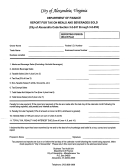

INSTRUCTIONS

COLUMN 1

Complete this form for each county listed in which you conducted business.

COLUMN 2

Enter total taxable gallons of gasoline or any substitutes thereof. See exemptions below.

COLUMN 3

Enter total taxable gallons of motor fuel or any substitutes thereof. See exemptions below.

COLUMN 4

Enter total taxable gallons (add columns 2 and 3).

COLUMN 5

Tax rate of each county is indicated.

COLUMN 6

Enter gross tax due (multiply column 4 by column 5).

COLUMN 7

Enter interest due. Compute interest on the tax entered in column 6. Tax due on delinquent returns is subject

to an interest charge as established in Section 40-1-44(a), Code of Alabama 1975. Call (334) 242-9608 for

the applicable rate.

COLUMN 8

Multiply the tax due in column 6 by 25% penalty.

COLUMN 9

Deduct only credits authorized by the Alabama Department of Revenue. Attach a copy of authorization.

COLUMN 10

Enter total of tax, penalty, and interest due (add columns 6 through 8, subtract column 9).

ACT

COUNTY

TAX EXEMPTION CODES

87-100

Bullock

A, B, C, D, E

87-620

Lowndes

A, B, C, D, E

Explanation of Exemption Codes

A.

Kerosene oil, fuel oil, or crude oil used for lighting, heating, or industrial purposes.

B.

Such motor fuels sold to the State of Alabama or any agency thereof, or county governing agencies, municipalities, and

boards of education.

C.

Sale of gasoline or motor fuel in interstate commerce.

D.

Alabama located refineries using gasoline or motor fuel in the manufacturing process, or federal permit holders who

blend motor fuels under the federal law and statutes and who pay the federal excise tax on such motor fuels directly to

the federal government, when holders of the permit use gasoline in this state in the blending process.

E.

Such motor fuel sold for use off the highways of this state.

F.

Such motor fuels sold to the State of Alabama or any agency thereof, or county governing agencies, municipalities,

boards of education, National Guard Armories, and the federal government or any agency thereof.

1

1 2

2