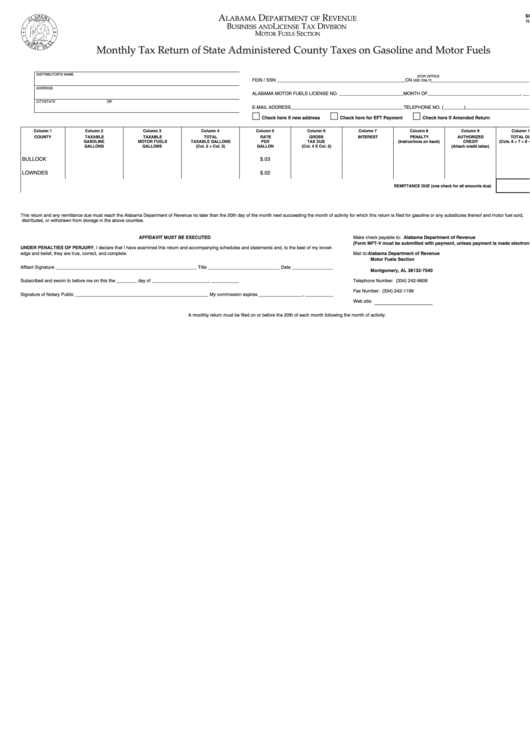

A

D

R

SUBT: MFCO

LABAMA

EPARTMENT OF

EVENUE

Reset

Revised

10/11

B

L

T

D

USINESS AND

ICENSE

AX

IVISION

M

F

S

OTOR

UELS

ECTION

Monthly Tax Return of State Administered County Taxes on Gasoline and Motor Fuels

DISTRIBUTOR’S NAME

(FOR OFFICE

FEIN / SSN __________________________________________________

CN

___________________________________________

USE ONLY)

ADDRESS

ALABAMA MOTOR FUELS LICENSE NO. _________________________

MONTH OF____________________________________, _______

CITY

STATE

ZIP

E-MAIL ADDRESS ____________________________________________

TELEPHONE NO. (________)_____________________________

Check here if new address

Check here for EFT Payment

Check here if Amended Return

Column 1

Column 2

Column 3

Column 4

Column 5

Column 6

Column 7

Column 8

Column 9

Column 10

COUNTY

TAXABLE

TAXABLE

TOTAL

RATE

GROSS

INTEREST

PENALTY

AUTHORIZED

TOTAL DUE

GASOLINE

MOTOR FUELS

TAXABLE GALLONS

PER

TAX DUE

(Instructions on back)

CREDIT

(Cols. 6 + 7 + 8 – Col. 9)

GALLONS

GALLONS

(Col. 2 + Col. 3)

GALLON

(Col. 4 X Col. 5)

(Attach credit letter)

BULLOCK

$.03

LOWNDES

$.02

REMITTANCE DUE (one check for all amounts due)

This return and any remittance due must reach the Alabama Department of Revenue no later than the 20th day of the month next succeeding the month of activity for which this return is filed for gasoline or any substitutes thereof and motor fuel sold,

distributed, or withdrawn from storage in the above counties.

AFFIDAVIT MUST BE EXECUTED

Make check payable to: Alabama Department of Revenue

(Form MFT-V must be submitted with payment, unless payment is made electronically.)

UNDER PENALTIES OF PERJURY, I declare that I have examined this return and accompanying schedules and statements and, to the best of my knowl-

edge and belief, they are true, correct, and complete.

Mail to: Alabama Department of Revenue

Motor Fuels Section

P.O. Box 327540

Affiant Signature _______________________________________________________ Title ____________________________ Date ________________

Montgomery, AL 36132-7540

Subscribed and sworn to before me on this the ________ day of ______________________, ___________

Telephone Number: (334) 242-9608

Fax Number: (334) 242-1199

Signature of Notary Public ____________________________________________________ My commission expires _________________, ___________

Web site:

A monthly return must be filed on or before the 20th of each month following the month of activity.

1

1 2

2