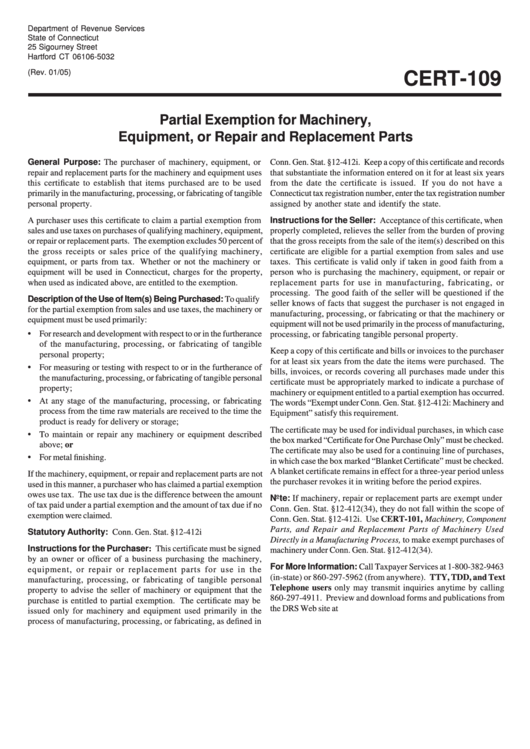

Form Cert-109 - Partial Exemption For Machinery, Equipment, Or Repair And Replacement Parts

ADVERTISEMENT

Department of Revenue Services

State of Connecticut

25 Sigourney Street

Hartford CT 06106-5032

(Rev. 01/05)

CERT-109

Partial Exemption for Machinery,

Equipment, or Repair and Replacement Parts

General Purpose: The purchaser of machinery, equipment, or

Conn. Gen. Stat. §12-412i. Keep a copy of this certificate and records

repair and replacement parts for the machinery and equipment uses

that substantiate the information entered on it for at least six years

this certificate to establish that items purchased are to be used

from the date the certificate is issued. If you do not have a

primarily in the manufacturing, processing, or fabricating of tangible

Connecticut tax registration number, enter the tax registration number

personal property.

assigned by another state and identify the state.

A purchaser uses this certificate to claim a partial exemption from

Instructions for the Seller: Acceptance of this certificate, when

sales and use taxes on purchases of qualifying machinery, equipment,

properly completed, relieves the seller from the burden of proving

or repair or replacement parts. The exemption excludes 50 percent of

that the gross receipts from the sale of the item(s) described on this

the gross receipts or sales price of the qualifying machinery,

certificate are eligible for a partial exemption from sales and use

equipment, or parts from tax. Whether or not the machinery or

taxes. This certificate is valid only if taken in good faith from a

equipment will be used in Connecticut, charges for the property,

person who is purchasing the machinery, equipment, or repair or

when used as indicated above, are entitled to the exemption.

replacement parts for use in manufacturing, fabricating, or

processing. The good faith of the seller will be questioned if the

Description of the Use of Item(s) Being Purchased: To qualify

seller knows of facts that suggest the purchaser is not engaged in

for the partial exemption from sales and use taxes, the machinery or

manufacturing, processing, or fabricating or that the machinery or

equipment must be used primarily:

equipment will not be used primarily in the process of manufacturing,

• For research and development with respect to or in the furtherance

processing, or fabricating tangible personal property.

of the manufacturing, processing, or fabricating of tangible

Keep a copy of this certificate and bills or invoices to the purchaser

personal property;

for at least six years from the date the items were purchased. The

• For measuring or testing with respect to or in the furtherance of

bills, invoices, or records covering all purchases made under this

the manufacturing, processing, or fabricating of tangible personal

certificate must be appropriately marked to indicate a purchase of

property;

machinery or equipment entitled to a partial exemption has occurred.

• At any stage of the manufacturing, processing, or fabricating

The words “Exempt under Conn. Gen. Stat. §12-412i: Machinery and

process from the time raw materials are received to the time the

Equipment” satisfy this requirement.

product is ready for delivery or storage;

The certificate may be used for individual purchases, in which case

• To maintain or repair any machinery or equipment described

the box marked “Certificate for One Purchase Only” must be checked.

above; or

The certificate may also be used for a continuing line of purchases,

• For metal finishing.

in which case the box marked “Blanket Certificate” must be checked.

A blanket certificate remains in effect for a three-year period unless

If the machinery, equipment, or repair and replacement parts are not

the purchaser revokes it in writing before the period expires.

used in this manner, a purchaser who has claimed a partial exemption

owes use tax. The use tax due is the difference between the amount

Note: If machinery, repair or replacement parts are exempt under

of tax paid under a partial exemption and the amount of tax due if no

Conn. Gen. Stat. §12-412(34), they do not fall within the scope of

exemption were claimed.

Conn. Gen. Stat. §12-412i. Use CERT-101, Machinery, Component

Parts, and Repair and Replacement Parts of Machinery Used

Statutory Authority: Conn. Gen. Stat. §12-412i

Directly in a Manufacturing Process, to make exempt purchases of

Instructions for the Purchaser: This certificate must be signed

machinery under Conn. Gen. Stat. §12-412(34).

by an owner or officer of a business purchasing the machinery,

For More Information: Call Taxpayer Services at 1-800-382-9463

equipment, or repair or replacement parts for use in the

(in-state) or 860-297-5962 (from anywhere). TTY, TDD, and Text

manufacturing, processing, or fabricating of tangible personal

Telephone users only may transmit inquiries anytime by calling

property to advise the seller of machinery or equipment that the

860-297-4911. Preview and download forms and publications from

purchase is entitled to partial exemption. The certificate may be

the DRS Web site at

issued only for machinery and equipment used primarily in the

process of manufacturing, processing, or fabricating, as defined in

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2